Despite Nvidia, the leader in artificial intelligence chips, falling short of third-quarter estimates and surpassing expectations for the current period, the stock experienced a decline on Wednesday. This outcome raises the question: why aren’t investors celebrating instead of expressing disappointment?

Wall Street analysts suggest that Nvidia’s stock was overvalued, and its future prospects failed to meet lofty “whisper numbers.” This underperformance may be attributed to the impact of recent U.S. trade regulations on advanced semiconductor technology, resulting in a loss of business in China.

During a conference call with analysts, Nvidia’s Chief Financial Officer, Colette Kress, highlighted the significant negative impact of the trade restrictions on the company’s sales in China. The uncertainties surrounding the long-term effects of these restrictions further add to the concerns.

Falling Short of Expectations

According to Gene Munster, the managing partner at Deepwater Asset Management, investors were particularly interested in Nvidia’s profit guidance for the quarter ending in January. While there was an 11% increase in the guidance provided, speculations suggested a more substantial rise of 15 to 20%.

In response to these developments, Nvidia’s stock saw a 2.6% decline, closing at 486.41 in the day’s trading session. Prior to the earnings announcement, the stock had reached a record high of 505.48 on Monday.

For the quarter ending on October 29, Nvidia reported an adjusted earnings of \(4.02 per share on revenue of \)18.12 billion. This exceeded the analysts’ predictions of earnings per share of \(3.37 on revenue of \)16.19 billion. The company witnessed a remarkable 593% year-over-year growth in earnings and a 206% increase in sales.

Nvidia’s sales forecast for the current quarter stands at \(20 billion, reflecting a 231% surge from the previous year. Analysts, however, had projected revenues of \)17.96 billion for the fiscal third quarter ending in January.

Focus on Data Centers

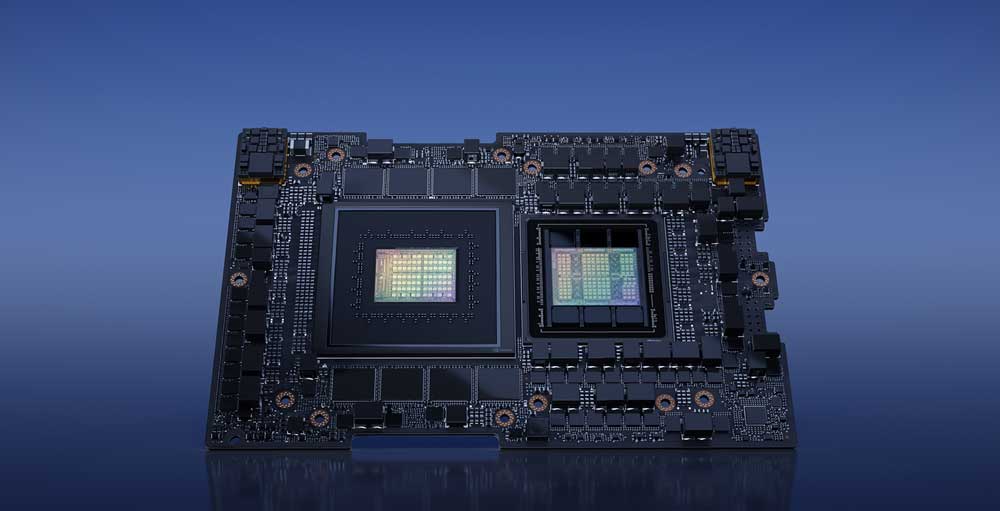

Nvidia’s data center sales soared by 279% to a record $14.51 billion in the second quarter compared to the previous year. Additionally, data center sales witnessed a 41% increase from the previous quarter, emphasizing the company’s strong performance in this segment.

Analysts emphasize the importance of Nvidia’s data center business growth and its impact on the company’s overall performance. Toshiya Hari, a researcher at Goldman Sachs, noted the ongoing strong demand for data center AI processors and related equipment. However, he cautioned that a shift in cloud service providers’ investments in AI could alter this trend. With a target price of 625, Hari recommends buying Nvidia’s stock.

Stacy Rasgon, an analyst at Bernstein, reiterated his positive outlook on NVDA stock and raised the price target from 675 to 700. Despite concerns about the sustainability of growth in the AI sector, Rasgon believes that Nvidia’s numbers will continue to show significant improvement in the near term.

Nvidia’s CEO, Jensen Huang, anticipates continued growth in the company’s data center business at least until 2025.

Analyst Recommendations

Wedbush Securities analyst Matt Bryson maintains a bullish stance on Nvidia’s stock with a price target of 600. Bryson predicts continued strong performance for Nvidia in the coming quarters due to the high demand for GPUs outpacing supply.

Nvidia’s stock broke out of a double-bottom base on November 9, reaching a purchase point of 476.09 according to IBD MarketSmith tables. The stock is listed in IBD 50, Leaderboard, and Tech Leaders categories, reflecting its strong market performance this year.