Hello and greetings. The recent acquisition of JetBlue shares by Carl Icahn has caused quite a stir in the market. Following the investor’s announcement of a substantial stake in the airline yesterday, JetBlue’s stock, which had been experiencing a downturn, surged by nearly 20%. It’s worth noting that Carl Icahn, who faced a $9 billion loss from shorting the company, is the key player in this scenario. Short selling is undeniably more challenging than stockpicking. For further inquiries, please reach out to john.ethan and [email protected]. [email protected].

Is Arm’s Role in AI Overstated?

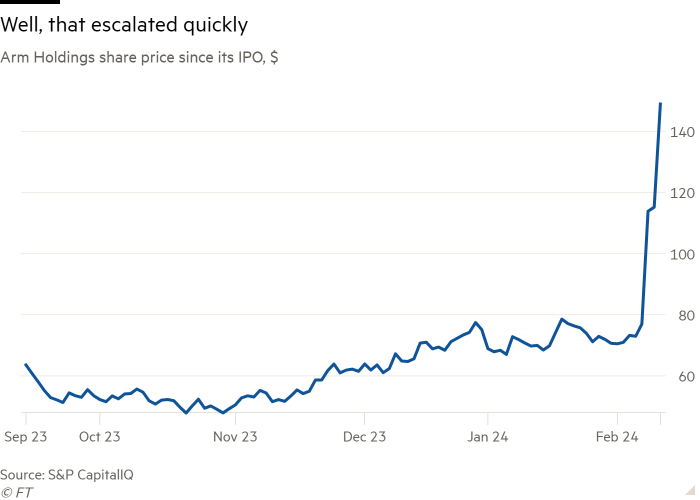

This week has been pivotal for Arm Holdings in the realm of custom devices. The company’s stock has almost doubled since its recent earnings update on Wednesday.

Two primary factors underpin this remarkable upswing. Firstly, SoftBank, holding a 90% stake in Arm, has a limited free float, and some shares from this float may have been sold just before the robust earnings report. Following the report, earnings forecasts for the upcoming fiscal year have surged by approximately 11%, a notable development considering the stock’s doubling.

Secondly, Arm is positioned as a player in the AI landscape that is gaining momentum. Notably, The Financial Times highlighted that the recent successes were “fueled by robust demand for artificial intelligence.” The company itself is not shying away from the AI hype. As per the quarterly shareholders’ letter, “Arm’s licensing revenue received a boost from the increasing demand for cutting-edge technology driven by all things AI.” Arm’s involvement in Nvidia and Google AI projects further underscores its significance in the AI domain.

Arm’s device models stand out for their superior energy efficiency compared to competitors, establishing them as the industry standard for wireless computing with a commanding 100% market share. Moreover, the company has reaped substantial benefits from energy-efficient data center chips, addressing the escalating concern over energy consumption in data centers. It’s important to note that while Arm specializes in CPUs (central processing units), GPUs (graphics processing units) are the primary drivers of AI computing due to their adeptness at handling multiple tasks concurrently, a crucial requirement for AI operations. Hence, the hype surrounding Arm’s role in AI may be somewhat exaggerated.

When presented with this perspective, Dylan Patel, the chief scientist at SemiAnalysis, a specialized research firm serving the chip industry and Wall Street, opined that the AI narrative might be overstated, emphasizing a stronger narrative in data center applications. This distinction holds significant weight, considering the diverse processing tasks involved in AI operations beyond primary functions.

Tech investor Gene Munster from Deepwater Asset Management concurred, acknowledging Arm as a part of the AI narrative. Munster highlighted the ongoing transformation in the computing market, with data centers undergoing substantial revamps as part of this evolution. While Arm features in this narrative, it ranks lower compared to AI stalwarts like Nvidia, AMD, and Taiwan Semiconductor, according to Munster.

Just as cloud and mobile technologies dominated discussions in previous years, AI is now the buzzword in computing. However, similar to past transitions, the benefits of embracing AI will not be uniformly distributed. While some entities will thrive in the AI era, others may struggle to keep pace with the rapid advancements.

Despite the nuanced landscape, Arm’s growth potential remains promising. Patel noted that the company has ample scope to increase the royalty rates charged to manufacturers utilizing its chip designs. For instance, Arm charges smartphone manufacturers up to 50 cents per phone for its smart CPU designs, while Qualcomm may charge up to $13 in royalties for its radio chips in high-end phones. This growth trajectory underscores that Arm’s success is not solely dependent on the AI narrative but extends to other revenue streams as well.

Are Dividends Making a Comeback?

While Meta’s recent dividend announcement may seem minor, it triggered a 20% surge in the company’s shares, sparking renewed interest among investors. According to capital planners at Goldman Sachs, this move by the social media giant has reignited discussions around dividend prospects, with The Economist proclaiming, “The payout is back.”

The resurgence of dividends holds significant implications, as reinvested dividends can substantially compound over time. Historical data shows that a considerable portion of investors’ returns, particularly in the S&P 500 index, have been derived from dividends since 1926, with the remainder stemming from price appreciation. However, the prevalence of share buybacks has overshadowed dividend payouts in recent years, with companies favoring buybacks as the primary method of returning capital to shareholders.

The renewed focus on dividends suggests that rising bond yields are prompting companies to maintain a stable dividend policy to attract and retain investors, as highlighted by FT’s Katie Martin. Despite this trend, Meta continues to engage in substantial share buybacks alongside its dividend initiatives.

While the prospect of dividend resurgence is promising, it is essential to note that this transition has yet to fully materialize. Howard Silverblatt from S&P presents compelling data indicating that dividends, following a significant decline post-financial crisis, have not fully recovered in terms of earnings per share:

[Graphic Data Unavailable]

Silverblatt further observes a slowdown in dividend growth from 10% in 2022 to 6% in the subsequent year, reflecting a sense of caution prevailing in the business landscape. The market environment has been notably challenging since 2022, despite robust earnings growth in 2021 driving fresh dividend announcements. Unlike buybacks, which can be halted at any time, dividends represent a consistent cash outflow that necessitates sustained performance over multiple quarters.

Despite these challenges, a modest improvement in the second quarter of 2023 offers a glimmer of hope. Data from Wall Street Horizon indicates a notable uptick in companies announcing dividends in January, with 56 S&P 500 firms unveiling dividend increases averaging 6%. February traditionally marks a peak period for dividend announcements following year-end financial reconciliations, hinting at a potentially positive trend in the dividend landscape.

Analyzing the payout ratio, which signifies the proportion of earnings distributed as dividends, reveals a gradual recovery from the post-crisis slump, nearing the 30-year average:

[Graphical Representation Unavailable]

While these developments paint an optimistic picture, it is crucial to recognize that the current trends may be transient and subject to reversal in the event of an economic downturn. The evolving dividend landscape presents a nuanced scenario that warrants cautious optimism rather than definitive conclusions. (Ethan Wu)

For more insightful financial content, tune in to our new audio series, Unhedged, hosted by Katie Martin and Ethan Wu, offering a concise overview of the latest financial and market updates twice a week. Access previous magazine editions below.

Explore our exclusive ezines: Swamp Notes: Delve into professional analysis of the intricate relationship between wealth and power in US elections. Become a member today.