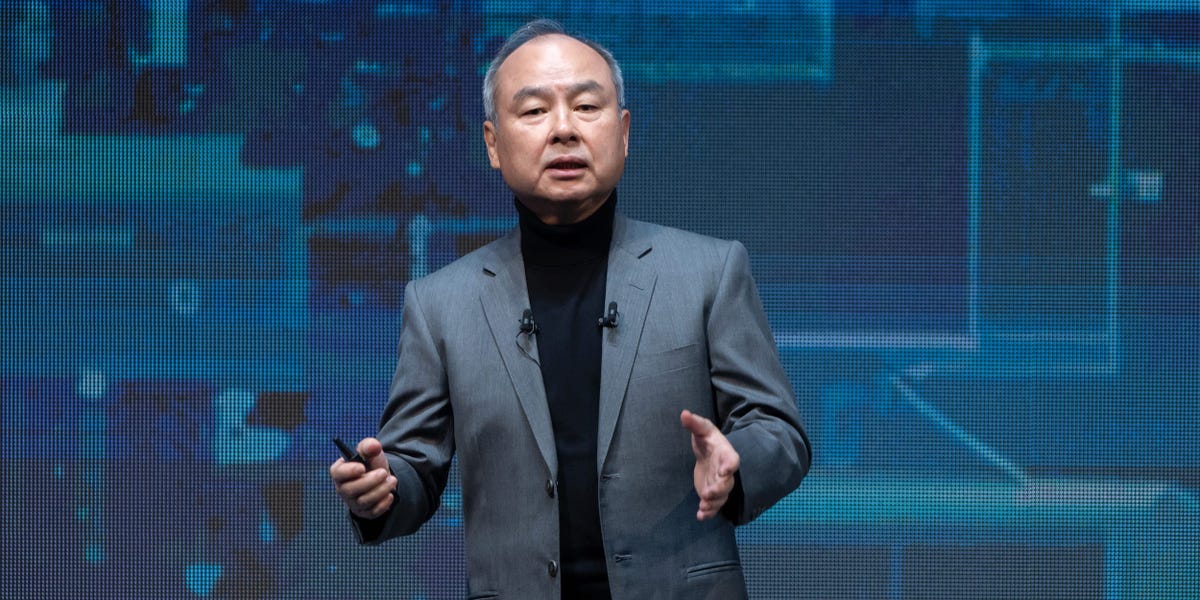

The $72 Billion Success Story of Masayoshi Son with Alibaba and His Quest for AI Dominance

By Hasan Chowdhury

Strategic Moves in the World of Business

Masayoshi Son, the forward-thinking CEO of SoftBank, is making a daring wager on the advancement of artificial intelligence (AI).

- Masayoshi Son has progressively been selling off his significant stake in Alibaba, shifting his attention towards the potential of AI technology.

- Despite drawing inspiration from the triumph of chip designer Arm, challenges persist within the Vision Funds housed under the umbrella of SoftBank.

A pivotal juncture in Masayoshi Son’s professional journey can be pinpointed to his strategic investment in Alibaba during the nascent stages of the internet revolution.

Back in 2000, when Jack Ma’s budding e-commerce venture was just taking its initial steps, Son took a calculated risk by injecting an initial \(20 million into the company. This marked the commencement of a longstanding partnership that saw SoftBank reaping an astounding \)72 billion in profits from its ventures with Alibaba—a testament to Son’s steadfast faith in Ma’s vision.

As Son gradually diminishes SoftBank’s stake in Alibaba, he is on the prowl for the next groundbreaking opportunity. The 66-year-old entrepreneur has been methodically offloading SoftBank’s shares in Alibaba in recent times, compelled by various factors such as financial obligations following a substantial $32 billion loss last year and the economic turbulence stemming from escalating inflation and interest rates.

Fortunately, Son’s enduring enthusiasm for artificial intelligence appears poised to take the spotlight.

Masayoshi Son’s strategic gamble on Alibaba and its visionary founder, Jack Ma, has unquestionably borne fruit.

Venturing Beyond Alibaba

While SoftBank’s influence over Alibaba may be dwindling, the rise of AI, exemplified by innovations like ChatGPT, has captured Son’s imagination, positioning AI as the linchpin of his future pursuits.

Son’s zeal for AI is unmistakable, as he boldly asserts that skeptics of AI’s potential are akin to “goldfish,” confidently predicting that AI will surpass human intelligence.

During SoftBank’s recent third-quarter earnings disclosure, CFO Yoshimitsu Goto reiterated the company’s strategic shift towards AI, affirming, “We are transitioning from our Alibaba focus to spearheading the AI revolution.”

The $32 billion merger with chip designer Arm and the establishment of the Vision Funds, among the world’s largest venture capital entities, underpin SoftBank’s concerted efforts in this direction.

However, the journey to success has been marked by a mix of outcomes.

Arm, the American semiconductor powerhouse fueling devices for tech giants like Apple, Google, Nvidia, and Samsung, witnessed a meteoric ascent following its Nasdaq debut in September, driven by the surging demand for AI-centric hardware solutions.

With SoftBank retaining a 90% stake in Arm post-IPO, the company reported a net income of 950 billion yen (approximately \(6.4 billion) for the final quarter of 2023, marking its first profit in five quarters, buoyed by robust performance in the chip sector. Arm’s revenue surged by 14% year-on-year to \)824 million, propelling the company’s valuation close to an all-time high of \(117 billion, a significant leap from its \)55 billion valuation in September.

Navigating the Path to Emulating Arm’s Triumph

Emulating the monumental success of Arm has proven to be a formidable challenge, given SoftBank’s initial ventures into the investment landscape.

The Vision Funds, headquartered in London, have been on a quest to discover early-stage ventures capable of catalyzing the AI revolution, attracting interest from sovereign wealth funds in the Middle East and SoftBank’s internal coffers.

Key assets in SoftBank’s portfolio include industry behemoths like Uber, TikTok under ByteDance’s ownership, and Nvidia, from which SoftBank divested in 2019.

Despite registering \(4 billion in gains over the past quarter—a period marked by a downturn in VC funding—write-downs on overvalued assets and limited exit opportunities have resulted in an aggregate loss of \)2 billion as of December 31.

Nevertheless, SoftBank remains resolute in its trajectory towards transformation. Shifting from a growth-at-all-costs ethos, its investment arms are embracing a more pragmatic approach, eagerly integrating AI across diverse sectors.

In its pursuit of the next breakthrough akin to OpenAI, Anthropic, or Cohere, SoftBank continues to scout for promising AI-centric ventures.

Reports indicate that Son has engaged in discussions with OpenAI’s CEO Sam Altman, signaling SoftBank’s keen interest in the realm of advanced language technologies, despite refraining from substantial investments thus far.

Collectively, Arm and the Vision Funds constitute 70% of SoftBank’s net asset value, a pivotal metric reflecting the conglomerate’s overall asset worth. In comparison, Alibaba accounted for 50% of net asset value by the end of 2019, up from 21%.

To replicate his prior triumphs, Son must navigate the dual challenges of sustaining Arm’s momentum while realigning the Vision Funds for future success.