Chip manufacturer Nvidia has emerged as the undisputed victor not only in the initial phases of the AI surge but also throughout the entire history of the stock market. The AI behemoth, valued at \(1.9 trillion, reached an all-time high stock price on Thursday, poised to increase its market capitalization by over \)230 billion, surpassing Meta’s record-breaking $197 billion gain just weeks prior.

Capturing over 70% of the AI chip market, Nvidia is commanding the industry, with startups eagerly investing hundreds of thousands of dollars in Nvidia’s cutting-edge hardware solutions. The financial realm is equally enthralled—Nvidia’s stock skyrocketed by an impressive 15% following the company’s exceptional performance in exceeding its earnings targets last quarter, propelling its market cap to over $1.9 trillion, with its stock value tripling in the past year alone.

So, what sets Nvidia apart? How has a company established as far back as 1993 outshined tech giants like Alphabet and Amazon to claim the position of the world’s third most valuable company? The answer lies in Nvidia’s forefront semiconductor chips tailored for artificial intelligence applications.

Pioneering Vision

Nvidia secured its leading position by adopting a long-term strategy and investing in AI well before the mainstream emergence of technologies like ChatGPT. Its chip designs have outpaced competitors significantly, prompting analysts to question the feasibility of catching up. Unlike players such as Arm Holdings and Intel, Nvidia has seamlessly integrated hardware with AI-specific software, setting it apart in the industry.

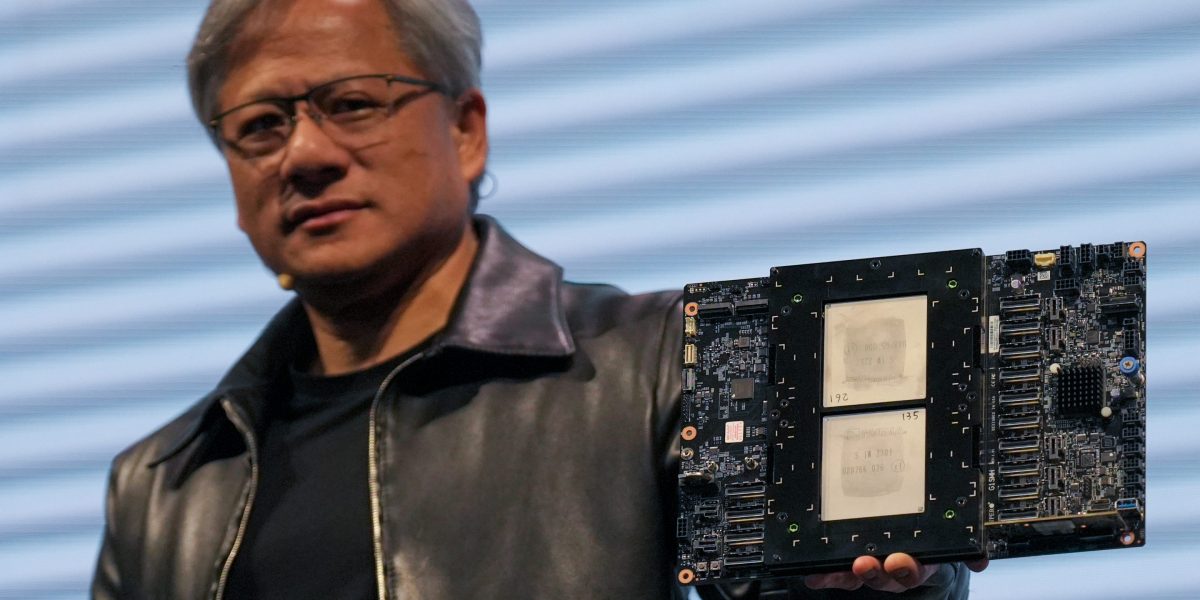

Nvidia’s co-founder and CEO Jensen Huang highlighted this strategic insight at the New York Times’ DealBook summit, emphasizing the company’s early recognition of the transformative impact of deep learning and AI on computing. The pivotal role played by software cannot be overstated. While rivals focused primarily on chip design, Nvidia aggressively promoted its CUDA programming interface, enhancing the performance of its chips. This dual emphasis on software and hardware has positioned Nvidia’s chips as indispensable tools for developers venturing into AI.

According to Edward Wilford, an analyst at Omdia, Nvidia’s success can be attributed to CUDA, which simplifies running operations on Nvidia chips, underscoring its significance in propelling Nvidia’s advancements and future prospects.

Early Adoption in the AI Arena

Nvidia’s proactive stance in AI hardware development dates back to the early stages of large-scale AI research, aligning perfectly with the burgeoning AI landscape in the mid-2010s. Leveraging its expertise in innovative GPUs renowned for gaming applications, Nvidia seamlessly transitioned into providing the computational support essential for AI system development and training.

The company’s strategic foresight and timely investments in AI-targeted hardware, evident as far back as 2012 with the foundational role of Nvidia chips in pioneering neural networks like AlexNet, have conferred a significant competitive edge. Nvidia’s visionary approach, coupled with meticulous execution, has enabled it to capitalize on evolving trends and technological shifts effectively.

Nvidia’s substantial investments in AI hardware have borne fruit, with the company’s flagship Hopper GPU commanding a hefty price tag of a quarter million dollars per unit. This high-performance supercomputer, comprising 35,000 individual components, underscores the robust demand for Nvidia’s cutting-edge technology, with waiting lists extending for months. Nvidia’s dominance in the AI chip sector is poised for further expansion as the demand for AI infrastructure continues to surge.

Despite its market leadership, Nvidia faces potential challenges, including export restrictions impacting business operations and the looming threat of increased competition from Chinese chip manufacturers. Moreover, Nvidia’s reliance on Taiwanese chip foundry TSMC for chip production poses geopolitical risks, necessitating a strategic approach to navigate these complexities.

For the latest insights on AI’s transformative impact on businesses, subscribe to the Eye on AI newsletter for valuable updates and trends analysis. Sign up today to stay informed.