Stay informed with complimentary notifications by subscribing to the Global inflation myFT Digest to receive updates directly in your email inbox.

The stock market has recently reached new heights following impressive results from a company that deals with products of obscure necessity but widespread demand.

As of now, Nasdaq 100 futures indicate a 2% increase, with Nvidia experiencing a significant overnight surge in value. Marko Kolanovic, the chief global markets strategist at JPMorgan, has expressed concerns about the ongoing asset price inflation potentially leading to worrisome levels of inflation.

The macroeconomic landscape has evolved over the past three years, transitioning from a post-pandemic recovery resembling the ‘roaring 20s’ to concerns about a looming recession, and now to a phase characterized by ideal conditions of robust growth, controlled inflation, and accommodative monetary policies. Despite the prevailing optimism and descriptions of the current situation as ‘parabolic stock markets’ and ‘platinum-locks,’ recent market theories suggesting that stock prices should rise due to the easing of financial conditions related to the neutral interest rate (r-star) appear speculative. Real-world decisions, such as mortgage rates or car loan payments, are unlikely to be significantly impacted by theoretical shifts in r-star. The current market trends present peculiarities, with countries like the UK, Japan, and Germany experiencing technical recessions while stock markets in Europe and Japan achieve record highs. Moreover, there is an overvaluation of AI-related stocks, with expectations of imminent economic boosts.

Recent upticks in the Consumer Price Index (CPI) and Producer Price Index (PPI), coupled with weaker economic indicators from the US and globally, have raised doubts about overly optimistic scenarios. With the Nasdaq index surging approximately 70% in a year, alongside tight labor markets, high immigration rates, and substantial government spending, the potential for inflation to stabilize or rise cannot be ignored. The influx of wealth in stock and crypto markets, along with certain monetary tightening measures like Quantitative Tightening (QT) being offset by treasury issuances, raises questions about the effectiveness of controlling inflation. For example, the gains of a single tech company have exceeded the combined market capitalization of the bottom 100 companies in the S&P 500, while the crypto market has doubled in size since the previous decline. Given these developments that ease monetary conditions, can the Federal Reserve effectively combat inflation?

Currently, momentum dominates the market with low volatility, favoring risk, strong earnings growth from the Mag7 companies, and the prominence of mega-cap stocks making equities a preferred overweight option. Despite fluctuations in the expected number of Federal Reserve rate cuts for 2024, equities have sustained a growth of more than 25%.

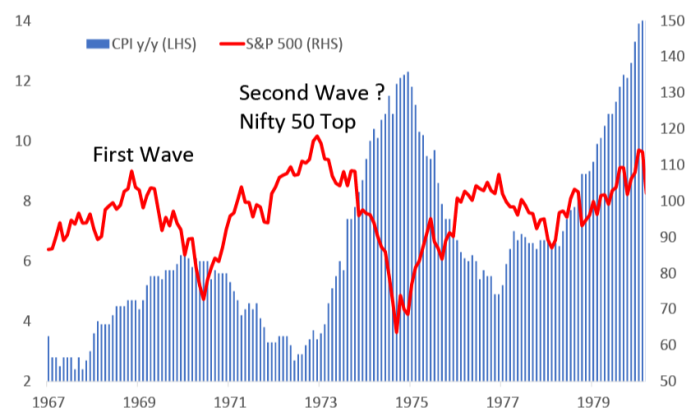

Kolanovic cautions about a potential shift in the narrative from the current favorable conditions to a scenario reminiscent of the stagflation in the 1970s, which could significantly impact asset allocation.

The 1970s were marked by high inflation in three waves, influenced by geopolitical events such as proxy wars in Southeast Asia, conflicts in the Middle East, oil embargoes leading to energy crises, shipping disruptions, and escalating deficit spending. Equity markets remained stagnant in nominal terms from 1967 to 1980, with bonds and credit significantly outperforming.

In the current landscape of 2024, geopolitical tensions persist in Eastern Europe, the Middle East, and potentially the South China Sea, alongside ongoing global elections. Supply chain disruptions, an unresolved energy crisis, unsustainable deficits in Western nations, and China’s efforts to navigate a deflationary spiral present a precarious situation according to Kolanovic.

The most significant risk lies in tensions or a potential trade war with China, which could have far-reaching effects on the global economy, triggering a substantial surge in inflation and market downturns. The possibility of reverting to a period akin to the late 1980s to 2000s, where positive feedback loops from the ‘peace dividend’ prevailed, now seems to be shifting towards a phase burdened by a “conflict tax or conflict inflation.”

If this negative feedback loop gains momentum, prompting a shift from equities to fixed-income assets to secure higher yields needed by companies and governments for funding, it could mirror the stagflationary era of the 1970s. Equities remained stagnant during this period, while bonds yielded above 7% on average, significantly outperforming stocks.

The potential implications of such a scenario highlight the importance of assessing the current market dynamics and the challenges that lie ahead.