Cloudflare

NET

$1.70 1.76%

1.76% 56%

56%

IBD Stock Analysis

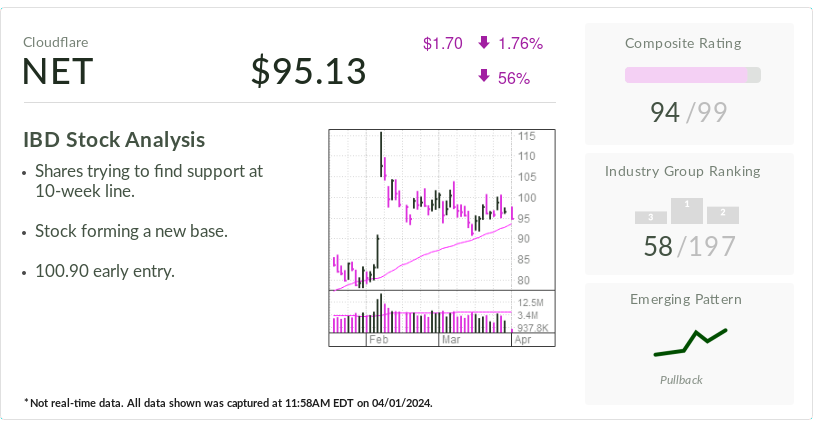

- Attempts are being made by shares to seek support at the 10-week line.

- The stock is in the process of establishing a new center.

- An earlier entry point was at 100.90.

Composite Rating

Market Group Ranking

Emerging Pattern

Pullback

Pullback

No real-time data is available. The information presented was collected at 11:58 AM EDT on 04/01/2024.

As interest from investors in artificial intelligence stocks continues to rise, Cloudflare (NET) emerges as the IBD Stock of the Day. The stock of Cloudflare has shown a 14% increase in 2024 and a 55% rise over the past year, although it has pulled back from its peak of 116 reached on Feb. 9.

On the current day in the stock market, Cloudflare’s stock experienced a slight decline to 96.09.

Given the downturn since the significant high on Feb. 9, potential buyers might seek support at the 50-day moving average. From a conventional technical standpoint, Cloudflare also requires a stable base, with an entry point at 116.

For more aggressive investors, an earlier entry point could be considered at 100.90, which was Cloudflare’s significant level on March 21, if that level is reclaimed.

Established in 2009, Cloudflare accelerates and secures online applications routed through its advanced global network.

In 2023, revenue increased by 33%, reaching \(1.296 billion. Analysts surveyed by FactSet anticipate a 28% revenue growth in 2024 to \)1.654 billion. Concurrently, Cloudflare has set a goal of achieving $5 billion in annual recurring revenue (ARR) from subscription-based services.

New Chief Strategy Officer Appointment

Recent news reveals that Cloudflare appointed Stephanie Cohen, a seasoned banker from Goldman Sachs, as its new chief strategy officer in late March.

According to a recent report by Oppenheimer analyst Tim Horan, “Cloudflare’s go-to-market strategy, product portfolio, and leadership teams have undergone significant enhancements.” He further noted, “Cloudflare’s new head of sales is expected to drive substantial improvements in acquiring new clients. The company is attracting talented new personnel.”

Since the introduction of ChatGPT maker OpenAI in late 2022, generative AI has become a focal point for investors. Additionally, Cloudflare has established connections with OpenAI. When users engage with ChatGPT, a conversational chatbot, Cloudflare ensures secure connections to cloud services.

In response to their collaboration with chipmaker Nvidia (NVDA), Cloudflare has intensified its investments in AI infrastructure.

Akamai Technologies (AKAM) and Cloudflare are competing to deploy network equipment that supports edge computing, bringing cloud services closer to the data source. Simultaneously, Cloudflare is concentrating on AI “inferencing,” which involves processing AI applications or workloads locally at the network edge.

Cloudflare Stock: Partnership with Nvidia

By the conclusion of 2024, Cloudflare has indicated to analysts its plans to deploy Nvidia AI chips in 300 cities. These AI networking cards can be easily inserted into PCI slots on computers, reducing the need for capital expenditures.

In late September, Cloudflare announced details about its “Workers AI” platform and collaborations with Microsoft (MSFT), Databricks, and Hugging Face, both privately held companies. Hugging Face is one of the numerous AI startups developing AI training models for applications.

Horan added, “The company is uniquely integrating networking, security, computing, and now AI all within one edge platform.” He continued, “Cloudflare will benefit from possessing a distinctive global AI infrastructure, especially during anticipated shortages. The growth of inference will focus on latency for various applications, leading to AI playing a more prominent role at the edge.”

Cloudflare Stock Technical Ratings

Currently, Cloudflare stock holds an IBD Composite Rating of 94, as per IBD Stock Checkup.

The Composite Rating by IBD consolidates five distinct proprietary ratings into a single user-friendly rating. The top-performing growth stocks typically have a Composite Rating of 90 or higher.

Moreover, Cloudflare stock boasts an Accumulation/Distribution Rating of B. This rating evaluates changes in a stock’s price and volume over the past 13 weeks of trading. The current rating suggests that more investors are buying rather than selling.

The rating, graded from A+ to E, assesses institutional buying and selling activities in a stock. An A+ indicates substantial institutional buying, while an E signifies significant selling pressure. The C grade signifies a neutral stance.

For the quarter ending on Dec. 31, Cloudflare reported earnings of 15 cents per share, marking a 150% increase from 6 cents in the previous year. Revenue climbed by 32% to $362.5 million, as reported by the San Francisco-based company.

Analysts had forecasted an adjusted profit of 12 cents per share and revenue of $353 million.

Follow Reinhardt Krause on X, formerly Twitter, @reinhardtk_tech for updates on artificial intelligence, cybersecurity, and cloud computing.