Due to the utilization of artificial intelligence and the allocation of a portion of the new billion-dollar investment in AI enterprises, Nvidia Corp. is projected to generate a higher income this year than the cumulative earnings amassed during its initial 25 years as a publicly traded entity.

In a recent blog post unveiled on Monday morning, Nvidia NVDA, -2.67 %, shared insights into its diverse investment approach with MarketWatch before its official publication. The company is actively injecting capital into various businesses and furnishing complimentary systems to numerous startups through strategic collaborations with entities like Hugging Face, a competitor of OpenAI.

Silicone Ventures, in an interview with MarketWatch, emphasized the significance of the AI business ecosystem, stating, “We prioritize investments in companies within this ecosystem to foster innovation catalyzed by AI and advanced technology.”

Over the past two decades, Siddeek has spearheaded Nvidia’s NVentures, a novel venture capital initiative that has been meticulously evolving. Siddeek articulated that his mandate at Nvidia was to devise a fresh strategy centered on revenue generation, distinct from the prior VC arm known as GPU Ventures.

“We have been actively investing as a company for a considerable period, primarily driven by highly tactical motives,” he remarked. “Our investment focus now pivots towards profitability; the shift transcends Nvidia’s interests, aiming to broaden our scope.”

Although Nvidia has not disclosed the exact sum channeled through NVentures, it confirmed that the venture capital division has executed 19 investments to date. An Nvidia spokesperson indicated that the investments span from a few million to tens of millions of dollars.

A notable portion of these investments targets leveraging Artificial Intelligence to expedite the advancement of pharmaceuticals. Additionally, other startups in Nvidia’s portfolio are dedicated to healthcare, pioneering innovative techniques for laparoscopic procedures and medical imaging, alongside exploring diverse AI applications such as automated logistics centers and synthetic media production.

“We actively seek out exceptional teams, accomplished founders with requisite expertise, integrity, and commendable personal attributes,” Siddeek emphasized. “Our quest extends to cutting-edge technological platforms and lucrative business prospects that either penetrate nascent markets or disrupt established ones.”

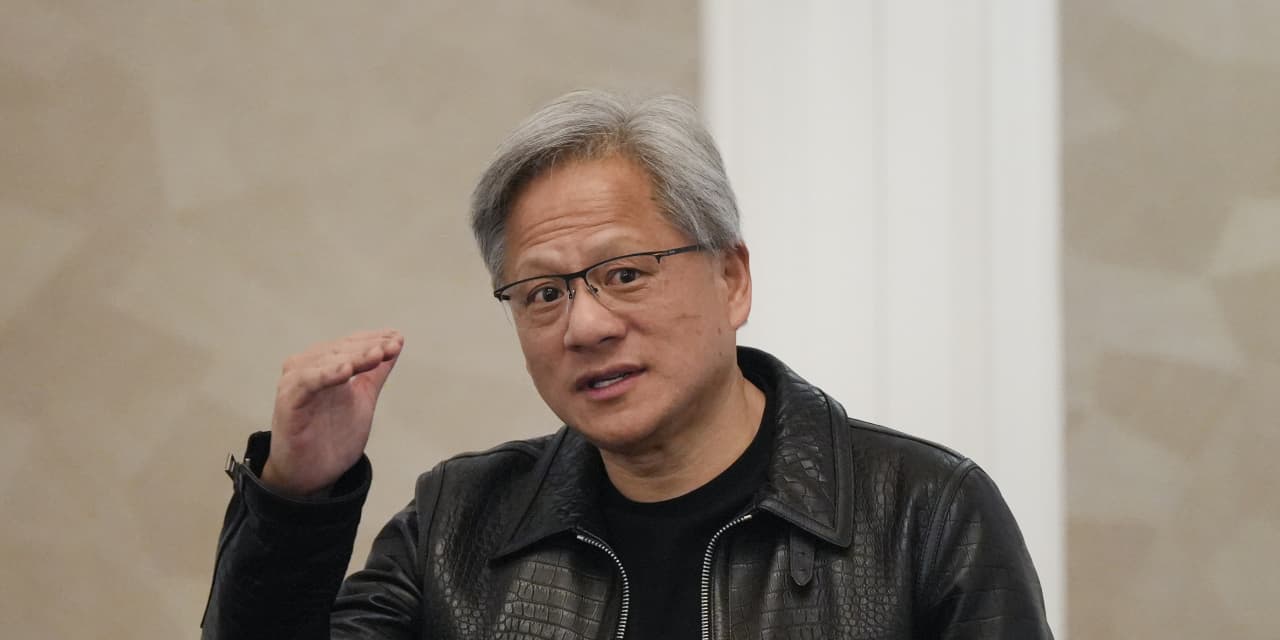

Siddeek’s profound familiarity with both Nvidia and the venture capital landscape stems from his pivotal role in facilitating Nvidia’s IPO at Morgan Stanley. Subsequently, Jensen Huang, the CEO of Nvidia, enlisted him to oversee investment relations at the Silicon Valley semiconductor giant. Following stints in VC investments and mergers and acquisitions, including a brief tenure at Softbank Corp.’s Vision Fund, Siddeek rejoined Nvidia in late 2021 to helm NVentures.

Reflecting on his reunion with Nvidia after a 17-year hiatus, Siddeek noted a sense of continuity despite minor architectural alterations and an expanded workforce.

While Nvidia’s business development endeavors, encompassing its prior investments through GPU Ventures, retain their previous ethos of fostering a robust ecosystem rather than solely pursuing financial gains, Vishal Bhagwati, overseeing these initiatives, has disclosed 14 investments in more established enterprises this year, including Databricks, Hugging Face, and Cohere.

Inception, Nvidia’s distinct startup investment arm, focuses on providing complimentary technical and marketing support while facilitating connections between startups and other venture capital entities. Launched in 2016, the initiative currently aids over 17,000 startups across 125 nations, serving as a cornerstone for fostering innovation.

“Our suite of offerings aims to stimulate creativity by granting access to cutting-edge technologies, hardware, software, expertise, AI specialists, and more,” Siddeek elucidated.

Fundamentally, it operates as a progressive ladder for AI startups, with Nvidia nurturing a plethora of emerging businesses, selecting the most promising ones for investment opportunities, and collaborating with thriving enterprises to shape the future landscape of the AI industry.

The nurturing, support, and evolution of this ecosystem lie at the core of Nvidia’s strategic vision, as articulated by Siddeek.