A sell-off in Meta’s stock after the company disclosed huge investments in the technology may be a sign of investor fears about tech giants’ spending.

Mark Zuckerberg has bet big on artificial intelligence, but the hefty costs are worrying investorsLoren Elliott for The New York Times.

Meta’s A.I. bet tests investors’ patience

Meta just reported its best-ever first-quarter earnings. But for investors, that’s not enough — and that’s a warning to other tech giants set to announce their own financial results in the coming days.

Shares in the parent company of Facebook and Instagram are down 15 percent in premarket trading on Thursday, erasing more than $200 billion in market value, after Meta revealed the hefty costs of its bet on artificial intelligence. That makes clear that while Wall Street loves the opportunities that A.I. presents, it may not tolerate the profligate spending it takes to get them for that much longer.

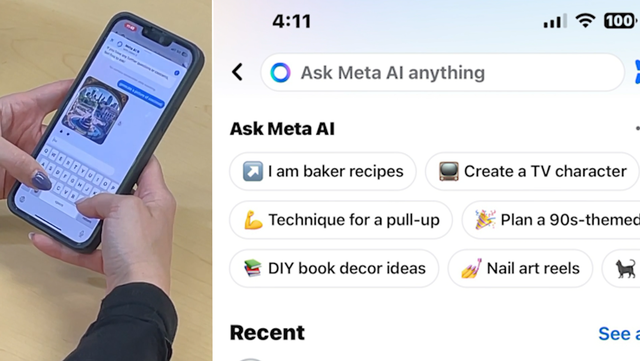

Meta warned that A.I. costs would weigh on near-term results. The company plans to spend $35 billion to $40 billion this year — much of that on the technology — up from a forecast of $30 billion to $37 billion. It also expects second-quarter revenue to come in at $36.5 billion to $39 billion, below analyst estimates.

Mark Zuckerberg urged investors to be patient. Here’s what Meta’s C.E.O. told analysts:

It’s worth calling that out, that we’ve historically seen a lot of volatility in our stock during this phase of our product playbook, where we’re investing and scaling a new product, but aren’t yet monetizing it.

He added that other products, including short video offerings like Reels and Stories, initially didn’t make any money, but became huge sources of advertising revenue.

Meta has been dinged for huge spending before, but bounced back. The company’s stock plunged in 2022 over investor fears about the billions that it spent on the metaverse, the virtual- and augmented-reality technologies that the company previously said were its future.

Meta’s stock recovered after Zuckerberg declared 2023 a “year of efficiency” by cutting costs. That helped Meta’s stock soar over the past year.