Main Points to Note

- Super Micro Computer stocks saw a significant increase this week, indicating potential growth opportunities for companies in the artificial intelligence (AI) sector benefiting from the rising demand for AI technology.

- While Super Micro Computer may not have received as much attention as Nvidia for its involvement in the AI industry, it plays a crucial role in providing computing, storage, and networking solutions to its clients.

- Analysts from J.P. Morgan highlighted that network and hardware companies could be the “overlooked” beneficiaries of the AI trend.

- Companies like Arista, Dell, HP Enterprise, and Coherent are also expected to experience substantial growth due to the increasing demand for AI technology, particularly with chipmakers being among their clients.

Super Micro Computer (SMCI) witnessed a surge in its stock value earlier this week, nearly tripling since the beginning of 2024, with analysts projecting significant gains for the company from the AI technology demand.

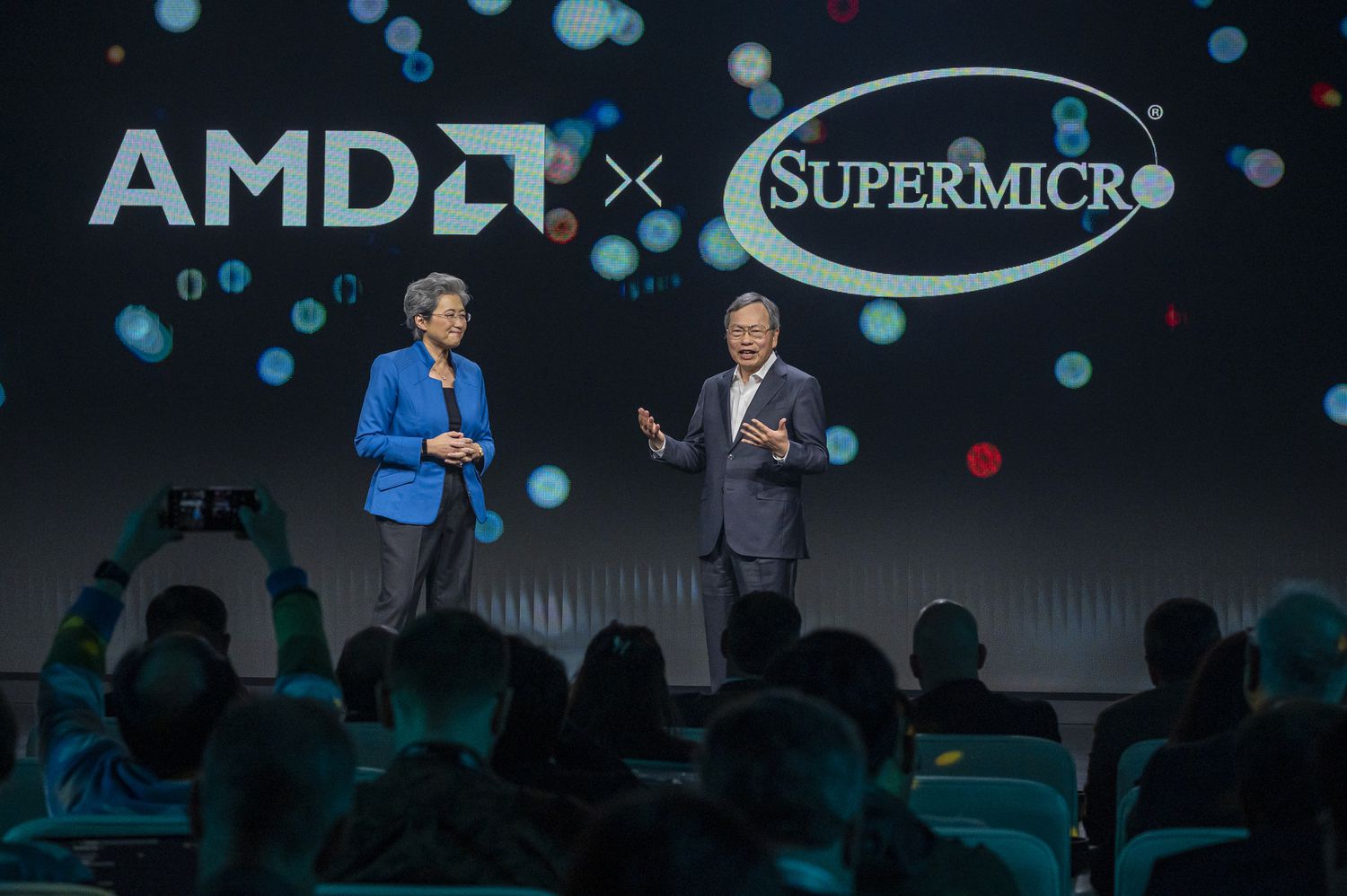

This uptrend also implies potential benefits for other entities within the expanding AI ecosystem, beyond prominent players like Nvidia and AMD, who have experienced substantial market value growth amidst the AI optimism.

Understanding Super Micro Computer’s Role and Stock Surge

Although Super Micro Computer may not enjoy the same level of recognition as Nvidia, its offerings in computing, storage, and networking are vital for semiconductor companies to meet the escalating AI requirements.

Noteworthy customers of Super Micro Computer utilizing its AI infrastructure include Nvidia, AMD, and Intel.

Bank of America analysts anticipate robust revenue growth for SMCI in the upcoming years, primarily driven by the demand for AI-related products. The stock reached record highs recently; however, a decline followed after Wells Fargo analysts suggested that the AI-related benefits for the company might already be factored into the stock price.

Potential Growth for Other Tech Hardware and Network Stocks in the AI Landscape

The recent surge in Super Micro Computer’s stock could signal favorable prospects for companies offering services and products to AI chipmakers such as Nvidia.

J.P. Morgan analysts pointed out that while investors have largely identified the primary beneficiaries of AI investments, there are additional “forgotten” winners in the AI domain. The firm highlighted Arista Networks (ANET), Dell Technologies (DELL), Hewlett Packard Enterprise (HPE), and Coherent (COHR) in its report titled “Forgotten AI Warriors in Hardware,” alongside Super Micro Computer.

Arista Networks, a cloud networking company, indicated on its recent earnings call that it is conducting trials with major AI players for GPU and storage networks supporting AI workloads, without disclosing specific clients.

Dell Technologies and HP Enterprise are also positioned to benefit as server providers. These companies are enhancing their collaboration with Nvidia, which is expected to boost their content per server and margins in their compute businesses.

Nvidia’s announcement in late 2023 regarding the integration of NVIDIA Spectrum-X Ethernet networking technologies into Dell and HP Enterprise servers aims to accelerate generative AI workloads for enterprise clients.

Coherent, a manufacturer of optical hardware, foresees a growing market opportunity for its transceivers tailored to AI and machine learning (ML) requirements amid the AI surge. These transceivers can cater to various protocols essential for AI and ML applications, including NVIDIA’s NVLink.

William Blair analysts highlighted the increased attention on Coherent due to the rising demand for its 800G transceiver technology in the AI sector. They noted that Coherent is streamlining its development processes to meet the escalating demand, with expectations of substantial revenue growth from AI-related activities.

For news tips for Investopedia reporters, kindly reach out to us at

tips@ investopedia.com