Following the updated US import restrictions, Graphcore, a designer of AI devices, is downsizing its workforce in China due to the cessation of revenue in that region.

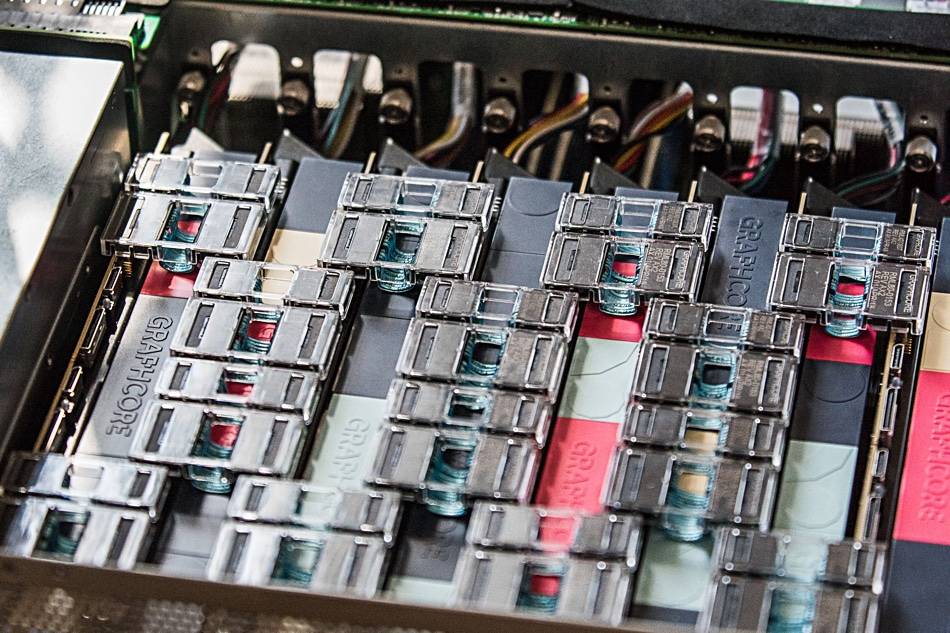

Graphcore, a UK-based company, is renowned for its development of IPU cloud services, the associated Poplar software stack, and AI accelerators known as Intelligence Processor Units (IPUs). Research from last year suggests that in certain AI workloads, Graphcore’s components may outperform those of the GPU giant Nvidia.

Unfortunately, Graphcore has become collateral damage in the US-China Chip War, a strategic move by the US to hinder China’s access to advanced AI and the necessary technology for its advancement.

In response to the recent trade regulations imposed by the Biden administration, Graphcore has confirmed that it will no longer conduct sales operations in China. This decision is a result of the updated US Export Controls, which prevent AI hardware manufacturers like Graphcore from selling IPU systems in China.

Despite being a British company, Graphcore, like many others, is affected by Washington’s import restrictions, which restrict the use of American manufacturing and design tools crucial in the global semiconductor industry.

Graphcore had anticipated expanding its market presence in China, potentially capturing market share previously held by Nvidia. However, with the ban on exporting high-end GPU startups to China, Graphcore’s plans have been disrupted.

The company is exploring avenues to address its financial challenges, including seeking additional investments to offset rising costs. In its recent financial report, Graphcore disclosed a pre-tax loss of $204.6 million for the fiscal year ending December 31, 2022.

While facing these challenges, Graphcore remains committed to providing customers worldwide with competitive alternatives to GPUs, as the demand for AI solutions continues to grow globally.

The impact of these restrictions extends beyond Graphcore to other AI companies. Nvidia, a key player in the GPU market, expects its sales to China to be affected as well. Despite the anticipated decline in sales to affected regions, Nvidia remains optimistic about growth opportunities in other markets to offset any losses.

As the industry navigates these changes, buyers should prepare for potential shifts in the market landscape. Nvidia reported a significant revenue increase in the third quarter, highlighting the dynamic nature of the tech industry amidst evolving trade regulations and market conditions.