Nvidia, which roughly means “envy” in Latin, is currently experiencing a significant surge in its AI endeavors. The company’s stock has surged by approximately 30% year-to-date, reaching a closing price of $624.65 on Monday.

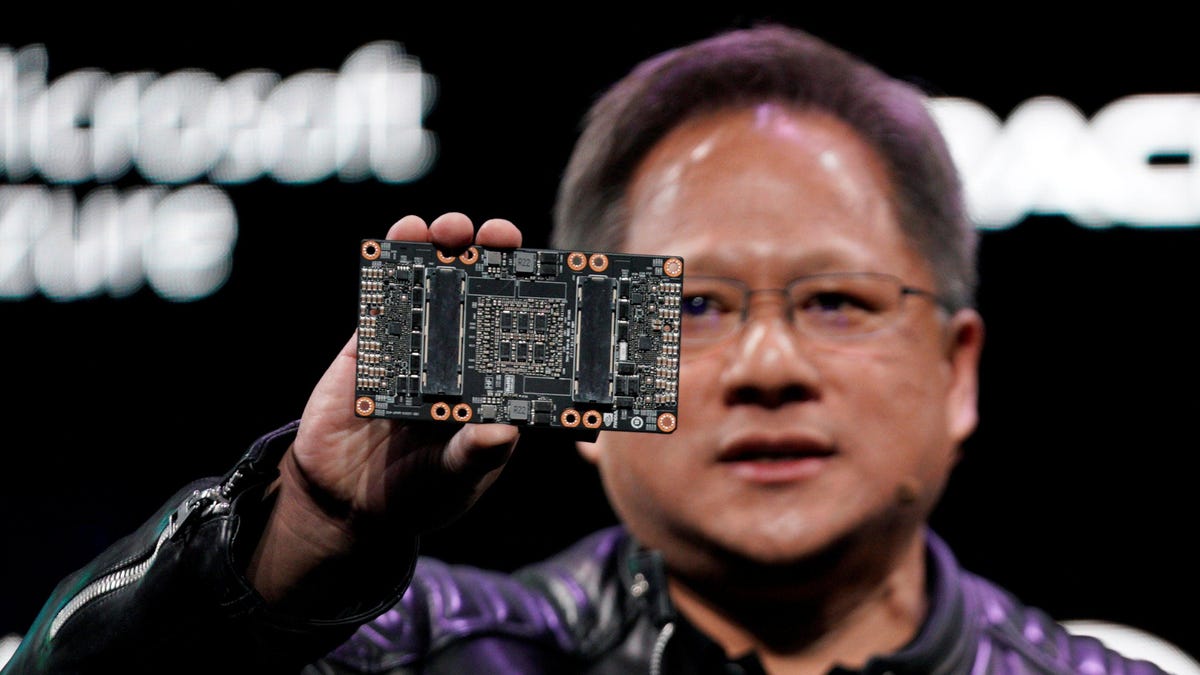

Microsoft and Meta stand out as the primary investors in Nvidia’s H100 chip, priced at \(30,000, utilized to power generative AI applications. Collectively, these tech giants have allocated a staggering \)9 billion solely towards chip procurement. However, both entities are also delving into the development of their own AI chips, posing potential challenges to Nvidia’s future revenue growth.

While numerous tech firms have been swift in introducing new AI technologies, Nvidia stands out as one of the few entities effectively monetizing generative AI. In the quarter ending on Oct. 29, its revenue surged by over threefold compared to the same period in 2022.

Emergence of AI Chips Among Tech Giants

Several prominent technology players, including Microsoft, Google, Amazon, and Meta, unveiled their proprietary AI chips last year, with some still in the developmental phase. This strategic move enables them to diminish their dependence on Nvidia while concurrently reducing the expenses associated with AI model development.

Moreover, Nvidia is encountering escalating competition from established chip manufacturers like AMD and Intel.

The Sustainability of Nvidia’s Growth Trajectory

For Nvidia to uphold its current revenue momentum, major clients in its computing and networking sector must escalate their capital investments with the company. Alternatively, other customers would need to amplify their expenditure on data center infrastructure and related equipment to offset any potential shortfall from tech giants.

Nvidia’s stock concluded Monday’s trading session with a 2.3% increase, reaching $624.65 per share.