- Nvidia is set to announce its fiscal fourth-quarter earnings after the market closes on Wednesday.

- This marks the company’s initial quarterly earnings report following Nvidia’s market capitalization surpassing that of Alphabet and Amazon.

- According to analysts at Bank of America, the surge in NVDA’s stock value has been extraordinary.

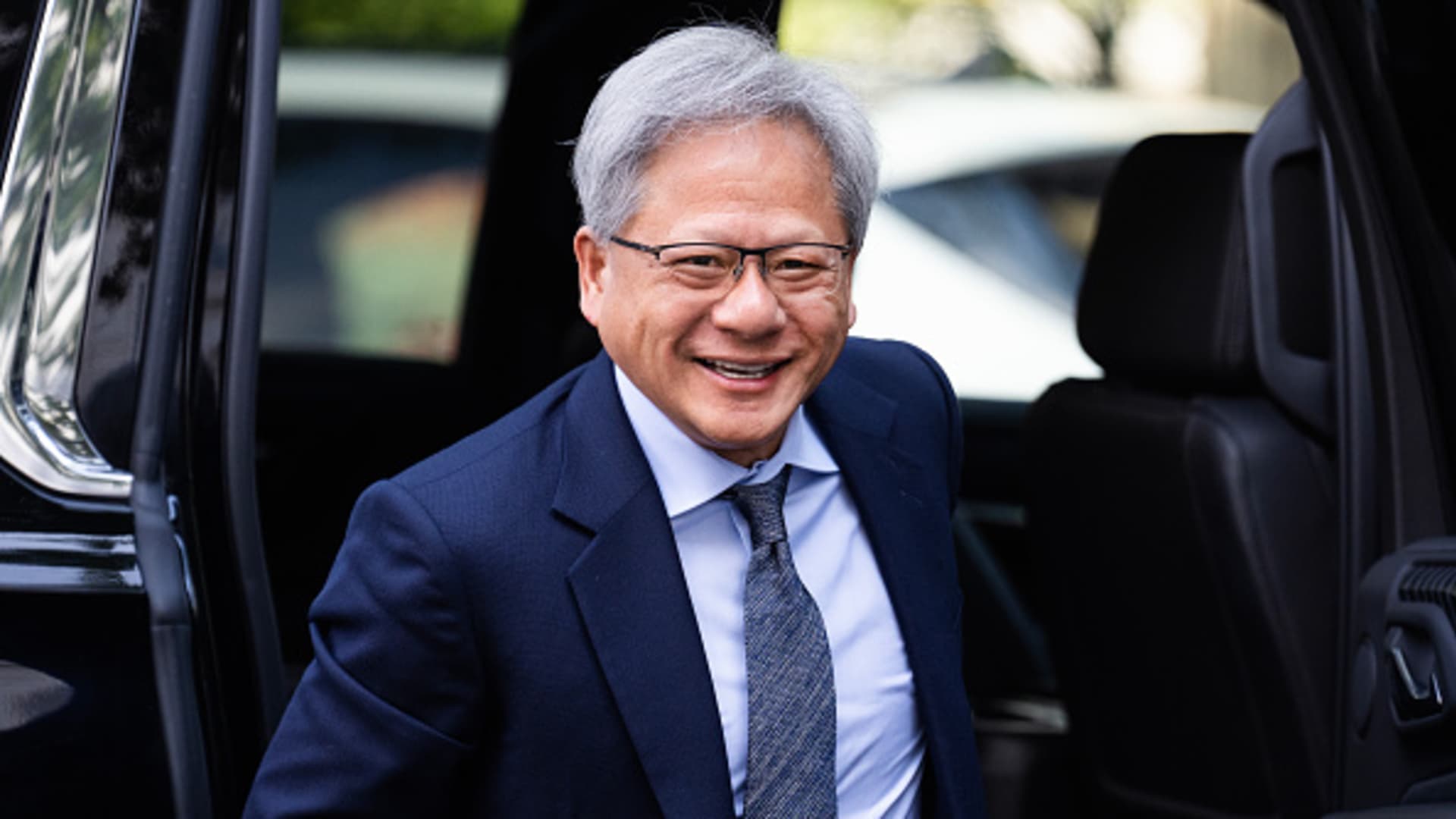

Jensen Huang, the CEO of Nvidia, was spotted at the Inaugural AI Insight Forum held in the Russell Building on Capitol Hill on September 13, 2023.

As Nvidia prepares to unveil its fiscal fourth-quarter results after the closing bell on Wednesday, it stands as the world’s third most valuable public firm. Investors are holding the company to a high standard with minimal room for error.

The stock price of Nvidia has skyrocketed fivefold since the conclusion of 2022 due to the soaring demand for its graphics processing units essential for the artificial intelligence sector. Nvidia’s cutting-edge chips like the H100 are instrumental for AI developers in creating advanced models such as those utilized by OpenAI to develop ChatGPT.

With a market capitalization reaching approximately $1.8 trillion last week, Nvidia has outpaced Alphabet and Amazon, now trailing solely behind Microsoft and Apple.

The analysts at Bank of America reiterated their buy recommendation, highlighting the “parabolic” surge in NVDA’s stock value and attributing it to a blend of fear, greed, and an indiscriminate chase for AI-related assets.

While the other tech giants have already disclosed their quarterly results weeks ago, all eyes are now fixed on Nvidia.

Analysts are anticipating a remarkable 240% surge in revenue from a year earlier, reaching $20.6 billion for the period ending on January 28, as per LSEG, previously known as Refinitiv. Nvidia is expected to generate substantial profits for every new dollar of sales.

The net income is projected to have surged over sevenfold to \(10.5 billion from \)1.41 billion a year ago. In the third quarter, Nvidia’s gross margin leaped to 74% from 53.6% in the preceding year.

Significant growth is forecasted in Nvidia’s data center business encompassing its AI chips, with analysts estimating an almost fourfold revenue increase on an annual basis to $17.06 billion, according to FactSet.

Market observers will closely heed the insights shared by Nvidia CEO Jensen Huang for indications of the sustainability of these remarkable growth rates. Having already reported a 200% year-over-year growth in the third quarter, analysts anticipate a similar expansion rate in the initial period of this year.

One potential area of concern is the substantial portion of Nvidia’s GPU sales directed towards major tech entities like Microsoft, Amazon, Meta, and Google. The possibility of these companies scaling down their AI hardware investments looms if the expected benefits are not realized.

Analyst Gil Luria from D.A. Davidson noted the positive impact of the tech giants’ increased AI infrastructure investments on Nvidia’s fourth-quarter results and 2024 Q1 guidance. However, he cautioned about the potential variability in long-term demand from Nvidia’s key clients.

Nvidia’s gaming segment, which includes graphics cards for PCs and laptops and was historically the company’s core business, is also anticipated to grow, albeit at a more moderate pace of 49% to $2.72 billion in revenue. Some of Nvidia’s gaming cards are also utilized by small enterprises and researchers for AI purposes.

Barclays’ Thomas O’Malley emphasized the significance of the data center GPU metric and broader market adoption commentary as key focal points for analysis. The sustainability of the current run-rate in the data center, which is approaching $100 billion annually, is a central topic of discussion.

Furthermore, analysts are monitoring Nvidia’s supply capacity to meet short-term demands, particularly considering the company’s reliance on Taiwan Semiconductor Manufacturing Company for chip production. Anticipation is also building around Nvidia’s upcoming premium AI chip, the B100, set to commence shipping this year.

Melius Research analyst Ben Reitzes, who advocates buying Nvidia’s stock, expressed enthusiasm about the forthcoming launch of the B100 later in 2024 and the X100 in 2025. The potential Total Cost of Ownership benefits for data center operators from these upgrades are expected to drive growth in 2025, following the success of the transition from the A100 to the H100.