Andrey Semenov

Super Micro Computer, Inc. (NASDAQ:SMCI), which was priced at \(1,004 as of the time of this composition, has experienced a significant increase of over \)500 since January 29. This surge can be attributed to the remarkable 103% year-on-year growth in revenue for the second quarter of fiscal year 2024 (FQ2), primarily fueled by the escalating demand for AI-related technologies. Notably, this growth trajectory draws parallels to its longstanding partner, NVIDIA Corporation (NVDA), which achieved a 101% year-on-year revenue surge in the corresponding quarter of the previous year.

A comparative analysis between these two entities reveals that SMCI’s stock has skyrocketed by more than 800% over the past year, surpassing the semiconductor giant’s 224% growth, as outlined below. This exceptional performance may be attributed to the CEO’s assertion that the demand for their products is poised to endure for decades amidst the AI revolution. Additionally, SMCI’s current valuation presents a substantial discount relative to Nvidia.

A detailed examination of key metrics (source: seekingalpha.com) underscores the competitive landscape. While Nvidia enjoys a quasi-monopoly with its AI-accelerating H100 GPUs and the capacity for rapid production scaling at a profit, SMCI faces competition that seems overlooked in analysts’ forecasts for fiscal year 2024.

Diversifying Beyond an OEM Supplier for AI Servers

The widespread adoption of ChatGPT has spurred executives to seek interactive chat-based solutions to enhance efficiency and maintain a competitive edge. Investment analysts predict that Generative AI will revolutionize various economic sectors.

To establish the necessary infrastructure for supporting Large Language Models (LLMs), servers equipped with Nvidia’s GPUs, particularly the advanced H100 model, are indispensable. This is where OEM suppliers like SMCI play a pivotal role. A comparison of revenue growth with industry peers such as Dell Technologies Inc. (DELL) and HP Inc. (HPQ) indicates that SMCI has adeptly positioned itself to capitalize on the AI wave.

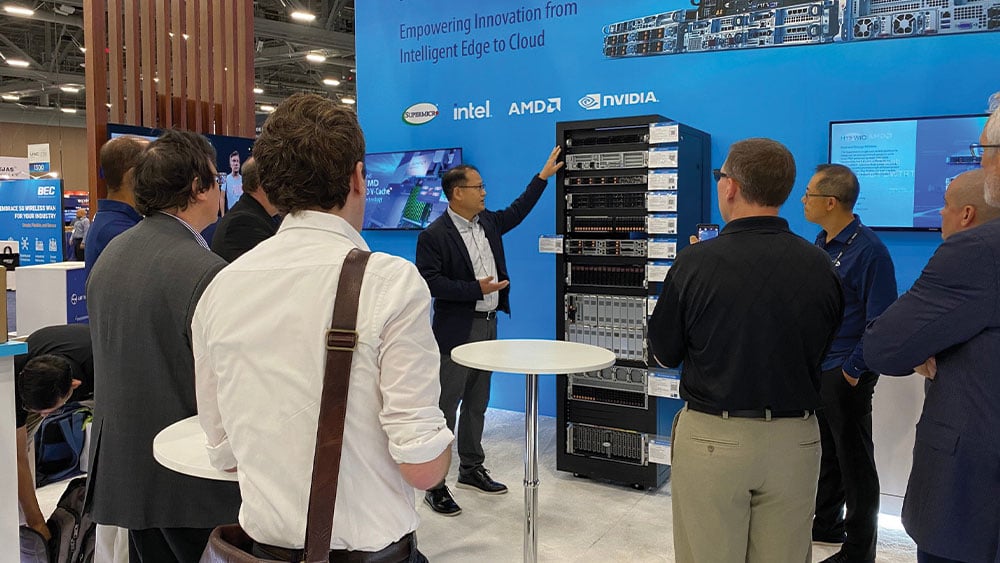

Setting itself apart from other OEMs, SMCI offers comprehensive IT solutions that integrate AI with general-purpose computing and storage, complemented by proprietary liquid cooling technologies crucial for data center installations handling high-intensity workloads.

Buoyed by an initial surge in demand, surpassing industry averages by fivefold, the management envisions scaling annual revenues to exceed \(25 billion from \)7.1 billion in fiscal year 2023, marking a significant threefold increase.

Company Presentation (source: static.seekingalpha.com)

However, achieving this ambitious target poses challenges, particularly concerning profitable growth and the complexities of scaling production.

Challenges in Profitability and Production Dynamics

A comparative analysis of SMCI’s income statement metrics, encompassing year-on-year revenue, gross profit, and EPS growth, against Nvidia’s performance, reveals contrasting trends. While Nvidia’s margins have been on an upward trajectory outpacing revenue growth, SMCI exhibits the opposite trend. This disparity suggests that SMCI may lack the same level of profitable growth as Nvidia, potentially indicating a lack of pricing power and higher production costs.

Further scrutiny reveals that SMCI operates within the Technology Hardware, Storage, and Peripherals industry, whereas Nvidia operates as a semiconductor and fabless entity. Unlike Nvidia, which outsources chip manufacturing to Taiwan Semiconductor Manufacturing Company Limited (TSM), SMCI procures GPU chips, CPU chips, memory modules, and storage devices for in-house assembly across its facilities in Los Angeles, the Netherlands, Taiwan, with plans for expansion in Malaysia. This substantial investment in production capacity resulted in negative free cash flow and operational cash outflow in FQ2, necessitating a debt raise of approximately $583 million through an equity offering. Additional financing, potentially through debt instruments, may be sought to avoid further share dilution.

While seeking additional working capital during an expansion phase is common, SMCI’s inability to generate positive operational cash flow hints at potential pricing challenges. Management’s indication of a gradual increase in average sales price (ASP) despite rising costs implies a delicate balance. The stark price contrast between the high-end H100 GPU priced around $30,000 and the more budget-friendly Intel 13th Gen Raptor Lake Core i9-13900K processor underscores the pricing dynamics within SMCI’s market segment.

Consequently, if demand wanes, excess production capacity could lead to inventory liquidation through discounts, thereby impacting profit margins. The resolution of this dilemma hinges on sustained demand.

Navigating Demand Dynamics and Competitive Landscape

A substantial portion of SMCI’s sales, approximately 40%, emanated from enterprise/channel verticals, driven by AI and CPU upgrade initiatives. Notably, the term “upgrade” implies existing customers enhancing their IT infrastructure to accommodate advanced applications, either through direct purchases or channel partnerships.

/article/4665859-super-micro-computer-inc-2024-q2-results-earnings-call-presentation (source: seekingalpha.com)

Amidst industry dynamics, enterprises, particularly smaller entities entrenched in long-standing relationships with specific OEMs, are inclined to maintain vendor loyalty to ensure strategic partnerships alongside solutions provision. This loyalty explains the surge in demand for AI-optimized servers from Dell, with backlogs doubling to approximately $1.6 billion on a quarter-to-quarter basis. Consequently, SMCI is gaining ground in the AI domain.

Moreover, competitors like International Business Machines Corporation (IBM) leverage consultancy services to address the dearth of Generative AI expertise among enterprises, offering a unique value proposition. Additionally, competition extends beyond traditional players to include Nvidia, which not only supplies GPU chips but also markets complete server racks like the DGX H100. Startups like SambaNova Systems also pose a competitive threat by leveraging their expertise in Large Language Models to expand their product portfolio to encompass comprehensive AI platforms.

A significant portion, 59%, of FQ2 revenues stemmed from Independent Software Vendors (ISVs) necessitating OEM appliances and Cloud Service Providers (CSPs) like Amazon.com, Inc. (AMZN) or Microsoft Corporation (MSFT) broadening their service offerings to include AI-as-a-service or cloud-based AI subscriptions. Leveraging Nvidia’s hardware virtualization and confidential computing capabilities, CSPs can create multiple virtual servers from a single physical H100 GPU for lease in a multi-tenant cloud environment.

Valuation and Market Positioning

With a substantial revenue share derived from potential competitors utilizing cloud-based distribution channels to reshape competitive dynamics, sustaining growth momentum in the latter half of fiscal 2024 may pose challenges. This scenario is compounded by the integration of the H100 into the Azure GPU family on January 30, enabling corporations under budget constraints to lease virtual server instances.

The prevailing market trend indicates a shift towards cloud-based AI consumption, with a projected 94% of enterprises integrating AI through cloud platforms. The forward price-to-sales ratio of 2.86x based on anticipated revenues of $14.46 billion for fiscal year 2024 may appear inflated, especially following an 800% surge in stock value. Consequently, a recalibration of valuations is anticipated as the AI hype gives way to pragmatic assessments.

To substantiate a more conservative valuation, SMCI’s EPS growth forecast for FY-2024, reflecting an 82.93% year-on-year increase, may be overstated given the nuanced profitability dynamics elucidated earlier. A more realistic estimate, akin to the 62% growth achieved in FQ2, suggests an adjustment is warranted. Consequently, the EPS projection of $21.60 may be inflated by approximately 33%.

By averaging these adjustments at 29% and 33%, the stock is potentially overvalued by around 31%, leading to a revised estimate of \(692 (1,004 × 0.69) relative to the current share price of \)1,004. This valuation aligns closely with the Wall Street average of $702.

Furthermore, competitors like Vertiv Holdings Co (VRT) specializing in liquid cooling solutions for high-power AI applications pose a challenge to SMCI’s competitive edge in this domain.

While uncertainties persist, particularly concerning non-GPU sales in China amidst potential tariff implications, a cautious outlook is warranted. In essence, the market positioning of SMCI may face headwinds as competitive pressures intensify, potentially impacting bottom-line performance.

Final Remarks

In conclusion, this analysis presents a bearish outlook predicated on competitive pressures and pricing challenges relative to Nvidia’s dominant market position. While the target price of \(692 exceeds the January 29 valuation of \)385, it reflects a tempered expectation of sustained demand for SMCI’s servers albeit at a moderated pace. Looking ahead, the evolution of AI consumption patterns, notably through cloud platforms, may redefine market dynamics, necessitating strategic adaptations.

Ultimately, while risks persist, prudent assessment and strategic positioning will be imperative for SMCI to navigate the evolving landscape and sustain its market relevance amidst intensifying competition and shifting industry paradigms.