Board members of Nvidia, a prominent player in the AI industry that has been generating significant buzz for its leading role in the software revolution, are currently reaping the rewards of the company’s soaring stock performance. The stock price of Nvidia surged to $887 today, marking a remarkable 26.5% increase in value for this month alone.

Recent filings with the Securities and Exchange Commission (SEC) have revealed that four executives have engaged in selling company shares through multiple transactions over the past four days. This trend adds to the growing number of professionals who have divested substantial amounts of company stock in recent months. Among them, notable figures include JPMorgan Chase CEO Jamie Dimon, who executed his first-ever stock sale amounting to \(150 million last month, and Amazon founder Jeff Bezos, who parted with \)8.5 billion worth of Amazon stock. Mark Zuckerberg, the leader of Meta Platforms, also sold \(1.2 billion in company shares, while private equity leader Leon Black initiated his selling spree with a transaction valued at \)172.8 million.

Within the Nvidia board, Tench Coxe, a former managing director at venture capital firm Sutter Hill Ventures, conducted three transactions selling \(170 million of company stock just yesterday. Apart from his selling activities, Coxe receives restricted stock valued at \)255,000 annually and $85,000 in cash as part of his director compensation. Coxe has been serving as a board member at Nvidia since 1993.

Similarly, Mark Stevens, another board member, sold 12,000 shares worth \(10.2 million this week, following a previous sale of 15,000 shares valued at approximately \)12 million last month. Stevens, who is the managing partner at private investment firm S-Cubic Capital and a former partner at VC firm Sequoia Capital, rejoined the board in 2008 after his initial tenure from 1993 to 2006. In January, Stevens also sold 36,000 shares when the stock price was around \(546, generating \)19.7 million.

Mark Perry, a longstanding board member for nearly a decade and a consultant for various organizations, sold 15,000 shares for around \(11.9 million on Feb. 23, shortly after the company’s earnings report on Feb. 21. Another director, Harvey Jones, who has been on the board since 2003, divested a portion of his stake in the company for approximately \)53 million. Jones is the managing partner at Square Wave Ventures.

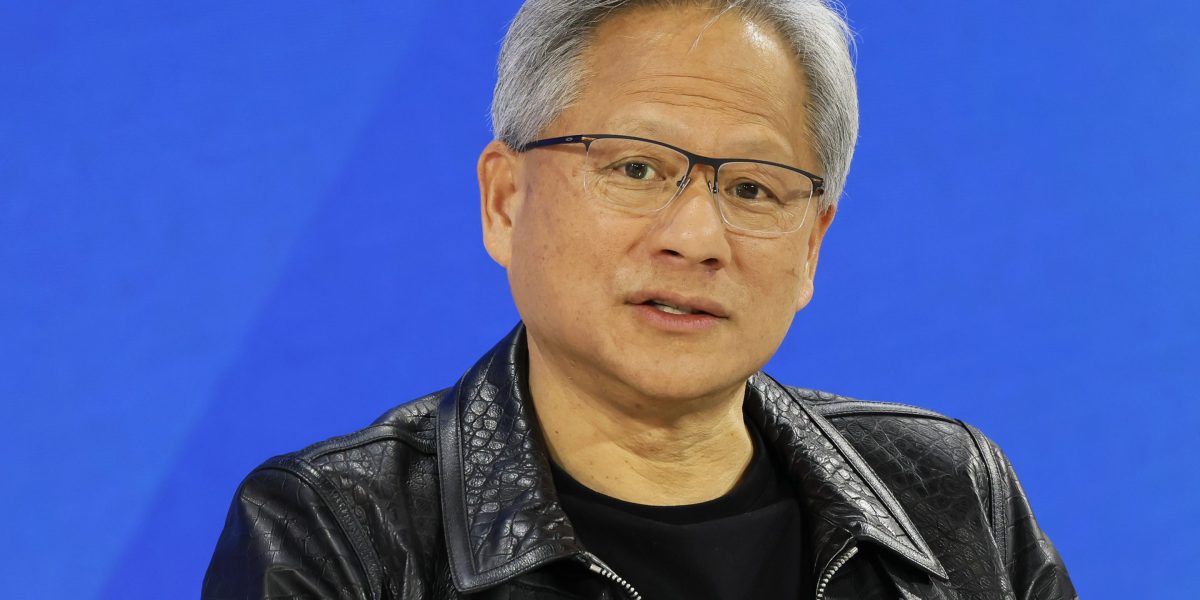

Despite the significant sell-offs by Coxe, Jones, Stevens, and Perry, they still retain substantial holdings in the AI chip designer. Coxe holds approximately 4.1 million shares, Jones owns roughly a million shares, Perry possesses 152,000 shares, and Stevens has 4.4 million shares. In comparison, CEO Jensen Huang maintains a significant interest in the company with approximately 86 million shares, representing a 3.5% stake.

In a separate development, Andrew Jassy, the CEO of Amazon, divested 50,000 shares of the company for about $9 million this week as part of a prearranged trading plan.