-

Should Nvidia’s fourth-quarter earnings fall short of expectations, it may lead to a broader market correction affecting equities and cryptocurrencies.

-

The performance of AI-related tokens like OCEAN and FET could also be influenced by Nvidia’s earnings report and the industry outlook.

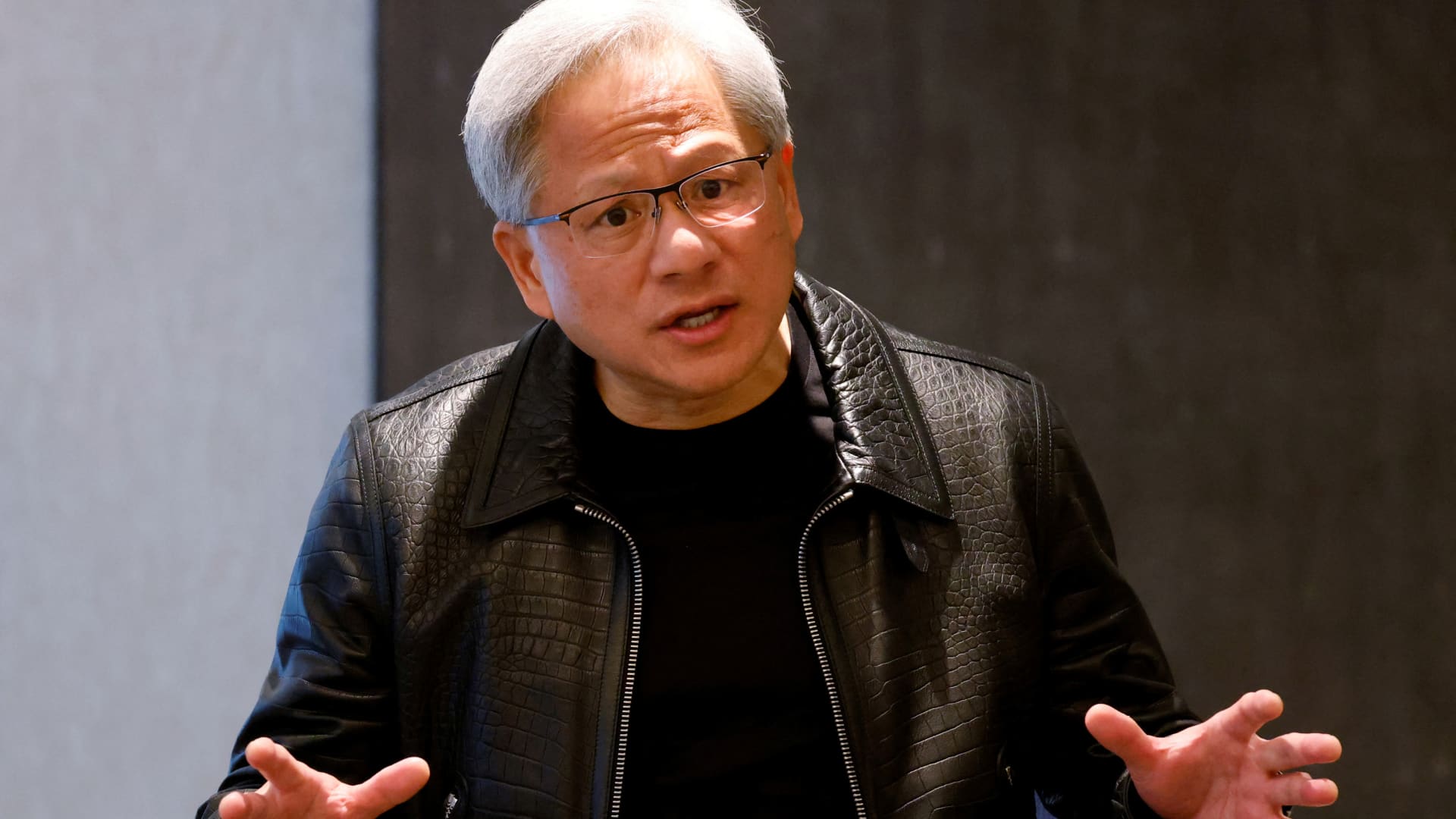

Singapore-based QCP Capital highlighted the potential impact of Nvidia’s fourth-quarter earnings on the ongoing bitcoin (BTC) and broader crypto rally. The firm suggested that a disappointing earnings report from Nvidia could halt the current market momentum, especially considering the high expectations set by Wall Street analysts.

Nvidia, a prominent GPU manufacturer crucial for the AI sector, is scheduled to announce its earnings post-market close in the U.S. on Wednesday. With its stock soaring by almost 220% in the past year, investors are closely monitoring whether Nvidia can sustain this remarkable growth trajectory. The company’s valuation, currently at 90x P/E, has raised concerns about a possible sell-off if earnings fall short of the elevated forecasts.

QCP Capital emphasized the significance of Nvidia’s performance not only for the S&P500 Index but also for the broader U.S. equities and crypto markets. The firm cautioned that any negative surprises in Nvidia’s earnings could trigger a market downturn, impacting both equities and crypto prices.

Furthermore, the AI-related crypto tokens, including OCEAN and FET, are likely to experience volatility based on Nvidia’s earnings report. As Nvidia plays a pivotal role in the AI industry, its outlook will influence trading decisions within the crypto market.

Analysts have underscored Nvidia’s heavy reliance on the server industry, a critical component of the AI revolution. Despite short-term challenges in the global PC market, projections suggest a rebound in 2024 driven by factors like commercial PC refresh cycles, AI integration, and recovery in consumer demand.

While the computing sector’s growth may stabilize due to saturated PC and notebook demand, emerging data centers are expected to drive future growth for chip companies like Nvidia. This trend will boost server shipments and demand for HPC chips, sustaining Nvidia’s long-term growth prospects.

Despite a recent 7% decline in Nvidia’s stock price, Wall Street analysts maintain a positive outlook, with a majority recommending a buy rating. The average 12-month price target stands at approximately $751, according to FactSet data.

In the cryptocurrency market, Bitcoin is currently trading at $51,200, showing a slight decline of 0.4% over the last 24 hours. The CoinDesk 20 Index (CD20), reflecting the performance of the top 20 digital assets, is down by 1.9%.

Edited by Aoyon Ashraf.