SAN JOSE, California—In a bustling tech landscape, two CEOs in the race to ramp up production of advanced chips crucial for artificial intelligence convened for a collaborative session on Wednesday, coinciding with another remarkable surge in the market’s growth.

The dialogue unfolded on stage between Pat Gelsinger, the CEO of Intel, and Sam Altman, the CEO of OpenAI, at a convention center in San Jose, California, just hours after Nvidia revealed a staggering nearly fourfold increase in revenue for the November-January period.

Intel, a longstanding Silicon Valley innovator facing recent challenges, outlined its strategies to catch up with Nvidia during a comprehensive conference. Gelsinger set the stage with an opening address, articulating his vision of the fervent demand for AI-enabled chips reinvigorating the company in what he termed the “Siliconomy.”

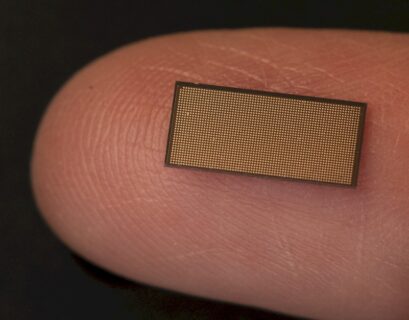

Gelsinger expressed his enthusiasm, stating, “It’s truly remarkable how these minuscule chips are driving the current economic cycle.” Meanwhile, OpenAI, a San Francisco startup supported by Microsoft, has emerged as a prominent player in the tech realm since introducing its breakthrough AI creation, ChatGPT, in late 2022. Altman is now focused on pushing boundaries further in competition with tech giants like Google and emerging players such as Anthropic and Inflection AI. However, the advancements he envisions necessitate significantly more processing power than is currently available.

The gap between supply and the escalating demand for AI chips underscores Altman’s keen interest in securing additional funding to bolster the industry’s manufacturing capacity. While discussing with Gelsinger, he sidestepped queries about a rumored fundraising target of up to $7 trillion, emphasizing the need for substantial global investments to meet the soaring demand for AI compute.

Altman stressed the imperative of sustaining the momentum in AI progress from the past year to drive a technology that he believes will shape a brighter future for humanity, despite acknowledging potential challenges along the way.

Nvidia stands out as a prime beneficiary of the ongoing AI boom. The 31-year-old chipmaker has surged to the forefront due to its early lead in producing GPUs essential for powering popular AI applications like ChatGPT and Google’s Gemini chatbot.

Over the past year, Nvidia has witnessed a remarkable growth streak, generating over $1.3 trillion in shareholder value in less than 14 months, propelling it to the fifth spot among the most valuable publicly traded U.S. companies.

In contrast, Intel has been striving to convince investors of a resurgence under Gelsinger’s leadership. Since assuming the role of CEO, Gelsinger has steered the company towards chip manufacturing for third parties and committed $20 billion to establish new factories in Ohio, expanding into running “foundries.”

Gelsinger envisions Intel becoming the world’s second-largest foundry business by 2030, primarily driven by meeting the escalating demand for AI chips, positioning itself behind Taiwan Semiconductor Manufacturing Co. (TSMC).

Despite Gelsinger’s revitalization efforts, Intel’s stock has dipped by 30% during his tenure, while Nvidia’s shares have soared nearly fivefold in the same period.

Furthermore, Intel aims to capture a share of the \(52 billion allocated by the U.S. Commerce Department to boost the country’s manufacturing capacity in the \)527 billion processor market. As the funds under the 2022 CHIPs and Science Act are gradually distributed, Commerce Secretary Gina Raimondo expressed astonishment at the vast potential of the burgeoning market discussed in recent dialogues with industry leaders.

“The scale of chip demand they anticipate is staggering,” she remarked, hinting at forthcoming announcements on additional fund allocations to fuel industry growth.