As demonstrated by the recent surge in Arm and Nvidia’s share prices, with increases of 63% and 26% respectively in the past month, the semiconductor industry is currently experiencing significant activity. The momentum and anticipation in this sector are palpable.

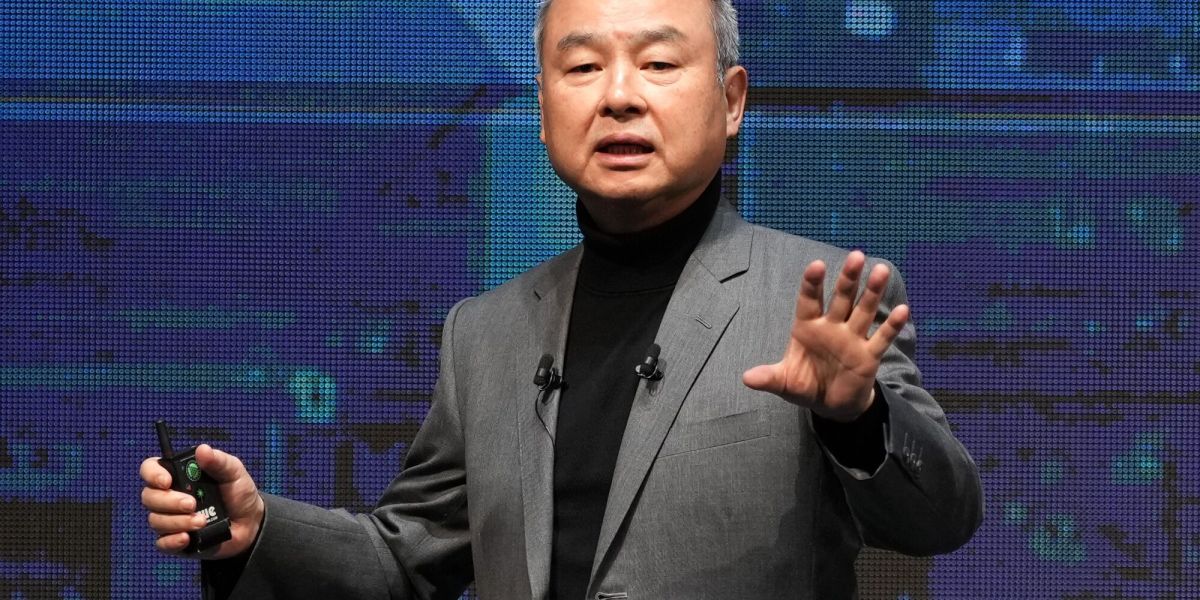

A major development unfolded on Friday as Bloomberg disclosed SoftBank’s ambitious plan to directly challenge Nvidia through a new AI chip initiative, aiming to secure a substantial \(100 billion in funding. Reportedly, SoftBank intends to contribute \)30 billion, while Middle Eastern institutions are expected to provide the remaining \(70 billion for this project codenamed Izanagi, a nod to the Japanese creator deity. Despite previously holding a \)3.6 billion stake in Nvidia, SoftBank divested its shares in early 2019 and now seeks to establish a formidable competitor.

Following the Izanagi announcement, SoftBank’s stock rose by nearly 5% today. Should this venture materialize, the potential collaboration between Izanagi and Arm, of which SoftBank owns a 90% stake, raises intriguing prospects. Given Arm’s pivotal role in chip design for industry players like Nvidia, any partnership with chipmakers could raise antitrust issues for Arm, as evidenced by Nvidia’s failed \(40 billion acquisition bid for Arm two years ago due to regulatory concerns. (However, Nvidia recently acquired a \)147 million stake in Arm, which currently boasts a market capitalization of $132 billion.)

SoftBank’s strategic shift towards semiconductor investments, fueled by its substantial cash reserves from the T-Mobile US and Sprint merger and Arm’s resurgence, marks a significant departure from its previous focus on startup funding. Notably, rumors suggest that SoftBank is among the potential suitors for Graphcore, a U.K.-based AI-chip firm facing financial challenges and seeking strategic alternatives.

Similarly, OpenAI’s CEO Sam Altman is exploring significant funding opportunities in the Middle East for a multi-trillion-dollar AI-chip venture, mirroring SoftBank’s approach. Altman’s efforts, however, may encounter regulatory hurdles, including national security reviews and potential antitrust implications, especially if OpenAI becomes a customer or competitor of such ventures.

On a governmental level, the Biden administration’s rollout of substantial subsidies under the 2022 CHIPS Act to bolster domestic semiconductor manufacturing is gaining momentum. Companies like Microchip Technology and BAE Systems have already received significant funding, with GlobalFoundries set to receive \(1.5 billion for enhancing its U.S.-based production capabilities. Moreover, Intel is reportedly in line to receive \)10 billion to support the reshoring of its manufacturing operations.

Amidst the buzz surrounding Altman’s ambitious chip venture and the government’s efforts to bolster semiconductor manufacturing domestically, the tech industry landscape is evolving rapidly with eye-watering sums at stake. The interplay between technological advancements, regulatory scrutiny, and market dynamics sets the stage for a transformative period in the semiconductor ecosystem.

David Meyer Want to share your thoughts or suggestions with Data Sheet? Feel free to reach out here.