Chip manufacturer Nvidia experienced a notable increase in its stock value during after-hours trading following an optimistic revenue outlook driven by the strong demand for its state-of-the-art artificial intelligence chips.

In the fourth quarter, Nvidia surpassed revenue projections by 7%. Remarkably, throughout the initial three quarters of 2023, the company consistently exceeded analysts’ revenue estimates by a significant margin ranging from 10% to 20%.

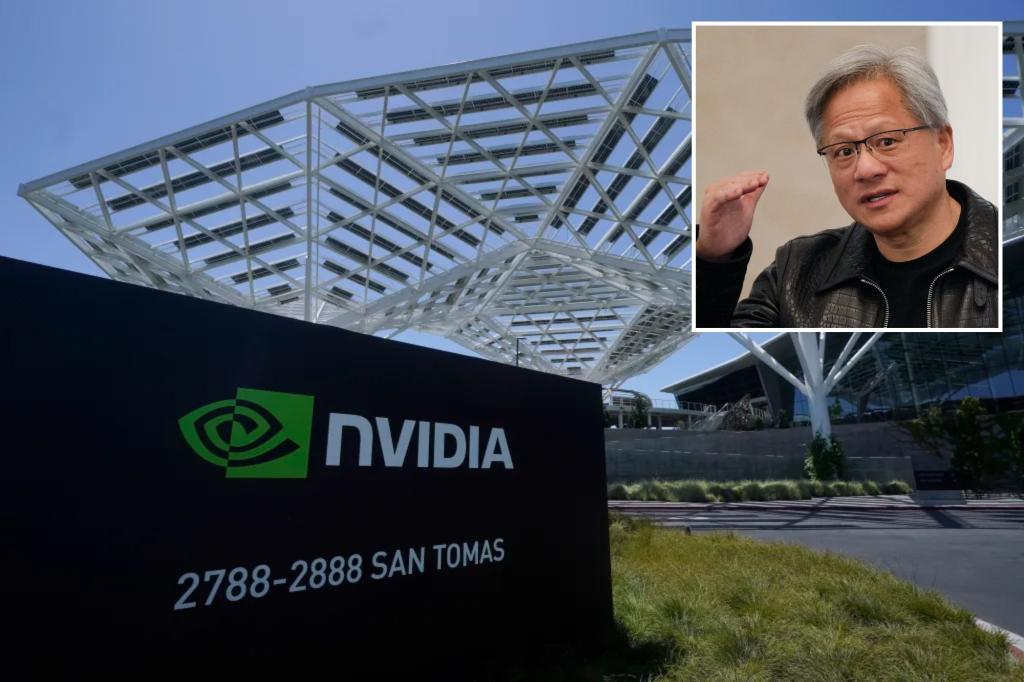

Nvidia is forecasting a revenue of approximately \(24 billion, with a slight margin of error, surpassing the average analyst expectation of \)22.17 billion, according to LSEG data. As a result, Nvidia’s shares, headquartered in Santa Clara, California, surged over 9% to $741 in the volatile after-hours market.

This year, Nvidia’s stock has demonstrated impressive growth of over 30%, positioning itself in competition with tech giants such as Amazon and Alphabet to solidify its standing among the most valuable companies.

In recent trading sessions, Nvidia observed an average daily trading volume of around \(30 billion, surpassing Tesla’s \)22 billion per day. The data center segment, which significantly contributes to Nvidia’s revenue, witnessed exceptional growth of 409%, reaching \(18.4 billion in the fiscal fourth quarter, surpassing the estimated \)16.8 billion, as per LSEG data. Furthermore, the data center revenue surged by nearly 280% in the previous quarter.

The increasing demand for Nvidia’s data center chips and GPUs, crucial for AI development, is propelling the company’s expansion. Nvidia’s dominance in the AI chip market, with key clients like Microsoft, highlights its market supremacy.

Despite encountering challenges in meeting the escalating chip demand, Nvidia’s supply chains are gradually enhancing, bolstering its capacity to fulfill orders and meet customer requirements effectively.

Analysts are optimistic about Taiwan Semiconductor Manufacturing Co.’s improved packaging capacity in the first half of the year, which is expected to alleviate bottlenecks and aid Nvidia in addressing the growing chip demand.

Despite encountering trade restrictions, particularly with China, Nvidia’s revenue for the fourth quarter exceeded expectations, reaching \(22.10 billion, with adjusted earnings per share of \)5.16, surpassing estimates of $4.64 per share, as per LSEG data. Additionally, Nvidia anticipates a first-quarter adjusted gross margin of 77%, slightly higher than the average analyst forecast of 75.6%.