Economists are beginning to express caution about a potential “AI bubble” that could lead investors to pull out as huge sums of money are funneled into the AI frenzy.

Richard Windsor, a tech share analyst, used a striking analogy in a CNBC-discovered study to depict the potential aftermath of a bubble burst.

The AI sector continues to attract significant investments with minimal consideration for company fundamentals, indicating a precarious situation when the inevitable market correction occurs.

The recent surge in investments in innovative AI ventures has been underscored by a turbulent week for AI firms.

Cohere, a startup specializing in generative AI, is reportedly in talks to be valued at an astonishing $5 billion.

Meanwhile, Microsoft has placed a $13 billion bet on OpenAI and recently absorbed most of the personnel from AI startup Inflection AI. The unconventional approach raised concerns among investors, prompting questions about Microsoft’s strategic decisions.

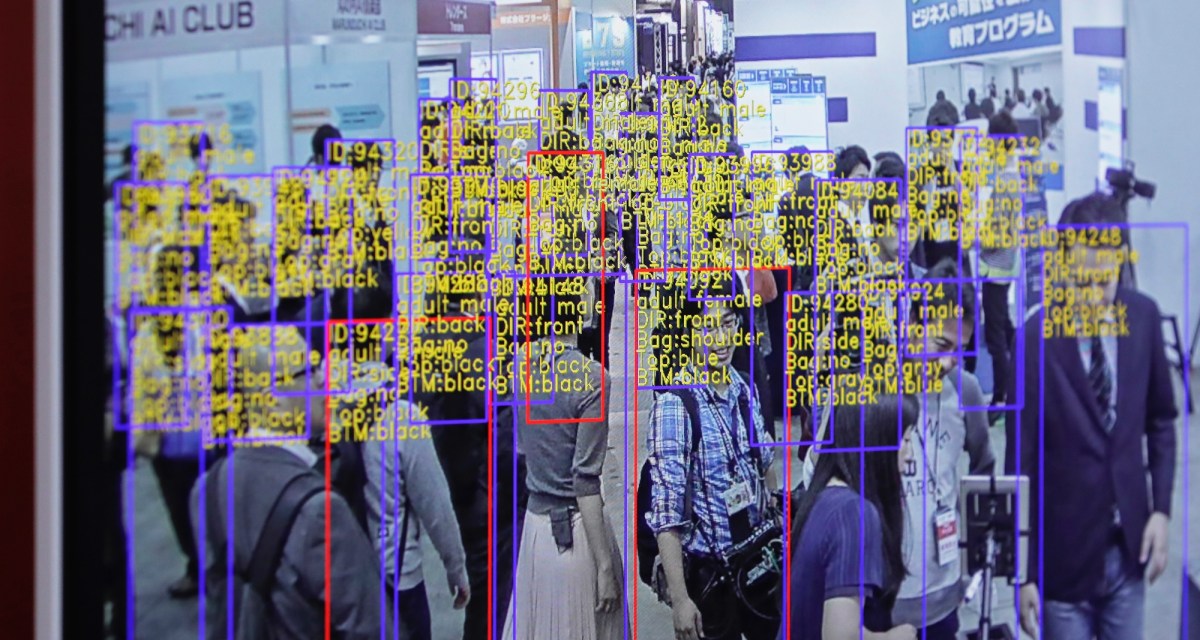

Windsor noted that businesses are eagerly embracing any AI-related opportunities without thorough evaluation, drawing parallels to past instances of overhyped technologies such as the Internet in 1999 and autonomous driving in 2017.

Investors are pouring substantial funds into AI ventures despite uncertainties surrounding profitability, echoing concerns raised by industry insiders.

Amidst the growing frenzy, critics like Emad Mostaque, the former CEO of Stability AI, have voiced apprehensions about the impending burst of what he terms the ‘dot AI’ bubble.

With prominent figures like Jeffrey Gundlach and John Hussman drawing parallels to historical market bubbles, the apprehension surrounding the AI hype is palpable.

Experts caution that the current trend of inflated valuations and speculative deals, exemplified by Microsoft’s recent activities, could signal an impending crisis in the AI sector.

The challenges of translating AI advancements into tangible profits, particularly evident in AI chatbots’ struggle to discern reality from fabrications, raise ethical and financial concerns among industry stakeholders.

As the echoes of past market bubbles reverberate through the AI landscape, the looming question remains whether the current AI fervor will meet a similar fate or chart a different course.