- When Nvidia discloses its third-quarter financial results on Tuesday, experts are projecting a remarkable year-over-year surge of over 170%.

- The investor community will be particularly attentive to the fourth-quarter projections, with an expected sales growth rate approaching 20%.

- While Nvidia typically refrains from providing forecasts for the following year, any insights into the 2024 demand outlook will be under intense scrutiny.

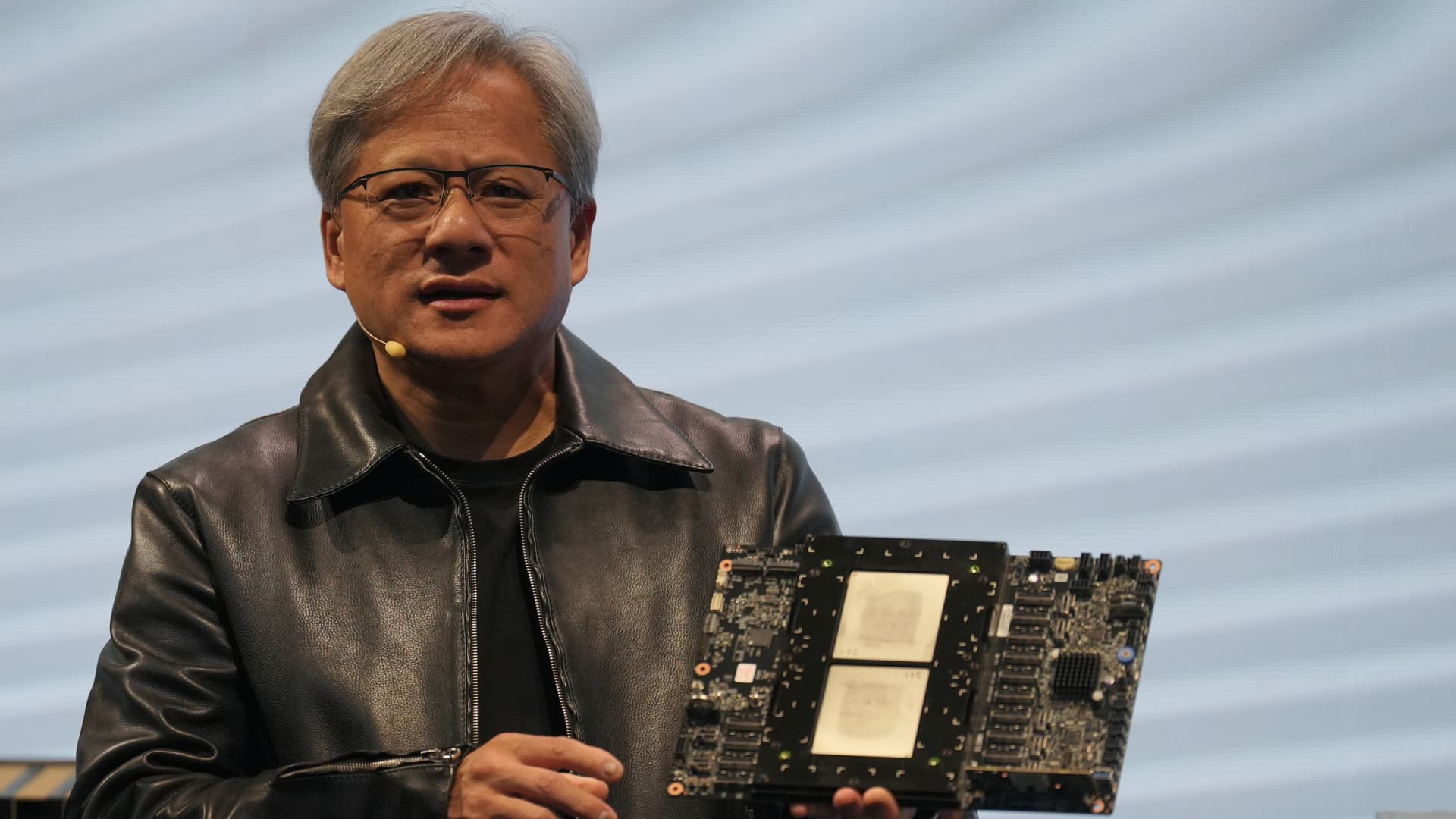

At the Computex 2023 event during the Supermicro presentation, Nvidia’s CEO Jensen Huang will showcase the cutting-edge Grace grinder superchip CPU, specifically designed for advanced AI applications.

Image credits: Lightrocket, Walid Berrazeg, and Getty Images

Ahead of Nvidia’s third-quarter earnings announcement, market analysts are anticipating a revenue expansion exceeding 170%.

Moreover, projections from LSEG suggest that the upcoming fourth-quarter forecast could reveal an even more impressive growth rate, nearing 200%.

As the Thanksgiving season approaches, the financial world will closely monitor the developments of the company that has been a focal point in the realm of artificial intelligence advancements this year.

Nvidia’s stock value has skyrocketed by 237% in 2023, significantly outperforming its peers in the S&P 500 index. With a market capitalization now standing at $1.2 trillion, surpassing that of Meta and Tesla, any indications during the earnings call of a slowdown in generative AI enthusiasm, a shift of major clients to AMD’s processors, or adverse impacts from Chinese regulatory constraints could potentially unsettle a stock that has been on a remarkable growth trajectory.

In a recent statement, analysts from Bank of America highlighted the high expectations surrounding Nvidia’s FQ3’24 earnings call on Nov-21, anticipating positive results and a potential upward revision in their evaluation.

However, concerns regarding Chinese regulations and competitive pressures are poised to capture investors’ attention. Nvidia, which has historically dominated the AI GPU market, is now facing a new landscape with AMD’s foray into generative AI technologies.

In a recent announcement, AMD’s CEO Lisa Su outlined ambitious revenue targets for GPU sales in 2024, with a substantial portion expected in the fourth quarter. The launch of MI300X, the company’s most advanced GPU for AI applications, is set to commence deliveries to select customers.

Despite Nvidia’s stronghold in the AI GPU sector, rising costs present a significant challenge. Addressing assertions that their products are excessively priced for relational AI inference will be crucial for Nvidia, as highlighted by experts from Bank of America.

The unveiling of H200, an upgraded GPU tailored for training and deploying cutting-edge AI models fueling the conceptual AI revolution, took place recently. This innovation builds upon the success of H100, the GPU instrumental in training OpenAI’s GPT-4 Turbo language model.

Market estimates suggest that H100 chips, priced between \(25,000 and \)40,000 each, are deployed in large numbers to facilitate the training of massive AI models.

Nvidia’s data center division, bolstered by the success of H100, witnessed a substantial 171% revenue surge to reach $10.32 billion in the last quarter, constituting a significant portion of Nvidia’s overall earnings.

Analysts foresee a near doubling of data center revenue in the upcoming quarter, soaring to \(13.02 billion from \)3.83 billion, as per FactSet data. Projections from LSEG, formerly Refinitiv, indicate a robust 172% growth in total revenue, reaching $16.2 billion.

While the growth momentum is anticipated to gradually decelerate throughout 2024, the trajectory remains robust.

During the earnings call, executives are likely to face inquiries regarding the recent leadership changes at OpenAI, a pivotal partner in Nvidia’s growth story this year. The abrupt departure of Sam Altman due to strategic disagreements has sparked interest, given OpenAI’s significant reliance on Nvidia’s GPUs and its primary supporter, Microsoft.

Despite the evolving landscape, Nvidia stakeholders have downplayed concerns related to China. Regulatory shifts in the U.S. impacting sales to China are being navigated by Nvidia, ensuring compliance while sustaining business operations in the lucrative Chinese market.

Nvidia’s strategic focus on quarterly guidance, rather than offering extensive long-term forecasts, will be scrutinized during the upcoming conference call. Given the substantial investments made in the company this year, stakeholders will keenly listen to CEO Jensen Huang’s insights for any indications of the evolving trends in conceptual AI technologies.