Nvidia Corporation, based in Santa Clara, California, has experienced a remarkable surge in value driven by the high demand for its graphics chips utilized in artificial intelligence applications. The company recently announced its fiscal fourth-quarter results, exceeding expectations with a revenue of \(22.1 billion, a significant increase from \)6.05 billion in the previous year. Nvidia’s profits also soared to \(12.29 billion compared to \)1.41 billion in the corresponding period.

Adjusted for exceptional items, Nvidia’s earnings per share for the latest quarter stood at \(5.16, surpassing the Wall Street estimate of \)4.59 per share. Industry analysts had anticipated revenue of $20.4 billion for the quarter, marking the conclusion of the fiscal year.

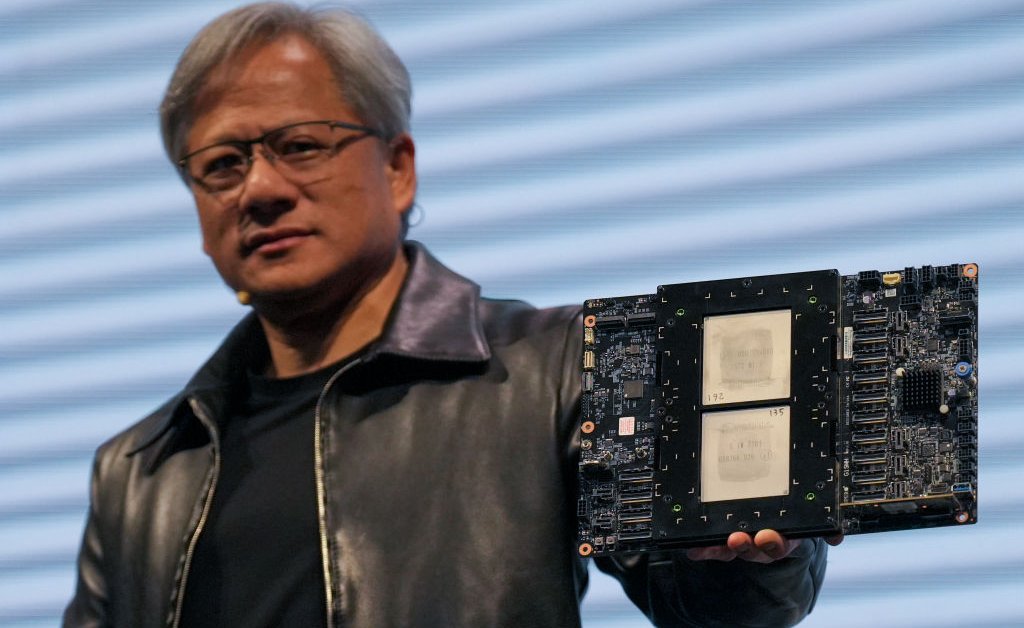

Nvidia’s specialized chips play a vital role in powering various artificial intelligence applications, including cutting-edge generative AI technologies like ChatGPT and Google’s Gemini. CEO Jensen Huang emphasized the significant global surge in demand for accelerated computing and generative AI, signaling a pivotal moment for the industry.

Nvidia’s strategic focus on adapting its hardware and software for AI applications has propelled its market dominance, particularly in the AI chip sector. Despite facing challenges such as economic uncertainties and competition from tech giants developing their AI chips, Nvidia’s market position remains robust and poised for sustained growth.

Looking ahead, Nvidia anticipates revenue of approximately $24 billion for the upcoming quarter, reflecting the company’s optimistic outlook for continued expansion beyond 2025. Notably, Nvidia has navigated regulatory challenges in China by introducing alternative products that comply with U.S. export regulations.

The company’s partnership with Taiwan Semiconductor Manufacturing Company (TSMC) is instrumental in manufacturing its cutting-edge chips. TSMC’s stock price surge, following positive market outlook and increased demand for AI chips, further underscores Nvidia’s growth trajectory.

Nvidia’s visionary approach to generative AI and data center infrastructure is expected to drive substantial investment in AI technologies, potentially doubling the global data center infrastructure in the next five years. This trend signifies a significant market opportunity for Nvidia, positioning the company for sustained success in the evolving AI landscape.

Following the earnings announcement, Nvidia’s stock surged by 7.5% in after-hours trading, reaching $726 per share, reflecting investor confidence in the company’s future growth prospects.