As per Albion Venture Capital’s recent update this week, the business growth trajectory in 2023 is aligning once again with the levels observed in 2020 post a surge in 2021. The surge in AI utilization is steering the European investments in digital health, fueled by a growing interest in diagnostics, clinical decision support, and supplier software.

The widespread adoption of systems globally during the pandemic has triggered a spree in venture capital investments. Western health technology start-ups witnessed a significant surge in funding, soaring to EUR12.5 billion in 2021, as reported by Albion Partner Christoph Ruedig and Investor Molly Gilmartin.

Albion’s data reveals that the total anticipated investment in German health technology start-ups is projected to reach EUR6 billion in 2023, akin to the EUR5.9 billion invested in 2020 and closer to historical averages.

Ruedig noted a decline in the number of companies raising funds presently but emphasized that the quality of the entering companies is notably higher, showcasing their ability to secure funding even in challenging circumstances.

Despite the prevalent perception of “doom and gloom,” Ruedig characterized the current market as a “healthy ecosystem,” attributing this sentiment to the slower adoption of technology in healthcare compared to other sectors.

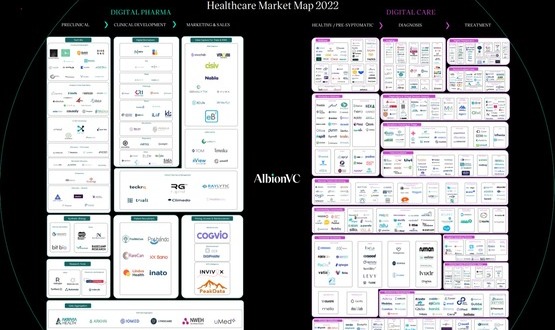

The advancements in AI have sparked a heightened interest in diagnostics, clinical decision support, and company technology post the Covid-19 recovery phase. Conversely, start-ups focusing on workplace healthcare, condition monitoring, and companion apps have experienced relatively less success.

Concurrently, investments in areas like individual recruitment for clinical trials and electronic indicators have outperformed in the electronic pharma sector, with a substantial 86% of such investments being in UK-founded companies. Gilmartin highlighted the transition of several businesses within this sector to the modern care space, particularly in electronic biomarkers.

While certain well-funded sectors during the pandemic, such as teleconsultation, online therapeutics, and office wellness, have witnessed a decline in investments, the growth of teleconsultation and office wellness outside Europe has been challenging.

In contrast, imaging companies have showcased more consistent performance compared to other segments within the sector, with 24% securing funds in 2023 and focusing on specialization and regional expansion through distribution partnerships.

The investors pointed out that the European health technology landscape is relatively nascent in comparison to other industries and regions, with only 13 “unicorns”—companies valued over $1 billion—compared to 112 in the US health tech sector and 164 in Europe’s fintech sector.

Despite this, Gilmartin highlighted the robust business creation environment, noting a 37% increase in digital care companies and a 45% increase in digital pharma companies over the past few years.

She further emphasized the significance of identifying businesses that cater to the evolving needs of consumers impacted by the economic landscape within the industry.