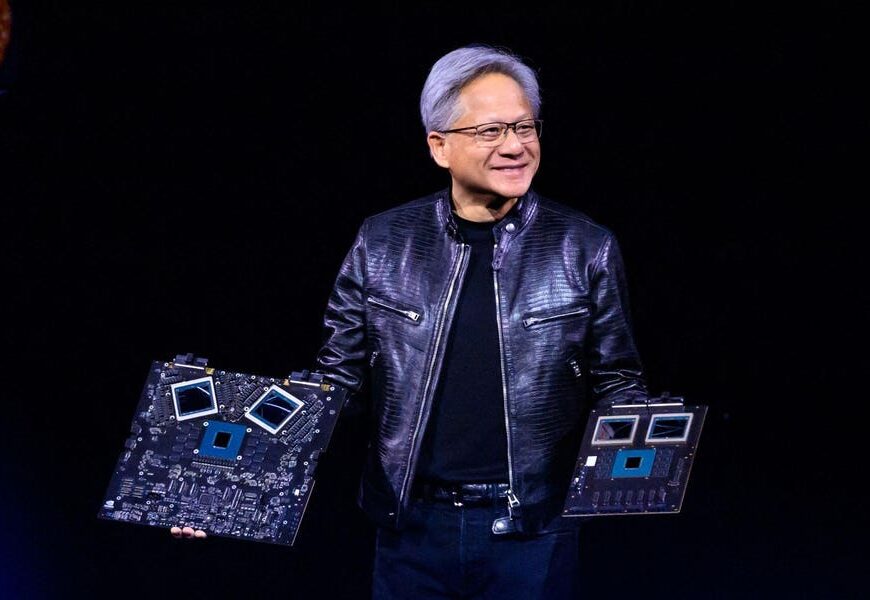

Last month, U.S. chip company Nvidia announced a new AI computing platform called Blackwell. Thought AI was moving fast? Blackwell will run 30 times faster than Nvidia’s current best chip, said CEO Jensen Huang. (Huang, 61, worth an estimated $79 billion, was born in Tainan in southwestern Taiwan. He lived in Thailand from ages 5 to 9, and was sent to America to live with an uncle in the 1970s.)

AI’s arrival on the world stage seems sudden. But the idea of artificial intelligence goes back to 1950, when British cryptographer Alan Turing proposed a test to see if a computer could pose as a human and fool observers. Since then, AI software has had many false dawns: AI startups briefly caught investor attention in the 1980s, 1990s and early 2000s. But until now, AI was more promise than practical. It was not ready for business.

What changed? Two things. One was “transformer”—a new AI language model that emerged from Google Labs in 2017 and made today’s generative AI possible. Two is the sheer processing power of Nvidia’s chips. The new Blackwell chip has 208 billion transistors. Nvidia says Blackwell can support a 27 trillion parameter model, a gigantic leap in processing power from what’s available today. One of the first deployments of Blackwell will be in Malaysia, powering a supercomputer created by YTL, the Malaysian business group run by Francis Yeoh, who shares a $1.4 billion fortune with his siblings.

Translation: Like going from steam ships to jet aircraft. Businesses will face rapid decline if they don’t adapt. Cities and countries, too. Think of how much the world has changed in the last five decades. China was reborn. Southeast Asia boomed. So have India, the Middle East, South America and now parts of sub-Saharan Africa. Communication is instant and affordable for most. Capital flows to opportunity, not perfectly, but amazingly well. Now imagine the last 50 years of change compressed into a decade or two. This is the world we now enter.

Will anything stop AI’s acceleration? Governments will try, under the guise of safety and security, and will find eager partners in older companies afraid of disruption. But this story has played out many times throughout history. Progress inevitably finds its way. If progress can’t climb over a barrier, it will leap over, go around or tunnel under.

One barrier won’t be so easy to defeat. It is electricity. AI consumes it, and vastly more than you might imagine. The world may soon run short.

On March 7, The Washington Post wrote a story headlined “Amid Explosive Demand, America Is Running Out of Power.”

Wrote the Post, “Vast swaths of the United States are at risk of running short of power as electricity-hungry data centers and clean-technology factories proliferate around the country, leaving utilities and regulators grasping for credible plans to expand the nation’s creaking power grid…Northern Virginia needs the equivalent of several large nuclear power plants to serve all the new data centers planned and under construction.”

The era of AI will need much more electricity. So will future prosperity. The race to supply that electricity is heating up. Companies, countries and cities will compete on available, reliable, affordable electricity. Investment hint: Copper is electricity’s indispensable mineral.