Dow Jones futures saw a slight increase on Monday morning, alongside S&P 500 and Nasdaq futures, marking the initial market response to the Federal Reserve’s preferred inflation report. Federal Reserve Chair Jerome Powell expressed satisfaction with the in-line data released on Friday.

The decisions regarding interest rates have an impact on both the economy and the stock market. Ed Carson, the News Editor at IBD, explains the varying reactions of each and provides insights for investors.

The recent stock market rally followed a strong performance during the holiday-shortened week. While growth stocks, particularly AI frontrunners like Nvidia (NVDA), experienced a slight retreat, they generally maintained levels above support. Despite this, the market remained resilient, displaying robust breadth. Small-cap stocks led the way with significant gains, while the Dow Jones and S&P 500 hovered near all-time highs. On the other hand, the Nasdaq experienced a slight decline as several tech behemoths pulled back.

Although Nvidia requires more time to stabilize, other tech leaders such as Microsoft (MSFT), Meta Platforms (META), and CrowdStrike (CRWD) are showing bullish retracements.

In a separate development, the newly listed AI chip company, Astera Labs (ALAB), is retracing from its peak achieved on Tuesday. A potential pause in Nvidia’s performance and AI-related stocks might pave the way for ALAB to establish a brief IPO base.

Furthermore, Chinese electric vehicle manufacturers like Nio (NIO), Li Auto (LI), XPeng (XPEV), and the prominent BYD (BYDDF) reported their March and first-quarter deliveries on Monday, meeting or surpassing modest expectations. Tesla (TSLA) is anticipated to disclose its first-quarter delivery figures on Tuesday, also amid subdued expectations.

Nvidia and META stocks are featured on the IBD Leaderboard, while Microsoft stock is part of the IBD Long-Term Leaders list. Additionally, Nvidia, Meta Platforms, and CrowdStrike stocks are included in the IBD 50 list.

Current Status of Dow Jones Futures

Dow Jones futures exhibited a 0.1% increase compared to fair value, with S&P 500 futures and Nasdaq 100 futures also showing a 0.1% and 0.15% rise, respectively. However, these futures have slightly receded from their overnight peaks.

Moreover, the 10-year Treasury yield experienced a marginal uptick to 4.23%.

Copper futures surged by 1%, likely influenced by robust economic data from China.

On the international front, China’s manufacturing index for March climbed to 50.8 from February’s 49.1, marking a year-high and the first reading above the crucial 50 level in six months. The services index also saw an uptick of 1.6 points to 53, reaching a nine-month peak, surpassing expectations.

In the U.S., markets remained closed on Friday due to Good Friday observance. European and Hong Kong markets also stayed shut on Friday and will remain closed on Easter Monday.

It’s important to note that the overnight movements in Dow futures and other indices may not necessarily mirror the actual trading behavior in the subsequent regular stock market session.

Insights on PCE Inflation

The Commerce Department’s report on the February PCE price index indicated a 0.3% increase from January, slightly below the anticipated 0.4%. Year-on-year, PCE inflation stood at 2.5%, aligning with expectations and slightly surpassing January’s 2.4%.

The core PCE price index, which serves as the Fed’s primary inflation metric, recorded a 0.3% rise from January, in line with projections. Core PCE inflation for the year reached 2.8%, meeting estimates and marking a slight decline from January’s revised 2.9%.

In response to the data, Fed Chair Jerome Powell expressed satisfaction with the absence of any negative surprises, noting that the PCE figures were in line with the desired trajectory.

Early Monday, the likelihood of a June Fed rate cut increased to nearly 69%, compared to around 64% on Thursday.

The PCE inflation statistics were part of the income and spending report, which revealed a 0.3% growth in personal income, slightly below the 0.4% forecast. Consumer spending, on the other hand, surged by 0.8%, surpassing the expected 0.5%.

Summary of Stock Market Rally

The stock market rally witnessed moderate to substantial gains across various sectors, excluding some growth-oriented segments.

During the week, the Dow Jones Industrial Average rose by 0.8%, achieving a record close on Thursday. The S&P 500 index posted a 0.4% gain, hitting an intraday all-time high on Thursday. Conversely, the Nasdaq experienced a marginal 0.3% decline, remaining below its peak levels. For the quarter, the Dow recorded a 5.6% increase, the S&P 500 surged by 10.2%, and the Nasdaq leaped by 9.1%.

Notably, market breadth demonstrated strength throughout the week, with the small-cap Russell 2000 soaring by 2.5% to reach a two-year high. Additionally, the Invesco S&P 500 Equal Weight ETF (RSP) set a record high with a 1.6% gain. The First Trust Nasdaq 100 Equal Weighted Index ETF (QQEW) rose by 0.4%, contrasting the Nasdaq 100’s 0.5% decline.

Moreover, the 10-year Treasury yield dropped by 3 basis points to 4.19% for the week, slipping below the 200-day line.

In the commodities market, U.S. crude oil futures surged by 3.15% to $83.15 per barrel last week, marking a 16.1% increase in the first quarter.

Insights on ETF Performance

Among the various ETFs, the iShares Expanded Tech-Software Sector ETF (IGV) recorded a 0.8% decline for the week. Notably, Microsoft stock holds a significant position within this ETF, alongside CrowdStrike. The VanEck Vectors Semiconductor ETF (SMH) also experienced a 1.2% retreat. However, these declines were relatively modest, reflecting only a portion of the previous week’s robust gains.

In the realm of speculative stocks, the ARK Innovation ETF (ARKK) and ARK Genomics ETF (ARKG) climbed by 1.3% and 2.1%, respectively, during the week. Both ETFs are majorly invested in Tesla stock.

Across different sectors, the Industrial Select Sector SPDR Fund (XLI) increased by 0.6%, the Financial Select SPDR ETF (XLF) rose by 1.7%, and the SPDR S&P Homebuilders ETF (XHB) surged by 1.2%, all reaching record highs.

Furthermore, the SPDR S&P Metals & Mining ETF (XME) jumped by 4%, while the U.S. Global Jets ETF (JETS) ascended by 3.3%, both achieving multi-month highs. The Energy Select SPDR ETF (XLE) also gained by 2.15%, reaching a 52-week high. The Health Care Select Sector SPDR Fund (XLV) rose by 1.6%, hovering just below its all-time high levels.

Analysis of Nvidia Stock

Nvidia stock witnessed a 4.2% decline last week, closing at 903.56 after an impressive 92% surge over an 11-week winning streak. Currently, the stock is trading within a narrow range without testing its 21-day moving average. Given the substantial growth in recent weeks, a consolidation phase for Nvidia seems reasonable. It is anticipated that NVDA stock might establish a new base in the coming weeks, potentially leading to an extended consolidation period similar to late 2023.

The performance of other AI stocks, particularly chip manufacturers, is likely to be influenced by Nvidia’s trajectory. A prolonged consolidation period to form bases and align moving averages could be beneficial for these stocks.

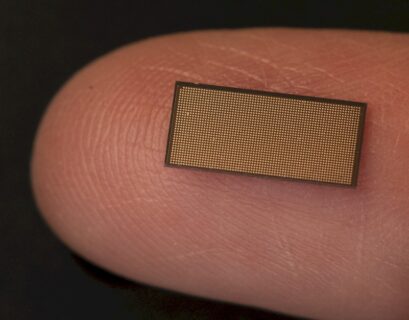

Overview of Astera Labs Stock

Astera Labs made its market debut at 36, soaring by 72% on March 20. Subsequently, the AI chip IPO reached 95.21 before retracing. Currently, ALAB stock is experiencing a pullback, with shares rising by 5.9% to 74.15 for the week.

For investors considering Astera Labs, it is advisable to wait for the stock to stabilize and form a consolidation pattern over a few weeks. Although IPO bases can be relatively short, potentially lasting as little as two weeks, they often take shape over several weeks, depending on market conditions.

Astera Labs boasts rapid revenue growth from a modest starting point. While the company incurred losses in 2023, it is projected to achieve profitability in 2024, accompanied by sustained earnings growth in 2025.

Evaluation of Stocks Approaching Buy Points

Microsoft stock has been on a five-session downtrend, albeit with minimal losses and light trading volume. The stock is currently hovering just below a buy point of 420.82, while maintaining levels above the 21-day moving average. A rebound in Microsoft shares could present a viable buying opportunity.

Meta stock witnessed a 4.7% decline to 485.58 last week, accompanied by subdued trading volume. The stock is retracing towards the rapidly ascending 10-week line, which might intersect with Meta on Monday. This potential convergence could mark the first significant test of the 10-week line in 2024, offering a potential entry point for investors. Meta stock might also establish a new base in the coming weeks.

CrowdStrike stock declined by 2.1% to 320.59 last week, finding support around the 21-day and 10-week moving averages. Despite a somewhat messy consolidation pattern, investors could consider a buy point around 338.45 or potentially use Wednesday’s high of 333.84 as an early entry opportunity.

Several software stocks, including CrowdStrike peer CyberArk Software (CYBR) as well as Cloudflare (NET), Monday.com (MNDY), ServiceNow (NOW), and HubSpot (HUBS), are currently positioned near support levels, presenting potential entry opportunities.

Insights on Tesla Stock

Tesla stock posted a 2.9% gain last week, reaching 175.70, although encountering resistance at the 10-week line. Bullish sentiment surrounding Tesla is driven by expectations of significant improvements in Full Self-Driving capabilities, with CEO Elon Musk mandating FSD test drives before new purchases or service visits. However, analysts continue to revise down Tesla’s earnings and delivery estimates in the short term, primarily due to subdued EV demand. In China, intensifying competition, notably from smartphone manufacturer Xiaomi’s entry into the EV market, is adding pressure.

Tesla is scheduled to release its first-quarter production and delivery figures on Tuesday, April 2, followed by Q1 earnings later in the month.

The consensus forecast for Tesla indicates an average of 443,000 deliveries or a median of 431,125. These figures surpass certain online estimates, possibly reflecting older analyst projections.

Tesla recently raised Model Y prices in the U.S. and China, a move aimed at boosting sales in March. However, this strategy could potentially dampen demand at the beginning of the second quarter, particularly in China.

Strategic Considerations for Investors

The broadening and rotation of the stock market rally suggest a constructive trend. While the focus has been on tech stocks in this analysis, investors can explore actionable opportunities in sectors like housing, finance, healthcare, travel, and consumer goods.

Stocks such as Eli Lilly (LLY), Medpace (MEDP), Uber Technologies (UBER), ELF Beauty (ELF), Nextracker (NXT), XP (XP), Royal Caribbean (RCL), East West Bancorp (EWBC), Axon Enterprise (AXON), On Holding (ONON), M/I Homes (MHO), and Berkshire Hathaway (BRKB) present promising investment prospects.

Amidst the potential consolidation phase for tech growth leaders like Nvidia, Microsoft, and Meta, it is advisable for investors to explore a diverse range of investment options. Utilize the extended weekend to conduct thorough research, screen potential stocks, and identify specific targets.

Additionally, maintaining a defensive stance is crucial, considering the sell signals triggered by several leading stocks in the past week. While numerous stocks exhibit favorable setups or retracements that appear bullish, a slight increase in selling pressure could alter the landscape significantly.

For updated insights on market direction, leading stocks, and sector performance, it is recommended to follow Ed Carson on Threads at @edcarson1971, X/Twitter at @IBD_ECarson, and Bluesky at @edcarson.bsky.social for timely stock market updates and analysis.