Nvidia is set to unveil its fourth-quarter earnings after the bell on Wednesday in a highly anticipated report that will provide insights into the sustainability of the AI boom on Wall Street.

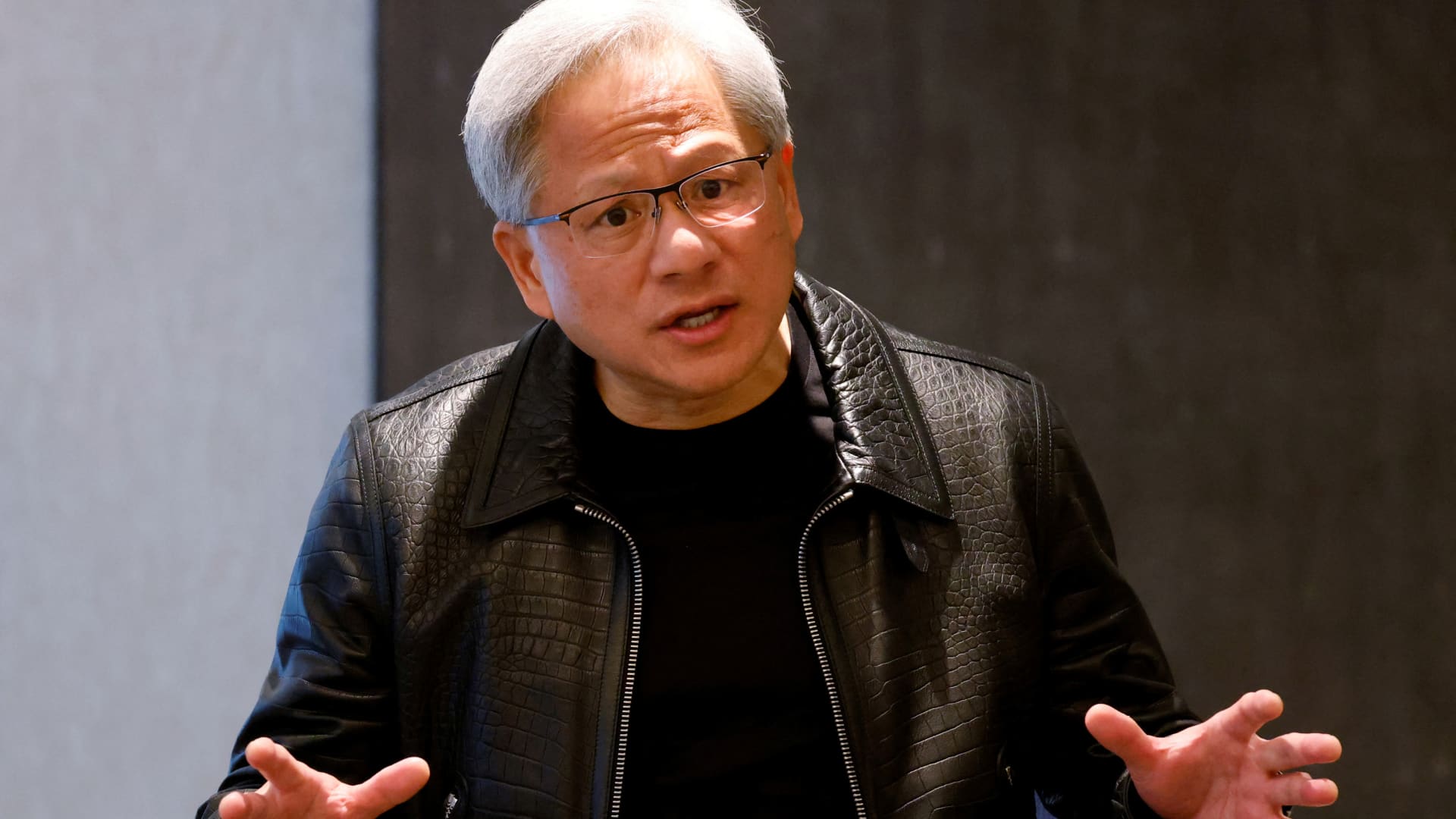

CEO Jensen Huang of NVIDIA participated in a media roundtable meeting in Singapore on December 6, 2023.

Nvidia has emerged as a key beneficiary of the recent industry focus on large artificial intelligence models, leveraging its high-end graphics processors for server applications.

The company’s stock price has surged nearly fivefold since the close of 2022, propelling Nvidia to a market value of $1.72 trillion, briefly surpassing tech giants like Amazon and Alphabet.

With investor expectations running high for AI firms, Nvidia is under pressure to deliver on these elevated projections.

Analysts are anticipating a remarkable 240% revenue growth from the previous year, reaching \(20.6 billion, primarily fueled by \)17.06 billion in data center revenue, particularly from the sale of AI GPUs such as the H100. Net income is predicted to skyrocket over sevenfold to $10.5 billion in the January quarter.

Investors are keen to hear from CEO Jensen Huang regarding the sustainability of these impressive growth rates. There are concerns that a significant portion of Nvidia’s GPUs are sold to major tech players like Microsoft, Amazon, Meta, and Google.

While these companies have indicated continued investments in new GPUs in the near term, some analysts suggest a more nuanced outlook on long-term demand.

Analyst Gil Luria from D.A. Davidson highlighted in a recent investor note that these tech giants have described their purchasing as ‘flexible’ and ‘demand-driven,’ hinting at a potential scaling back post the current hype cycle. Though not imminent, early signals of this trend are being observed.

Nvidia is gearing up to launch its most advanced server GPU, the B100, in 2024. The timing of this release could impact the company’s growth trajectory.

For the ongoing quarter, analysts on Wall Street are projecting a 208% growth rate, translating to approximately $22.17 billion in sales.

While Nvidia operates in various sectors, including PC gaming and automotive chips, the spotlight on Wednesday will predominantly be on its AI GPUs, which contribute over 80% to the company’s total sales.

Barclays analyst Thomas O’Malley emphasized in a note earlier this month that the data center GPU performance will be the pivotal metric of interest, alongside insights into the broader market adoption.