According to data from the market research company Omida (cited by Business Korea), SK Hynix currently holds a 35% market share in the DRAM market in the third quarter of this year. The increasing demand for AI hardware, which relies heavily on memory, has led to substantial growth in the entire DRAM industry recently. SK Hynix, in particular, has shown exceptional performance in this evolving landscape, achieving a record-high market share.

Data center GPUs utilized by businesses for AI training and related tasks now incorporate more VRAM than ever before. For instance, AMD’s Radeon Instinct MI100 in 2020 featured 32 GB of HBM2, while the MI200 in 2021 boasted 64 GB. The latest offering from AMD, the MI300X, is equipped with a substantial 192 GB of HBM3. Nvidia is also competitive in this space with its H200 premier model, offering just under 141GB.

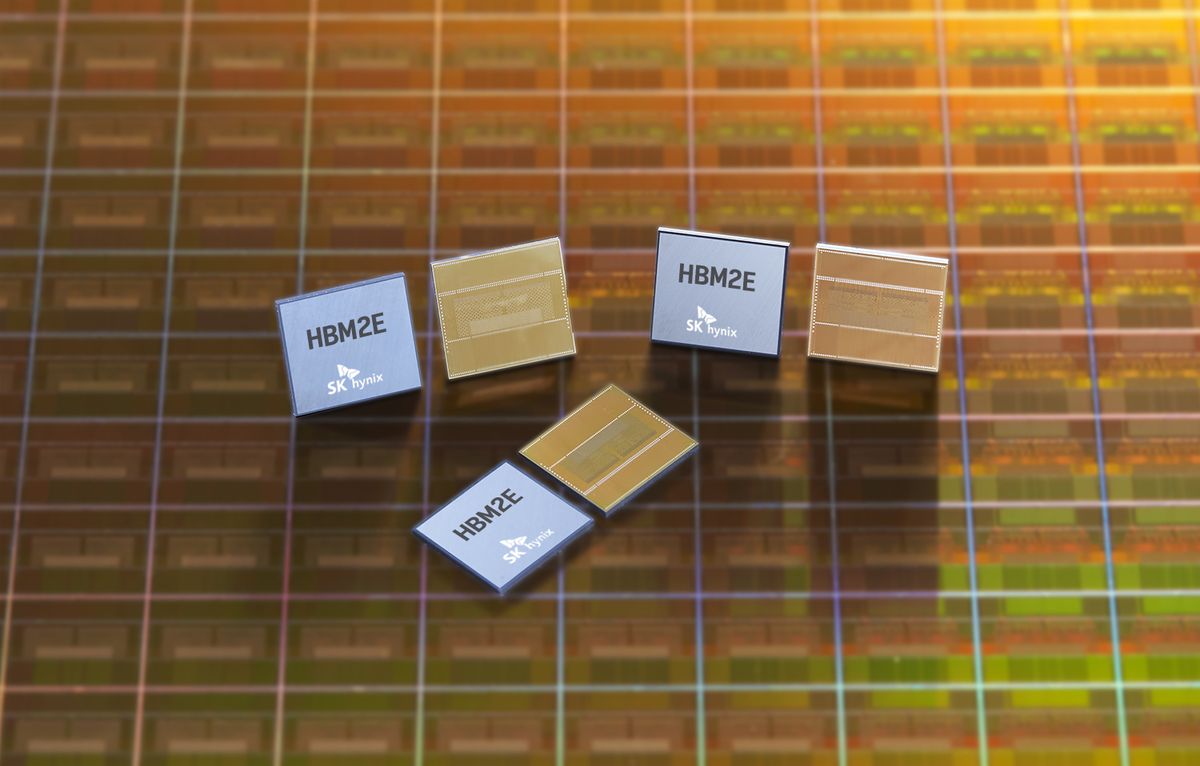

Given the prevalence of HBM in these chips, it is not surprising that the submarket is projected to grow at a rate of 52%, significantly outpacing the overall DRAM market’s growth rate of 21%. The surge in demand for AI components has catalyzed this rapid expansion, propelling SK Hynix to a new pinnacle with a 35% market share.

SK Hynix’s recent success can be largely attributed to HBM technology. Despite HBM contributing only 10% to DRAM revenue currently, SK Hynix already commanded a 50% market share in April. With the expansion of the HBM market since then, it is likely that SK Hynix has further solidified its market position.

While Omida did not provide specific details on SK Hynix’s standing relative to Samsung and Micron, other major players in the RAM market, it is speculated that SK Hynix ranks second. Trendforce data indicated that Samsung held a 45% market share for DRAM in March, including a 40% share of the HBM market. It seems improbable that Samsung has experienced a significant decline since then. If such a scenario had occurred, Omida would likely have highlighted this development initially.

Samsung has long held the title of the world’s leading memory manufacturer, but the rise of AI technology could challenge its dominance. Projections suggest that by 2027, HBM’s revenue share within the broader DRAM market could double from the current 10% to 20%. If SK Hynix’s HBM products continue their successful trajectory, Samsung’s position as the DRAM industry leader may be at risk.