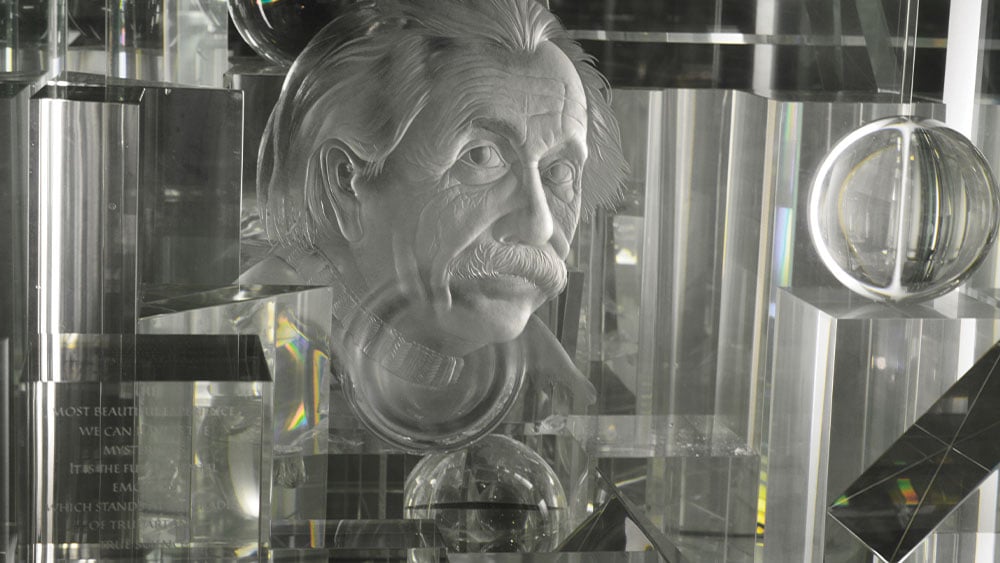

Tesla (TSLA), founded by Elon Musk, is not the sole entity paying homage to Nikola Tesla’s ingenuity. Salesforce.com (CRM) has introduced the Einstein 1 platform under the guidance of CEO Marc Benioff, in tribute to Albert Einstein. This innovative platform has elevated CRM property history to a new level with advanced artificial intelligence capabilities.

Einstein 1, built on Salesforce’s foundational data platform, showcases significant enhancements for Sap Data Cloud and its AI functionalities. Through seamless integration with the Einstein 1 platform, clients can amalgamate diverse data sources to generate a comprehensive customer profile. Moreover, it seamlessly integrates AI, technology, and insights into every user interaction.

Despite not being included in the recent acquisitions list of prominent mutual funds alongside other enterprise software companies such as ServiceNow (NOW), Palantir (PLTR), and SAP (SAP), Salesforce has witnessed three consecutive quarters of increasing fund ownership. Furthermore, it boasts 94 funds with an A+ rating from IBD focusing on personal Amazon property stocks.

With a robust Composite Rating of 96, CRM property has secured a position on the IBD 50 and the EBD Leaderboard. Its industry peers, PLTR stock and ServiceNow, have also received commendable ratings, experiencing a resurgence following their feature in the IBD Stock Analysis last week.

Amazon Harnesses AI Advancements for 78% Growth

Salesforce stands out as a frontrunner in cloud-based customer relationship management (CRM) software, empowering businesses to identify prospects, close deals efficiently, and foster extensive customer connections.

Headquartered in San Francisco, California, the company serves a diverse range of industries, including energy, manufacturing, retail, and the public sector. Noteworthy brands such as Williams-Sonoma (WSM), Spotify (SPOT), and Ford (F) are among its esteemed clientele.

On August 30, Amazon reported its fiscal 2024 second-quarter earnings, achieving a profit of \(2.12 per share. The company’s revenue surged by 11% to surpass \)8.6 billion, signifying a remarkable 78% growth compared to the previous year’s quarter.

Anticipated to unveil its Q3 financial results after-market on November 30, Amazon is projected to report revenue ranging between \(8.70 billion and \)8.82 billion, with a projected decrease in earnings per share to \(1.02-\)0.03. Analysts foresee a 53% revenue growth for the entire fiscal year.

CRM Stock Sets Sights on New Heights, Clears Acquisition Threshold

Amazon has successfully approached the challenging zone near 215. Since July, the turbulent market conditions have transformed a cup-shaped handle into an accumulation pattern. Additionally, CRM stock displays characteristics of a triple bottom, presenting a purchase point at 228.79, highlighting the dynamic nature of stock chart patterns.

The stock surged by approximately 2% on Monday.

Having surpassed its 50-day moving average earlier this month, CRM stock experienced a notable gap up on November 14 with above-average volume, following successful support testing in the preceding days.

Despite the upcoming earnings announcement in less than two weeks, Amazon continues its ascent towards the 228.79 threshold.

Meanwhile, ServiceNow and PLTR stocks have extended beyond their acquisition zones. As analysts speculate on the potential impact of the Cybertruck cancellation, Tesla stock grapples with its own market volatility.