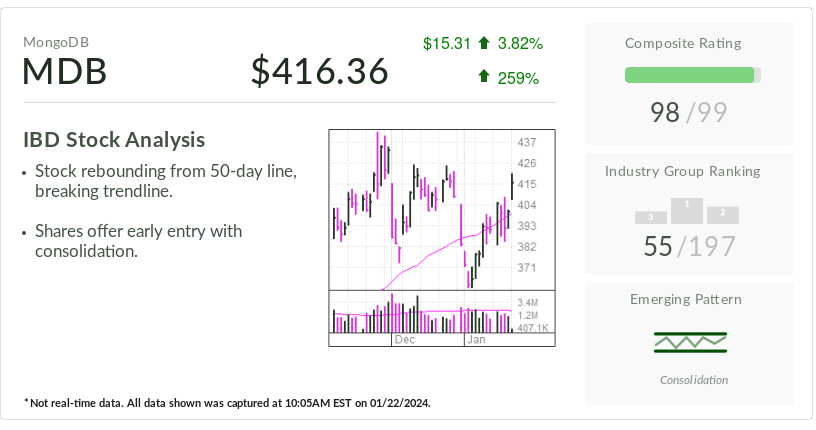

MongoDB

MDB

$15.31 3.82%

3.82% 259%

259%

IBD Stock Analysis

MongoDB, the focus of IBD Stock Analysis, is witnessing a stock rebound from its 50-day line and has broken a trendline, providing an opportunity for early entry with consolidation.

Composite Rating

Industry Group Ranking

Emerging Pattern

Consolidation

MongoDB, the IBD Stock of the Day for Monday, has shown resilience as MDB stock bounced back from its 50-day moving average and formed a consolidation pattern. The New York-based database software company, serving over 46,000 corporate clients, experienced significant growth in 2023, with its stock value more than doubling.

In 2023, MDB stock surged by 108%, fueled by robust triple-digit earnings growth and investor optimism regarding its potential in the artificial intelligence space. Despite a setback following a late November breakout and a dip post-December earnings report, MongoDB continues to be in focus for investors eyeing long-term growth.

Currently trading at 414.73, up 3.4% on the stock market, MDB stock is listed on the IBD 50, Tech Leaders, and IBD SwingTrader.

MDB Stock: AI Debate In 2024

The central theme surrounding MDB stock in 2024 revolves around its potential benefits from artificial intelligence (AI) integration. MongoDB’s primary platform, Atlas, a prominent NoSQL database software provider, is strategically positioned to cater to the rising demand for data storage in the cloud, especially from companies exploring AI-driven products.

While the market sentiment drove MDB stock upward in the past year, concerns have been raised about the pace of AI adoption. UBS downgraded MongoDB from a buy to neutral rating, citing a discrepancy between investor expectations and the current stage of AI implementation across industries.

Despite the cautious outlook, MongoDB remains proactive in its AI initiatives, with recent product launches focusing on AI applications. The company’s CEO highlighted the positive reception of their new AI-centric offerings, indicating a growing interest among enterprises to leverage AI technologies for business growth.

Earnings Growth

In its latest quarterly report for the fiscal 2024 third quarter, MongoDB exceeded expectations with adjusted earnings of 96 cents per share on $433 million in sales. The impressive 317% year-over-year increase in adjusted earnings, coupled with a 30% rise in sales, underscore MongoDB’s strong financial performance.

However, heightened market expectations led to a temporary dip in MDB stock post-earnings report. The upcoming fiscal fourth-quarter results in March are eagerly anticipated, with analysts projecting a 20% sales increase but a 19% decline in adjusted earnings.

MDB Stock: Consolidation Pattern

Currently, MongoDB stock is consolidating with a 442.84 buy point, indicating a potential entry opportunity. Recent positive movements, including breaking a downward trendline and bouncing from the 50-day moving average, suggest a favorable outlook for MDB stock.

With a top-notch IBD Composite Rating of 98 and a robust Relative Strength Rating of 94, MongoDB stock stands out for its strong fundamental and technical performance. Institutional investors have shown significant interest, with seven of the leading growth mutual funds holding positions in MongoDB, reflecting a positive Accumulation/Distribution Rating of B-.