Sam Altman stirred up significant attention in early February by advocating for a $5 to 7 trillion (€4.65 to 6.5 trillion) global investment to enhance the development of more advanced chips for the next wave of artificial intelligence (AI) platforms. This call to action, equivalent to nearly a quarter of the US federal budget, left many industry analysts astounded.

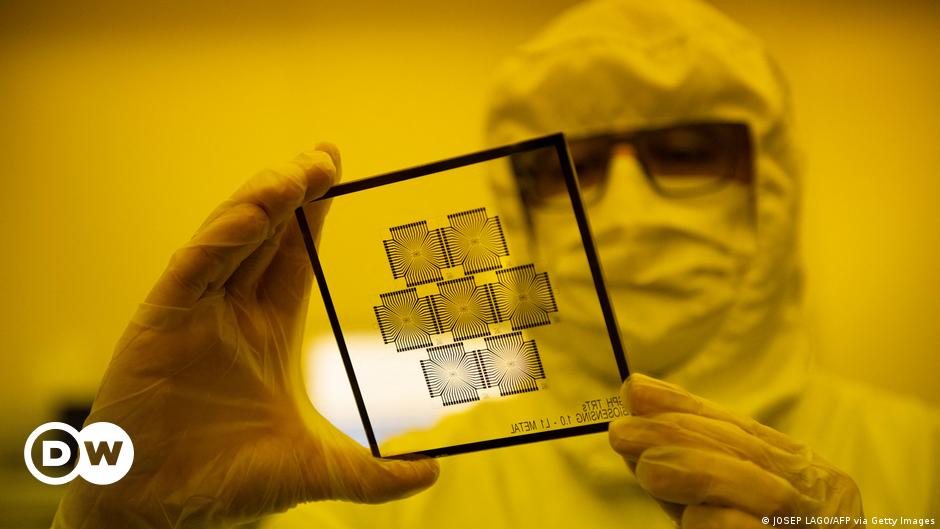

Altman’s primary goal is to address critical challenges confronting the AI sector, such as the severe shortage of chips and semiconductors essential for powering large language models like his company’s ChatGPT, as reported by the Wall Street Journal.

The visionary entrepreneur emphasized the necessity for significantly enhanced computing capabilities to propel AI beyond human intelligence. Altman recently engaged in discussions with potential investors in the United Arab Emirates, according to the business daily.

Unprecedented Investment Requirements

Pedro Domingos, a respected professor emeritus of computer science and engineering at the University of Washington, criticized the audacity of requesting $7 trillion, deeming it “indecent.” He highlighted that this amount far surpasses the cumulative spending of the entire chip industry throughout its history.

Domingos speculated that Altman might ultimately seek around \(700 billion in funding, still a substantial sum compared to the current value of the AI chip sector. A recent analysis by Canadian-Indian analytics firm Precedence Research estimated that the industry could reach a value of approximately \)135 billion by 2030.

Some experts believe that Altman’s ambitious projection may not be unrealistic if the objective is for AI to eventually surpass human intelligence comprehensively.

Dylan Patel, chief analyst at SemiAnalysis, raised thought-provoking questions about the future evolution of AI capabilities, envisioning scenarios where AI excels in various domains beyond textual interactions. This expanded scope, incorporating images, videos, audio, and tactile feedback, could indeed necessitate investments amounting to hundreds of billions or even trillions of dollars.

In a recent development showcasing the rapid progress in AI technology, OpenAI introduced Sora, a platform capable of generating high-quality short videos based on simple text inputs.

Intensifying Competition in the AI Chip Sector

Even before Altman’s bold proposal, major global players such as the United States, China, Japan, and various European nations were already vying to secure their positions in the chip industry.

Over the past year and a half, Washington has imposed sanctions on Beijing to restrict Chinese access to US-designed chips. However, Domingos criticized these sanctions as “counterproductive,” suggesting that they inadvertently incentivize China to bolster its domestic chip capabilities, reducing reliance on US imports.

China, in particular, has demonstrated a strong commitment to narrowing the technological gap by investing heavily in AI chip production. Patel highlighted China’s substantial subsidies amounting to $250 billion over the next decade to fortify its manufacturing capabilities and compete with established leaders like Taiwan and the United States.

While countries like Germany may face challenges in establishing a foothold in AI chip production due to the absence of major tech corporations investing significantly in this domain, Patel emphasized the necessity of government support to foster innovation and competitiveness.

Strategic Significance of Advanced Chips

Recognizing the strategic importance of ultra-high-speed chips in the current geopolitical landscape, more countries are acknowledging the critical role of advanced chip technologies as a “strategic commodity.”

Economic historian Chris Miller emphasized the heightened sensitivity among governments regarding the localization and ownership of chip manufacturing facilities to prevent authoritarian regimes from exploiting AI for malicious purposes.

The world’s leading chip designer NVIDIA has experienced a remarkable surge in market value, emerging as a dominant player in AI chip design. Amid a period of rapid market expansion driven by investor optimism, NVIDIA’s market capitalization has soared, prompting discussions about the sustainability of this growth trajectory.

Domingos likened the current enthusiasm for AI investments to an inflating balloon that may eventually burst, leading to financial losses for many stakeholders. However, he expressed confidence in the long-term transformative potential of AI, drawing parallels to the enduring impact of the Internet despite past market downturns.

In conclusion, the evolving landscape of AI chip development underscores the critical role of strategic investments, technological innovation, and international competition in shaping the future of artificial intelligence.