In this biweekly newsletter, Roula Khalaf, the managing editor of the FT, handpicks her preferred articles.

Following concerns that the expansion of artificial intelligence is concealing a broader decline in the demand for semiconductors, the surge in US tech stocks, exemplified by the doubling of Nvidia and AMD’s value in the past month, is facing pressure.

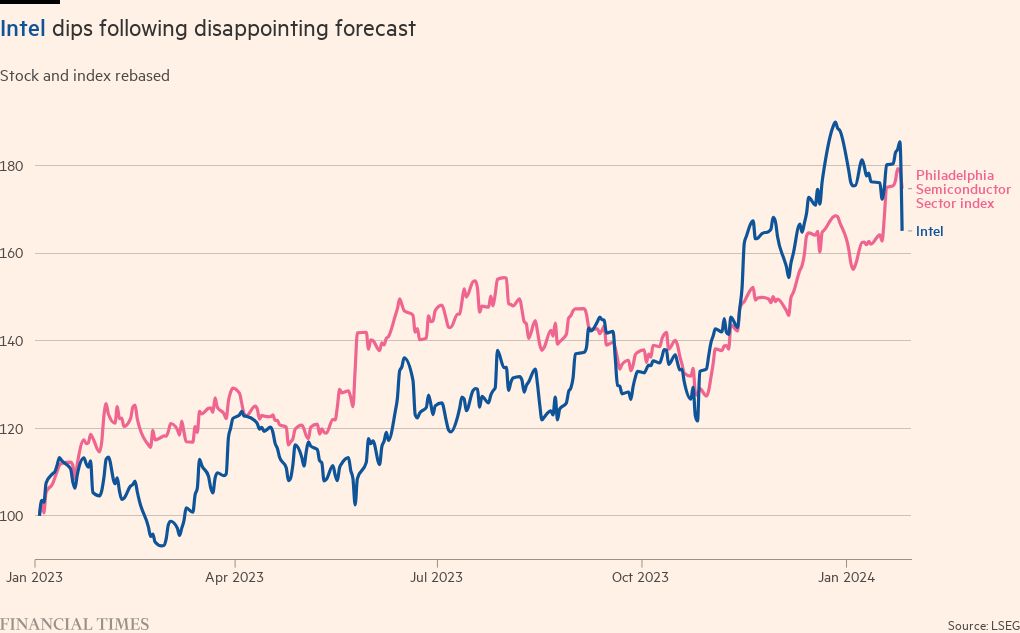

Investors are banking on sustained high demand for AI processors fueling applications like OpenAI’s ChatGPT, driving the Philadelphia Stock Exchange Semiconductor Index up by over 50% in just a year, tracking the performance of 30 major US chip manufacturers.

Despite this growth, only a select few companies have significantly profited from the escalating demand for IoT components among tech giants and startups such as OpenAI and Anthropic. While many chipmakers grapple with excess inventory and tepid consumer interest across various sectors, Nvidia and its partners like TSMC and Supermicro have reaped disproportionate benefits.

The market’s confidence in a broader recovery was rattled this week when industry leaders Intel and Texas Instruments issued lackluster forecasts for the first quarter of 2024. Concerns about manufacturing and industrial demand have surfaced following a sluggish period for PCs and smartphones in 2023.

The upcoming financial reports from AMD, considered Nvidia’s primary rival in providing GPUs crucial for training cutting-edge AI systems, and Qualcomm, banking on AI-driven smartphones to rejuvenate the mobile market, will gauge the momentum of the tech sector that gained traction towards the end of 2023.

Intel’s shares plummeted approximately 12% on Friday, shedding around \(25 billion in market capitalization due to the company’s projection of first-quarter revenue falling short of Wall Street estimates by up to \)2 billion.

Analysts suggest that Intel is trailing behind Nvidia, whose advanced chips have become indispensable for tech giants like Microsoft, OpenAI, and Meta investing heavily in new AI-centric data centers.

By the year’s end, Meta aims to acquire nearly 600,000 high-performance Nvidia chips, primarily from Nvidia, in a move disclosed by Meta’s CEO Mark Zuckerberg earlier this month. This investment could amount to several billion dollars as the company intensifies its AI research endeavors.

While tech giants pour substantial resources into AI chip development, semiconductor manufacturers supplying a broader client base in traditional sectors, such as Texas Instruments and ST Micro, have reported subdued demand below investors’ expectations.

Texas Instruments announced a projected 10% revenue decline for the first quarter compared to Wall Street forecasts. During an analyst call, Dave Pahl, TI’s head of investor relations, mentioned that “we anticipate continued challenges in a tough environment where customers are still adjusting their overall inventories.”

Intel’s market shake-up triggered a sell-off in the semiconductor industry on Friday. Although Nvidia experienced a 1% decline, Qualcomm, AMD, and Broadcom faced approximately 2% drops.

Despite significant profit surges in recent quarters, Nvidia’s stock has surged over 25% in January after nearly tripling in 2023, as per industry experts.

Jonathan Goldberg from D2D Advisory noted, “AI represents a shift from Intel to Nvidia as the dominant force in data centers.” He added that “any entity associated with Nvidia is thriving,” including Super Micro, a server component manufacturer, and chipmaker TSMC, projecting up to 25% earnings growth this year. Supermicro’s stock has soared by over 60% this month after reporting sales for the December quarter exceeding expectations by up to 33%, or $900 million.

Investors anticipated a potential turnaround in the PC sector, with Intel possibly tapping into the substantial AI demand witnessed by Nvidia in the past year. Despite Friday’s setback, Intel’s stocks have risen by around 50% over the previous year.

In a bid to reassure stakeholders, Intel’s CEO Pat Gelsinger pledged “significant revenue momentum” in its Gaudi AI chips, poised to rival Nvidia’s offerings, while attributing the first-quarter challenges to being “transitory.”

Ben Bajarin, an analyst at Creative Strategies, remarked that though not a structural business issue, the setback has dented confidence for many. However, prospects point to a promising rebound in the semiconductor market this year.