- Reuters reported delays in the launch of the new H20 device due to challenges faced by client manufacturers in integrating the silicon into their products.

- Nvidia’s shares declined by 2.4% in pre-market trading on a shorter U.S. trading day.

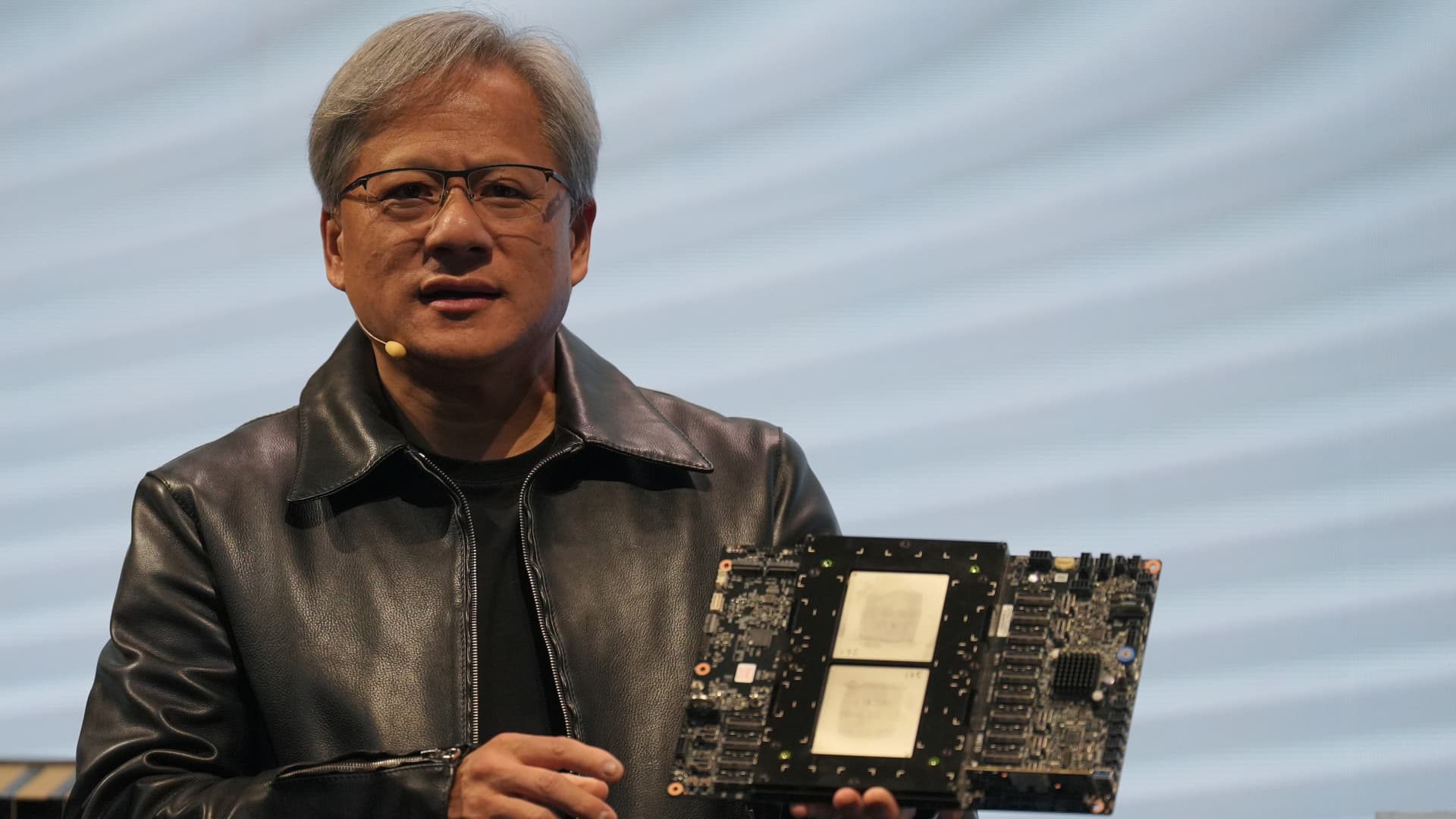

During the Supermicro presentation at Computex 2023, Jensen Huang, Nvidia’s leader, presented the Grace grinder superchip CPU tailored for advanced AI applications.

Nvidia’s stock price fell on Friday as the company postponed the release of a new AI chip customized for the Chinese market to comply with U.S. export regulations.

On a truncated U.S. trading day, Nvidia shares saw a 2.4% decrease in pre-market trading.

This decision came after Nvidia informed its Chinese clients, as per a Reuters report, about delaying the AI device launch scheduled to align with U.S. trade restrictions until the first quarter of the following year. The postponement was due to difficulties faced by client manufacturers in integrating the silicon component into their products.

Nvidia was not immediately available for comment when CNBC reached out for a statement.

In October, the U.S. government imposed stricter export regulations on AI chips to China, restricting the export of Nvidia’s A800 and H800 cards developed for the Chinese market. Nvidia now plans to introduce three new export-compliant chips: the L20, L2, and H20, according to Reuters.

With about one-fifth of its revenue originating from China and competition from local rivals like Huawei, Nvidia may encounter setbacks due to the delay in the H20 device launch.

Despite reporting a threefold revenue increase for the third quarter ending in September, Nvidia cautioned about significant sales declines in regions affected by trade restrictions.