During this period of heightened volatility in the stock market, let’s explore the potential areas for new growth opportunities. Nvidia is set to concentrate on expanding its horizons in Inference processing, Software development, Edge computing, and Automotive sectors. The trajectory of Nvidia’s advancements in AI is far from reaching its pinnacle.

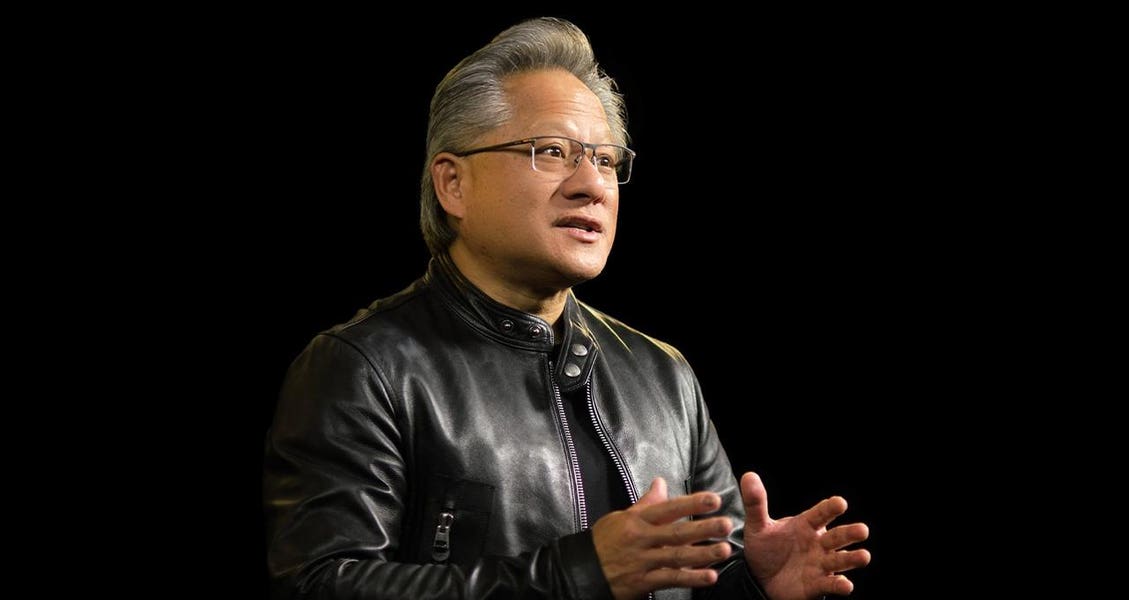

The excitement surrounding GTC is palpable, with Jensen Huang’s charismatic presence, sleek Black Leather attire, and impressive technological showcases creating a carnival-like atmosphere. This year, the event is further energized by the remarkable surge in AI-related stocks, particularly Nvidia’s. Here’s a preview of what to anticipate from Jensen and the event as a whole.

Having been a participant at GTC since 2012, I’ve witnessed the conference evolve from a gathering of graphics enthusiasts to a congregation of AI experts, expanding from a few hundred attendees to tens of thousands, and transitioning from a focus on application developers to attracting a diverse mix of investors and enterprises. This year promises to be distinct, partly due to the additional trillion-dollar valuation bestowed upon the GPU and AI industry leader by the market.

Key Areas of Interest: Hardware Innovations

Anticipate the unveiling of new hardware tailored for both training and inference tasks, with the spotlight likely on the upcoming Blackwell B100 processor. This successor to the highly successful Hopper is projected to cater to LLMs’ training and inference needs. Despite reports of Nvidia being fully booked on Hopper capacity for the remainder of 2024, the spotlight may shift towards the H100, H200, and notably, the GH200. The Grace Hopper processor is expected to feature prominently, showcasing its performance capabilities and capacity with endorsements from numerous customers.

The B100, projected to deliver a twofold increase in performance, incorporate model-specific accelerators, and potentially offer a 25% boost in HBM capacity, is poised to drive revenue growth in 2025. However, Nvidia stands to capitalize significantly in 2024 by optimizing its product mix and introducing items that mitigate supply chain challenges, a topic that will be elaborated on shortly.

Crucial Point to Note

Some skeptics have questioned the potential of Nvidia’s new roadmap to generate incremental revenue rather than mere churn. Drawing parallels with AMD and Intel CPUs, it’s evident that customers value variety, with both companies offering an extensive range of distinct parts (SKUs). While current users of H100 or H200 GPUs may persist with these models for existing tasks, the rapid expansion of LLM models, doubling in size every few months, necessitates readiness for future demands. As AI models scale up exponentially, approaching the complexity of the human brain within the next five years according to Jensen’s projections, the upcoming Nvidia GH200, the pinnacle of their Supercomputer platform for training trillion-parameter models, will play a pivotal role.

Advancements in GDDR7 Technology

In addition to the B100 launch, expect revelations in generative AI inference processing. While the L40S has been commendable, its limitations in handling large LLM inference tasks due to memory constraints may prompt Nvidia to introduce a new Lovelace GPU supporting GDDR7. This next-generation memory technology, offering twice the capacity and performance of GDDR6, could enhance Nvidia’s offerings in this domain. Given that data center inference processing accounted for around 40% of Nvidia’s revenue last quarter, a push to surpass the 60% mark by the end of 2024 is likely, necessitating a more cost-effective platform like Lovelace with GDDR7.

Thriving in Edge AI

Although Edge AI adoption is projected to eventually outpace data center usage, the recent surge in H100 adoption has slightly shifted this trend. Despite generating hundreds of millions in revenue compared to the tens of billions from data centers, Nvidia remains committed to fostering growth outside traditional data center environments, particularly in robotics and automotive applications. The evolution of Nvidia’s Jetson platform, currently based on the Ampere GPU architecture, is a focal point. Whether an upgrade to Hopper or Lovelace is imminent for Jetson, Jensen is expected to emphasize the market’s expansion potential. Noteworthy collaborations like Volkswagen integrating ChatGPT into their vehicles signal the burgeoning opportunities in this sector.

Regarding electric vehicles (EVs), Nvidia’s updates on the automotive supply pipeline guidance at GTC, especially considering the subdued EV market performance in recent times, will be of interest. Insights from key players like Mercedes Benz, Jaguar Land Rover, Volvo, Hyundai, and BYD are anticipated, shedding light on their respective programs and strategies.

Software Realm: Pioneering Innovations

Nvidia’s software business, recently disclosed to have reached a \(1 billion run-rate, encompasses Enterprise AI and Nvidia Omniverse Enterprise. The comprehensive AI models and tools under Enterprise AI, along with the immersive Omniverse Enterprise platform, are valued at premium rates, with the AI Enterprise package available at \)3,595 per CPU socket. This software suite, known for its robustness and versatility, is proving instrumental in diverse applications. Noteworthy collaborations like Mercedes leveraging Omniverse for creating digital replicas of factories underscore the software’s transformative potential. While Meta focuses on virtual experiences, Nvidia’s software empowers real-world simulations with unparalleled realism, a testament to the company’s innovative prowess.

MediaTek Collaboration: Uncharted Territories

Mobile technology remains a domain where Nvidia may harbor unfulfilled aspirations, particularly in collaboration with MediaTek. The joint efforts announced last year for automotive applications hint at a deeper partnership, with MediaTek handling the SoC engineering and Nvidia contributing GPU expertise. Speculation surrounds Nvidia’s potential involvement in enhancing MediaTek’s GPU capabilities, possibly through chiplet technology integration, aligning with Nvidia’s reported interest in custom silicon projects. The evolving dynamics between these tech giants, especially in the mobile sector, bear watching for further developments.

Final Thoughts

As we eagerly await Jensen’s revelations at GTC, the element of surprise is guaranteed. The event promises to be a melting pot of innovation, insights, and industry dynamics. For a firsthand account of the unfolding events, connect with me at the show, and stay tuned for detailed coverage right here on Forbes! Thank you for your attention!