Nvidia (NVDA) is set to unveil its fourth-quarter earnings post-market close on Wednesday, marking a highly anticipated financial report. The AI chip leader has witnessed a remarkable surge of 184% in its stock value over the past year, surpassing competitors AMD (AMD) and Intel (INTC), with gains of 91% and 67% respectively.

During its impressive rally, Nvidia briefly exceeded the market capitalization of tech giants Amazon (AMZN) and Google’s parent company Alphabet (GOOG, GOOGL) last week, securing the third spot among the world’s most valuable publicly traded firms, trailing only behind Microsoft (MSFT) and Apple (AAPL). However, as of Tuesday, Amazon and Alphabet have regained their positions ahead of Nvidia.

Analysts project Nvidia to announce adjusted earnings per share (EPS) of \(4.60 on revenue of \)20.4 billion for the fourth quarter, a substantial increase from adj. EPS of \(0.88 on \)6.1 billion reported a year earlier, reflecting a remarkable 234% year-over-year growth. In 2022, Nvidia recorded a total revenue of $27 billion.

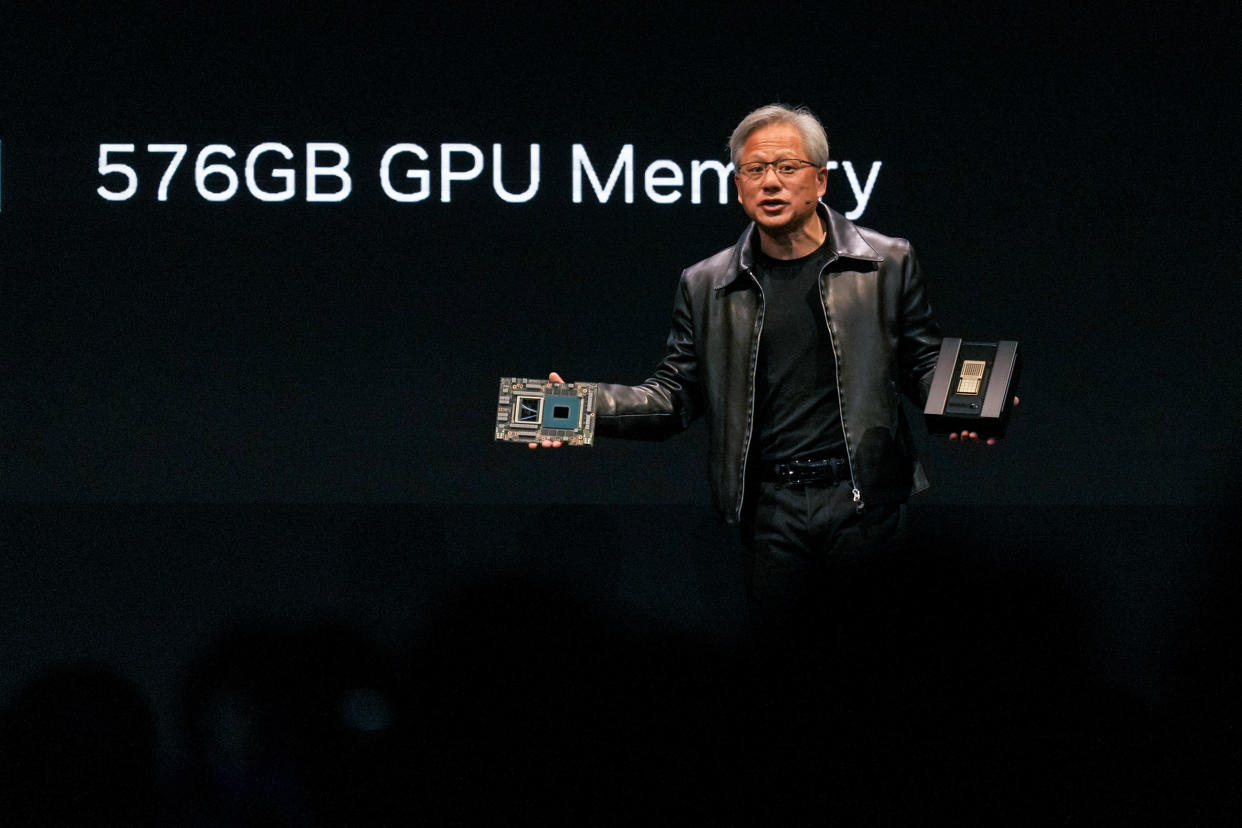

The Data Center segment is expected to drive significant revenue for Nvidia, with analysts forecasting \(17.2 billion in the quarter compared to \)3.62 billion in the corresponding period last year. This segment has emerged as Nvidia’s primary revenue source, fueled by the growing demand for artificial intelligence applications, particularly generative AI technologies.

Meta (META) recently announced plans to integrate 350,000 units of Nvidia’s flagship H100 chips into its AI data centers by the end of 2024. While the exact pricing of the H100 remains undisclosed, estimates suggest a price tag in the tens of thousands of dollars per chip, indicating a multi-billion-dollar investment by Meta in Nvidia’s technology.

The Gaming segment, historically Nvidia’s largest business division, is anticipated to generate \(2.7 billion in revenue, up from \)1.8 billion in the previous year.

Analysts will closely monitor Nvidia’s forward guidance, as the company has consistently exceeded revenue projections in recent quarters, signaling robust performance in the AI sector.

Numerous Wall Street analysts have revised their price targets for Nvidia, with UBS raising its target from \(580 to \)850, Stifel setting a new target of \(865, and Wedbush increasing its target to \)800. These adjustments underscore the high expectations surrounding Nvidia’s performance.

Despite its growth trajectory, Nvidia faces increasing competition, notably from AMD, which is heavily investing in AI chip development, including the new MI300X chip. While AMD claims superiority in certain workloads over Nvidia’s H100, Nvidia has contested these assertions, citing incomplete testing by AMD.

Moreover, Nvidia’s customers are exploring the development of custom AI chips to reduce dependence on Nvidia’s products. Major firms such as Amazon, Google, Meta, Microsoft, and Tesla (TSLA) are either offering or actively pursuing in-house AI chip solutions tailored to their specific requirements, aiming to enhance efficiency and power consumption compared to Nvidia’s more generalized offerings.

In response to these challenges, Nvidia has engaged in discussions with tech giants like Alphabet, Amazon, Meta, Microsoft, and OpenAI to explore the possibility of crafting custom chips for their unique needs.

Additionally, Nvidia grapples with US export restrictions on its most potent chips to China, expressing concerns about potential sales implications in the future despite affirming that the current ban has not impacted its financial standing.

Subscribe to the Yahoo Finance Tech newsletter for more tech insights.