Sam Altman, the Chief Executive Officer of OpenAI, faced an unexpected termination during this period, leading to swift recruitment by Microsoft MSFT after failed negotiations for his return. This transition has reignited interest in a sector that has captivated the global community since 2023.

The unveiling of OpenAI’s flagship conceptual AI innovation, ChatGPT, has sparked a resurgence of interest across various industries throughout the year. ChatGPT made its debut in November 2022 and has since been integrated into numerous platforms, including Microsoft’s search engine, Bing. Moreover, the updated versions, GPT-4, and the premium edition featuring API support were introduced in March 2023. This wave of advancements has also witnessed the decline of several competitors, such as Google’s Bard.

The impact of AI on industries, particularly in the realm of cross-border payments, has been profound. While earlier iterations of AI technology were predominantly utilized in industrial sectors like KYC and fraud prevention, relational AI has opened up new horizons. Initial reactions to ChatGPT within the tech community were marked by enthusiasm and anticipation.

Amid concerns of potential competitive disadvantages if not adopting the technology promptly, businesses scrambled to explore the commercial applications of ChatGPT. However, as the year progressed, the fervor surrounding relational AI subsided, giving way to more measured and practical industry dialogues focused on the tangible benefits of the technology.

As ChatGPT reaches its first anniversary, it is evident that substantial groundwork is still required before its full potential can be realized. While conceptual AI offers undeniable advantages, perceptions that once hailed it as a panacea have evolved in recent months.

Leveraging Artificial Intelligence in Cross-Border Payment Operations

Most banking institutions have ongoing projects leveraging conceptual AI either as a primary focus or as a supportive tool to streamline operations and automate repetitive tasks. However, the utilization of AI in active applications remains somewhat fragmented within the industry.

Public disclosure of AI applications remains rare among payment and remittance entities, reflecting a general lack of enthusiasm for the technology. Nevertheless, transaction processors have shown a higher propensity for AI adoption.

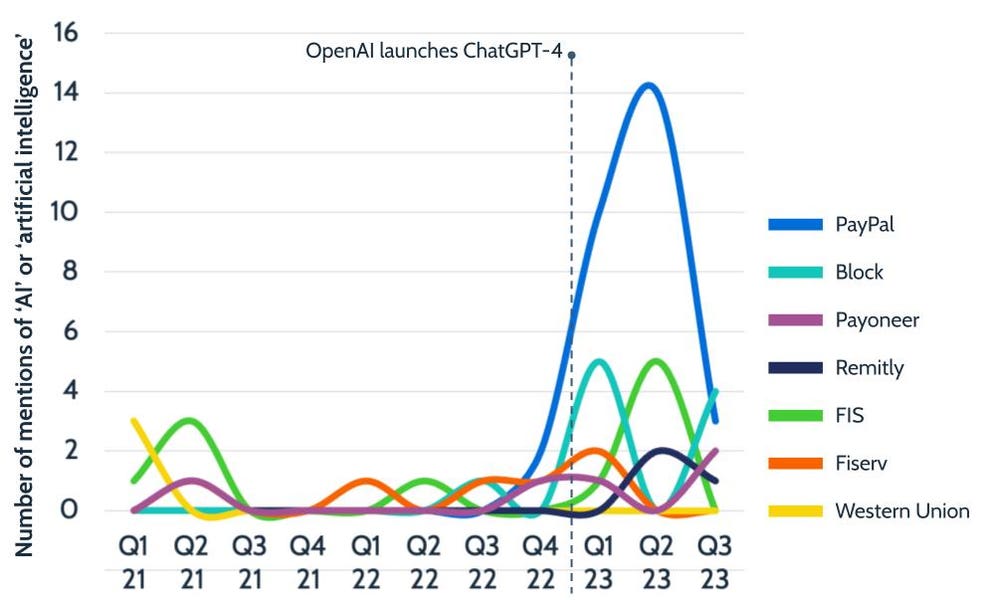

Analysis of publicly available company earnings calls indicates a varying degree of AI integration. While major players like Western Union (WU) have been notably silent on AI in recent quarters, others like Remitly have shown a gradual uptick in AI mentions. Payment processors, including PayPal (PYPL), Block, and FIS, have intensified their focus on AI technologies, especially following the introduction of ChatGPT-4.

Integration of AI in Cross-Border Payment Strategies: Insights from Earnings Calls

Key players in cross-border payment operations are exploring AI applications primarily in customer service and sales domains. For instance, Payoneer is contemplating the integration of relational AI to enhance customer interactions and operational efficiency across its business operations, as highlighted by CEO John Caplan.

Block CEO Jack Dorsey has underscored the strategic importance of AI in enhancing sales, customer service, and marketing effectiveness. Similarly, PayPal’s incoming CEO, Alex Chriss, has emphasized the potential of relational AI in fostering stronger merchant-consumer relationships.

Future Prospects: AI’s Role in Shaping the Payments Landscape

The utilization of AI, particularly conceptual AI, in cross-border payments is still in its nascent stages, with the full extent of its benefits likely to materialize gradually. As the industry undergoes a transformative phase driven by iterative research and technological advancements, the true potential, limitations, and opportunities of AI are gradually unfolding.

While much of the groundbreaking work in AI applications for payments is currently underway behind closed doors, organizations that invest in long-term research and development are poised to reap substantial rewards in the future. As we progress into 2024, the enduring relevance of AI in shaping the payments landscape is undeniable, signaling a continued evolution in the industry.