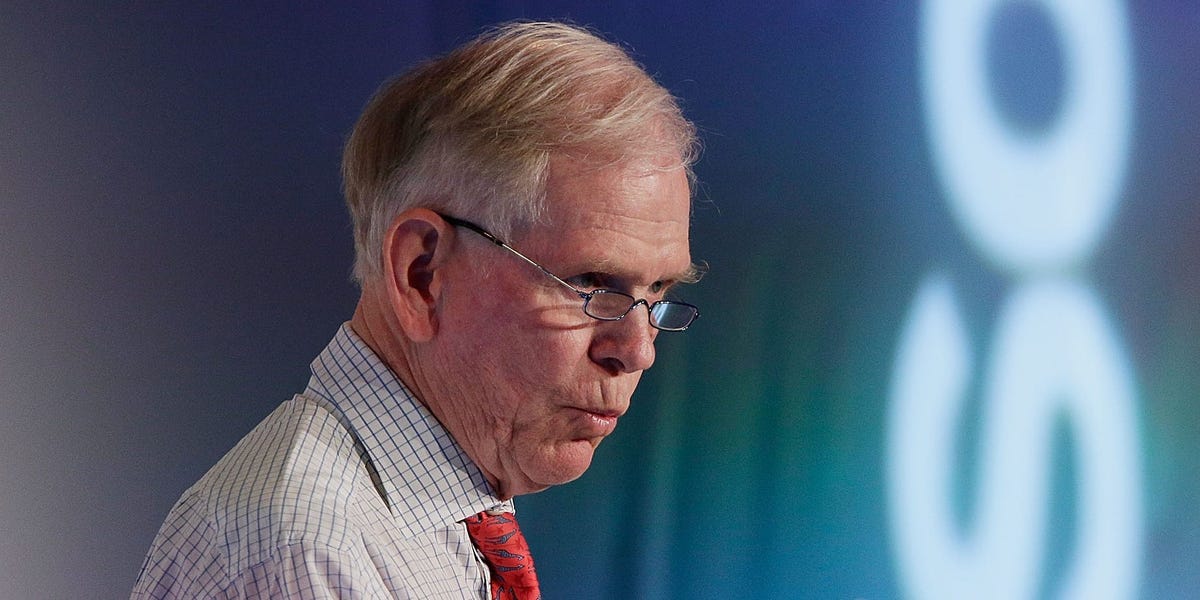

- This week, Jeremy Grantham raised concerns about the state of stocks, real estate, and the economy.

- The prominent investor forecasted the collapse of the AI bubble, which could have repercussions on the stock market.

- Grantham criticized the Federal Reserve for fueling asset bubbles and highlighted climate change as a significant issue.

Access your personalized feed on the go for the latest updates.

Jeremy Grantham sounded the alarm on a widespread real estate bubble, cautioning that US stocks are significantly overvalued and may underperform for the next decade. He also stated that the robust American economy is detached from reality.

As a co-founder of GMO and a seasoned investment strategist, Grantham anticipated that the hype surrounding AI would diminish, potentially triggering a downturn in the stock market.

Furthermore, the financial expert lambasted the Federal Reserve for its role in inflating asset bubbles and underscored climate change, dwindling resources, and population decline as critical long-term challenges.

Grantham delivered these impactful remarks at the Exchange conference in Miami this week. Here are 14 notable quotes from his presentation, slightly edited for brevity and clarity:

1. “The remarkable aspect of this entire scenario is its US-centric nature. A perilous real estate bubble exists globally, while equities, for some reason, exclude the rest of the world.”

2. “Historically, there has never been a sustained bull market originating from a Shiller price-to-earnings ratio of 33 — placing it in the top 2% of the historical range. A lasting rally has never commenced from full employment. To witness a prolonged, impressive rally, one would expect declining profit margins, rising unemployment, and low price-to-earnings ratios.”

3. “Higher prices equate to lower returns. Initiating from exceedingly high prices virtually guarantees disappointment over the next 10 to 15 years. Sustained success rarely accompanies optimistic beginnings. This principle appears quite evident, wouldn’t you agree?”

‘Shovels in the gold rush’

4. “No precedent exists where a substantial bubble — one of the three major bubbles in American history — has been interrupted by a secondary, focused bubble of a distinct nature — namely, artificial intelligence.”

5. “Our trajectory was progressing favorably by historical standards until the advent of ChatGPT. AI completely disrupted what was a relatively stable situation, sparking an extraordinary 10-month surge in a handful of stocks. The remaining market, astonished, observed these stocks surge by 50%, 60%, 70%. Subsequently, about 10 to 11 weeks ago, the rest of the market, no longer content to wait idly, joined the rally.”

6. “Everyone is procuring these chips to facilitate AI, without a clear purpose for their utilization. It resembles selling shovels during a gold rush, leaving the sellers in a state of panic.”

7. “A bear’s dilemma lies in the challenge of dismissing artificial intelligence outright. Euphoria is anticipated, akin to the fervor witnessed in previous instances such as railroads and the internet, followed by the inevitable setback that ensued each time.”

‘Living on air’

8. “We have exceeded our limits. Should this subsidiary bubble burst, it may deflate the broader market, prompting actions that might have occurred regardless. This is my conjecture.”

9. “Typically, rallies conclude following an extended period of growth — check; full employment — check. We are observing conditions indicative of such conclusions.”

10. “Likewise, the economy has been sustained artificially. How can we justify employment figures three times the long-term average in the labor force within the population? It is truly remarkable, especially considering the lack of global participation.”

11. “Quality represents the most enduring market inefficiency in history. AAA-rated stocks exhibit lower bankruptcy rates, perform better during bear markets, and have yielded an additional half a percentage point annually on average for nearly a century.”

‘Non-stop catastrophes’

12. “My personal perspective on the Fed has consistently been critical.”

(Grantham censured Alan Greenspan, the Fed’s chair during the dot-com bubble, as the “greatest fool of all” for artificially inflating stock and housing prices through loose monetary policies. He criticized Greenspan’s successor, Ben Bernanke, for replicating this error by inflating the mid-2000s housing bubble.)

13. “Both resources and climate change have been disregarded; they are remarkably undervalued. While they present long-term opportunities, they are volatile and precarious sectors.”

14. “We are besieged by continuous crises. Climate change is impeding our capacity to generate wealth and produce affordable food. In an era of climate change, escalating toxicity, health concerns, and primarily declining fertility, resources are depleting.”