Microsoft (NASDAQ:MSFT), the enterprise software giant, is scheduled to report their fiscal Q3 ’24 financial results after the bell on Thursday, April 25th, 2024.

The valuation of Microsoft is always a worry, as it’s trading at 30x expected ’24 EPS for an expected 20% growth rate in EPS, on 15% revenue growth.

When the company releases results on Thursday night, analyst consensus is expecting $2.82 in EPS (which has crept higher about $0.20 a share since the end of the Dec ’23 quarter), on $26.2 billion in operating income and $60.8 billion in revenue, for YoY growth of 15% in EPS, 17% in operating income and 15% in revenue.

- Q4 ’23’s current consensus is 7% expected growth in EPS, 10% growth in operating income, and another 15% expected growth in revenue.

- Fiscal 2025’s current Street consensus is $13.34 for full-year EPS on $279 billion in revenue for expected growth of 15% and 14% respectively, currently identical to fiscal ’24.

Since June of 2020, the average, “upside surprise” for Microsoft’s EPS is 8%, (pretty robust) and of those 15 quarters, only two have printed downside surprises. For the same period, revenue has averaged a “3% upside surprise” and only missed the estimate once.

What was interesting about the December ’23 quarter for Microsoft, was that “cash & equivalents” fell $62 billion, since Microsoft’s acquisition of Activision was an all-cash deal, and it closed in October ’23. Microsoft’s cash position of $81 billion is now where it was in 2013.

Recent quarters: Looking at the last few quarters for Microsoft, Azure has returned to a 28% (CC) run rate, and AI is starting to have an impact on Azure. In the fiscal Q1 ’24 quarter, AI was expected to contribute 2% to Azure’s growth, but AI’s contribution was 3%, and in the Dec ’23 (fiscal Q2 qtr), AI contributed 600 bps to Azure.

Activision has been additive to MSFT’s revenue growth, but dilutive to operating income, but that’s just with one quarter of consolidation. This quarter, that will be reported on Thursday night, will be the first full quarter of Activision’s consolidation into Microsoft.

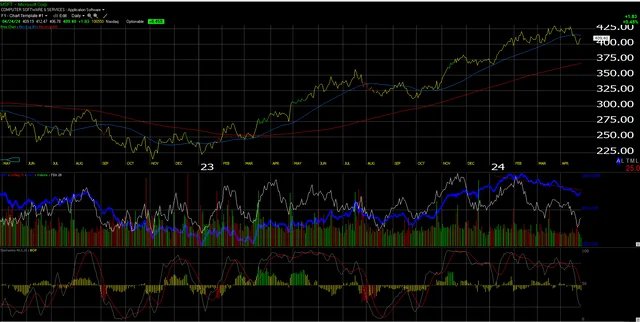

Technicals:

One positive to Microsoft’s daily chart is that it has sold off before this earnings report and closed tonight about $30 below its all-time-high. Microsoft is getting oversold on the daily chart coming into the Thursday night call, but still way overbought on the weekly chart.

Summary/conclusion: With Meta (META) down 18% after releasing their March ’24 quarterly earnings, and even IBM (IBM) selling off a little tonight on what was a slight miss on their software segment revenue, you have to think the Street won’t tolerate much with Microsoft’s earnings on Thursday night after the close.

What surprised me in preparing for Microsoft’s earnings on Thursday night, and looking at the past few quarters results, the way AI contributed to Azure’s results in the first and second fiscal quarters left an impression. Granted, the numbers are still very small, but Microsoft was well ahead of many of its competitors when the whole AI “story” broke.

Watching how the whole OpenAI and Sam Altman story broke, the details as they were released showed that Satya Nadella had Microsoft make a significant dollar investment in AI at an early stage. (Maybe an even bigger surprise was that Elon Musk had $15 billion invested.)

Unlike Bill Gates and Steve Ballmer, after March 2000, it was refreshing to see that Satya has been out in front of the AI evolution, and had Microsoft well positioned as AI exploded over the last year, and is now the “Next Big Thing”.

(To be fair to Gates and Ballmer though, there was no new “next big thing” in 2000. That’s what was so painful for investors. It wasn’t like the old giants could “pivot” their way out of what happened in 2000. Demand just dried up since everybody had enough memory, storage, fiber optics, PCs, servers and printers.)

While that’s a positive, the ultimate proof is in the numbers for Microsoft, and frankly it was good to read in fiscal Q1 and Q2 this year, that AI is already making a contribution to Azure.

Microsoft’s Intelligent Cloud segment is now 42% of total Microsoft revenue and 48% of total Microsoft income, so Intelligent Cloud is now almost half of Microsoft’s total business, which is pretty amazing since it’s only 14 years old (if that).

Personally, as it stands right now, it’s clear that Microsoft could be one of the big AI winners, but they need to execute. It’s up to them.

Microsoft remains clients’ largest holding and has been since 2013 and the ValueAct stake.

There’s no question though that given how all growth stocks are trading even with good earnings, it’s likely going to be “sell first and ask questions later” on Thursday night, unless Microsoft has a really big upside surprise and good guidance to boot. (This blog gave you the current fiscal Q4 and fiscal 2024 estimates in the third paragraph above.)

None of this is advice or a recommendation. Past performance is no guarantee of future results. Investing can involve loss of principal. All EPS and revenue estimates are sourced from LSEG.