Nvidia is currently experiencing a challenging situation, as indicated by its CEO Jensen Huang. The company, known for its semiconductor products utilized in various sectors such as data centers, autonomous vehicles, and gaming, plays a significant role in driving the artificial intelligence revolution that has energized Silicon Valley. Major tech giants vie for its high-end graphics cards, contributing to its market cap surpassing $1 trillion this year.

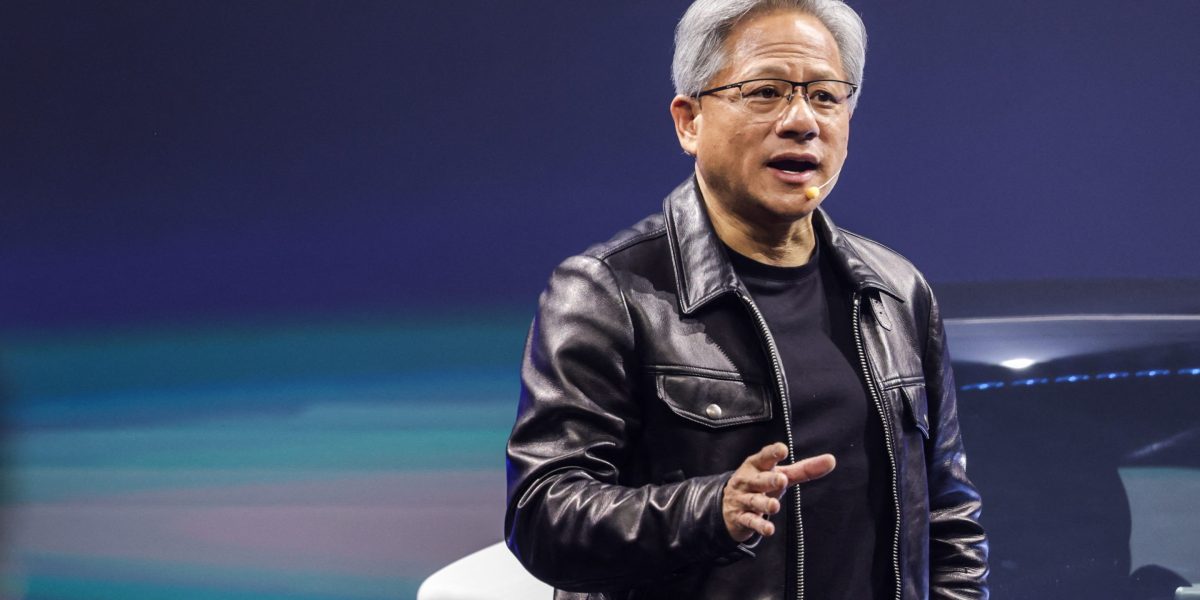

Despite its recent successes, Huang sounded a cautionary note during a recent event at the Harvard Business Review, emphasizing the uncertainty of business survival in today’s landscape. He highlighted the tumultuous history of Nvidia, including near-bankruptcy following the failure of its NV1 product in 1995, which was averted by the subsequent success of the RIVA 128 device.

Acknowledging the company’s past struggles, Huang stressed the importance of maintaining a balance between ambition and vigilance. He underscored the need to navigate challenges, such as the impact of stricter U.S. regulations on tech exports to China, which could potentially result in significant revenue losses for Nvidia.

While Nvidia has shown resilience in the face of competition, particularly from rivals like AMD, analysts caution that sustaining this momentum may prove challenging. The analogy drawn between Nvidia and Tesla, highlighting the risks of increased competition and market saturation, underscores the need for continuous innovation and strategic foresight.

Huang’s affinity for insightful business literature, including works by former Intel CEO Andrew Grove, reflects his proactive approach to leadership. His emphasis on staying alert to potential threats and embracing a mindset of perpetual preparedness resonates with the ever-evolving nature of the tech industry.

In conclusion, Nvidia’s journey exemplifies the dynamic nature of the business landscape, where adaptability, foresight, and a healthy dose of caution are essential for long-term sustainability and growth.