Nvidia (NVDA), the tech behemoth based in Silicon Valley and increasingly prominent in the life sciences sector, has seen a remarkable surge in its stock value during the initial weeks of the year. This upward trajectory is primarily driven by investors’ renewed confidence in the company’s achievements in artificial intelligence (AI) and the transformative potential of this technology across various industries, including biopharma.

The stock of Nvidia has experienced a significant 24% increase since the beginning of the year, rising from \(481.68 on January 2 to \)594.91 by the end of the third week. Notably, the share price hit an all-time high of $595 just before the market closed, registering a 4% gain in a single day.

This positive momentum was further bolstered by recent developments, such as Mark Zuckerberg’s announcement on Instagram about Meta’s plans to establish a substantial compute infrastructure embracing AI, with an order of 350,000 H100 graphics cards from Nvidia. Consequently, two analysts raised their 12-month price targets for Nvidia shares in recognition of the company’s stellar performance.

John Vinh, an equity research analyst at KeyBanc Capital Markets, raised the firm’s price target by 14% to \(740, while Ivan Feinseth from Tigress Financial Partners increased the target by 41% to \)790. Both analysts reiterated their positive ratings on Nvidia stock, maintaining an “Overweight” and “Buy” stance, respectively.

Nvidia’s recent success is further underscored by its strategic collaborations and product advancements in the domain of AI-driven drug discovery. The introduction of Nvidia’s BioNeMo™ platform, designed to expedite drug development through generative AI models, marks a significant step forward. Additionally, partnerships with Recursion (RXRX) and Amgen (AMGN) have showcased the company’s commitment to revolutionizing the pharmaceutical industry through AI integration.

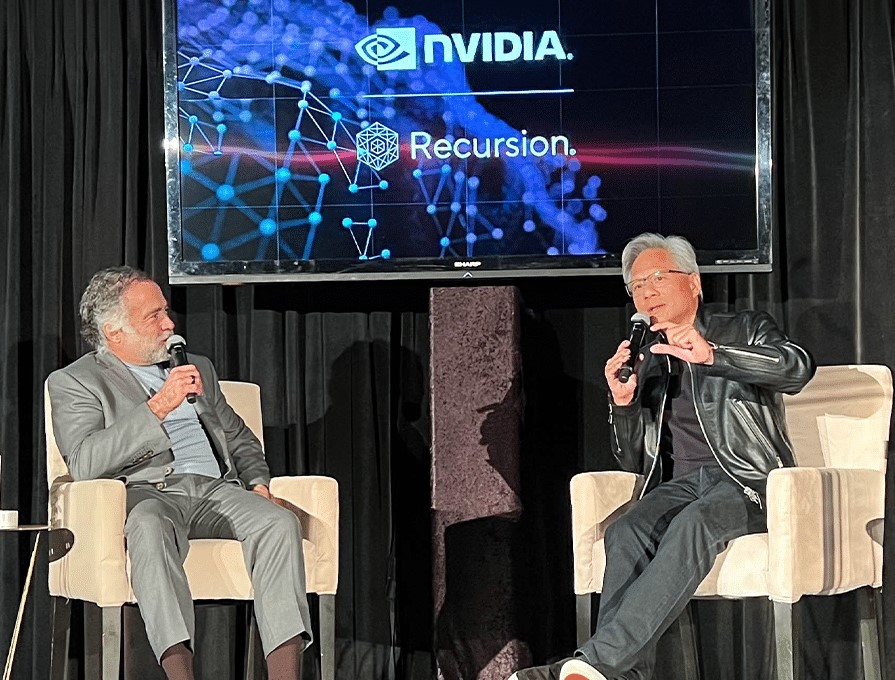

Looking ahead, Nvidia envisions a future where AI will play a pivotal role in accelerating drug design processes entirely within virtual simulations. Jensen Huang, the Founder and CEO of Nvidia, emphasized the shift towards in silico drug design during a recent discussion, highlighting the necessity for cutting-edge models and data processing capabilities to drive innovation in this field.

The collaboration between Nvidia and Recursion has yielded promising outcomes, with the unveiling of LOWE (Large Language Model-Orchestrated Workflow Engine) software, aimed at streamlining complex drug discovery tasks using natural language interfaces. This innovation, coupled with advancements in AI technology, has propelled Recursion’s shares to new heights, despite recent fluctuations in the market.

In a similar vein, Prime Medicine (PRME) witnessed a fluctuation in its stock value, experiencing a temporary decline followed by a partial recovery. The company’s focus on prime editing therapies for genetic disorders positions it as a key player in the evolving landscape of gene editing technologies. However, challenges related to investor sentiment, trial sizes, and financial stability continue to impact Prime Medicine’s market performance.

Amidst these developments, companies like Allakos (ALLK) and Bullfrog AI (BFRG) have also made headlines, with contrasting outcomes in their respective restructuring efforts and research collaborations, reflecting the dynamic nature of the biopharmaceutical industry.