- Nvidia’s recent regulatory filing revealed its stakes in several public companies, leading to a surge in their stock prices despite the known association with Nvidia.

- The company’s involvement in venture investing has been longstanding, but its more recent deals are expected to have a more significant impact due to the current artificial intelligence boom.

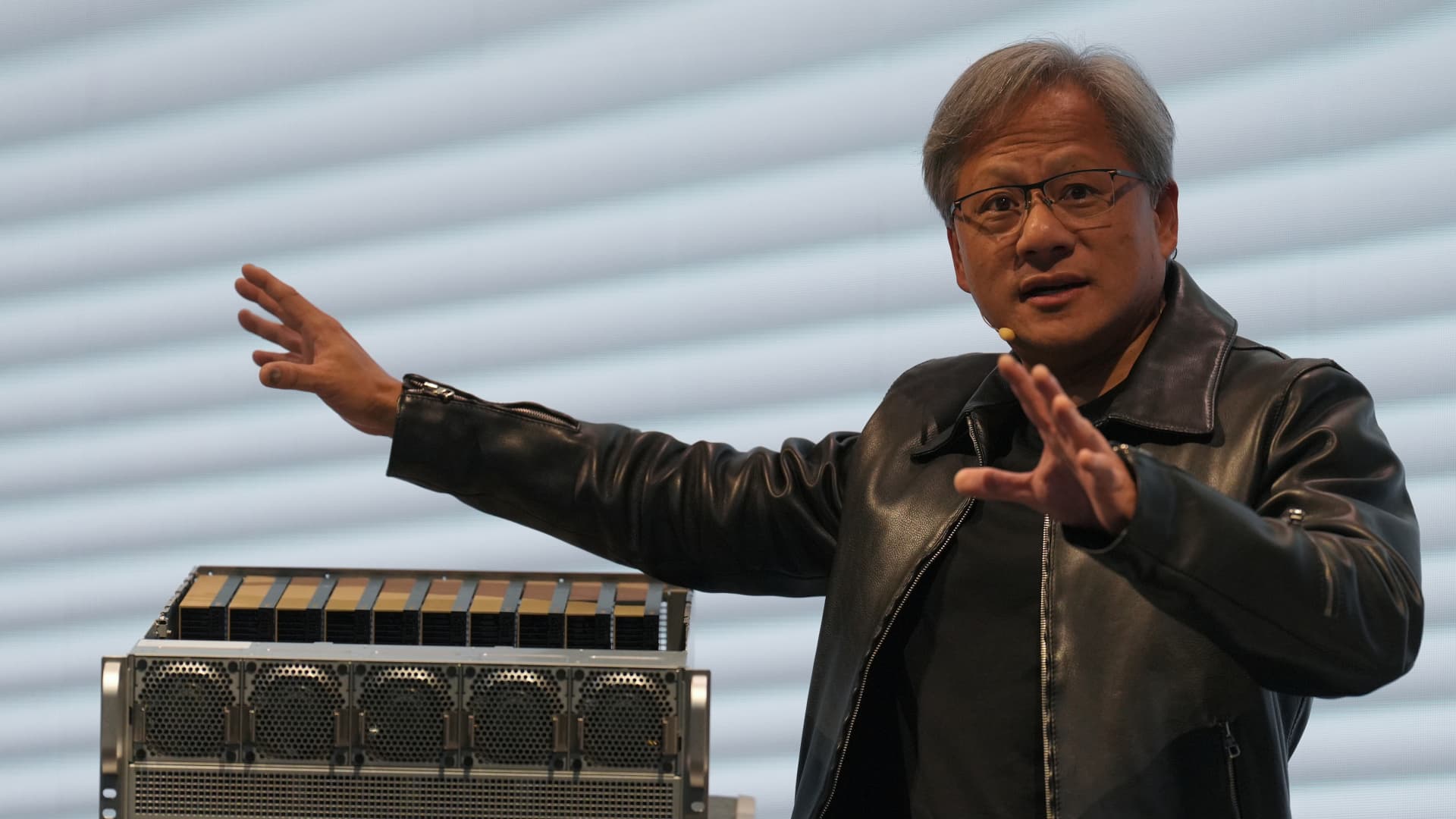

Nvidia CEO Jensen Huang delivered a speech at the Supermicro keynote presentation during the Computex conference in Taipei on June 1, 2023.

Investors are highly interested in Nvidia’s artificial intelligence narrative, eagerly seeking opportunities connected to the chipmaker.

On Wednesday, Nvidia disclosed its ownership in a few public companies, namely Arm, SoundHound AI, Recursion Pharmaceuticals, Nano-X Imaging, and TuSimple.

Except for Arm, which recently surpassed a market cap of \(130 billion, the shares of these Nvidia-affiliated companies experienced a notable surge following the submission of the 13F filing—a requirement for institutional investment managers overseeing assets exceeding \)100 million.

These investments, although significant, were not unexpected for those following previous news reports and disclosures. The current enthusiasm surrounding artificial intelligence has reached a level of irrational exuberance, prompting investors to capitalize on any related opportunities.

No company’s stock is currently more in demand than Nvidia’s, which surpassed Amazon in market value on Tuesday and then Alphabet on Wednesday, securing the third position among the most valuable U.S. companies, trailing only Apple and Microsoft. The remarkable 200% surge in Nvidia shares over the past year can be attributed to the soaring demand for its AI chips, essential components in powerful AI models developed by tech giants like Google, Amazon, and OpenAI.

SoundHound, a company specializing in AI-driven speech and voice recognition, witnessed a 68% increase in its stock price on Thursday following Nvidia’s disclosure of a \(3.7 million stake acquired during the filing. Nvidia initially invested in SoundHound back in 2017 as part of a \)75 million venture round.

Nano-X Imaging, utilizing AI in medical imaging, experienced a 59% surge in its stock price after Nvidia revealed a $380,000 investment in the company. Nvidia’s association with Nano-X traces back to its venture investment in Zebra Medical, an Israeli startup acquired by Nano-X in 2021.

TuSimple, an autonomous trucking company, saw a 40% rise in its stock value after Nvidia’s $3 million stake was disclosed. This surge followed TuSimple’s announcement of delisting from the Nasdaq due to significant changes in capital markets since its IPO in 2021.

Recursion Pharmaceuticals, a biotech firm, saw a 15% spike in its shares on Thursday after Nvidia’s recent investment. Unlike TuSimple, Recursion went public in 2021, with Nvidia acquiring a \(50 million stake in 2023 through a private investment in public equity (PIPE), now valued at \)76 million.

Nvidia’s upcoming quarterly earnings report will provide insights into its financial performance, with analysts anticipating revenue growth exceeding 200% year-over-year, surpassing $20 billion.

The company’s recent investments are poised to have a more substantial impact than its earlier ventures, as they are strategically positioned within the thriving AI sector. Nvidia has shown support for prominent AI startups such as Cohere, Hugging Face, CoreWeave, and Perplexity, recognizing the transformative potential of AI in reshaping information accessibility for consumers.