Analysts are exploring the potential long-term revenue growth opportunities arising from the company’s investments in artificial intelligence infrastructure, with Cloudflare (NET) emerging as the IBD Stock of the Day. Despite a downturn in April due to revised guidance for 2023, Cloudflare’s investment has surged by 51% over the year.

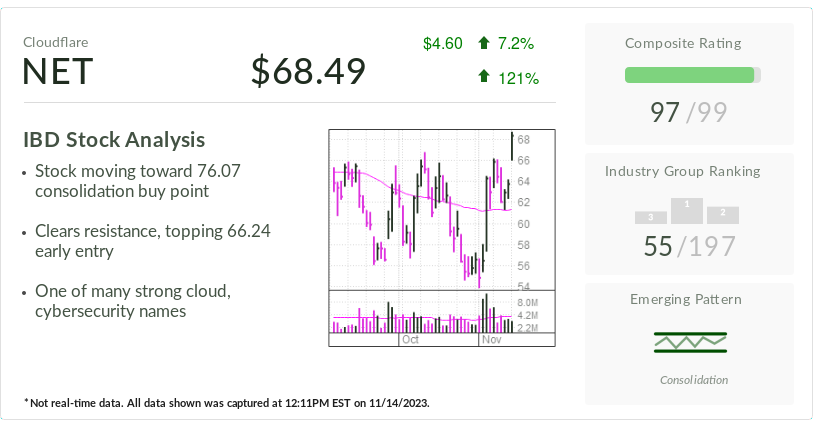

Currently, Cloudflare’s stock has risen by 7.4% to reach 68.63 in the stock market.

From a technical perspective, NET stock presents a buying point at 76.07 post-consolidation. For more assertive investors, the lower entry point is at 66.24 as of November 7. NET stock has shed the weight in the 66 buying range. The buy zone extends to 69.55, representing a 5% purchase area.

Established in 2009, Cloudflare accelerates and secures web applications transmitted through its advanced global network. During the release of the third-quarter earnings for NET shares on November 2, the management updated analysts on its AI system strategies.

In a bid to bring cloud services closer to data generation points, both Cloudflare and its competitor Akamai Technologies (AKAM) are in a race to deploy network equipment supporting edge computing. Concurrently, Cloudflare is emphasizing AI “inferencing,” involving the geographical processing of AI software or loads at the system edge.

NET Stock: Integration of Nvidia AI Chips

Cloudflare informed analysts that it had integrated “inference-optimized” Nvidia (NVDA)-manufactured GPUs in 75 cities by October 31. The plan is to expand this deployment to 100 locations by the end of 2023.

By 2024, Cloudflare aims to distribute Nvidia AI chips across 300 global locations. Simply plugging AI network cards into PCI slots on computer servers eliminates the need for capital expenditure.

As per a recent report by William Blair researcher Jonathan Ho, while the timing of AI monetization remains uncertain, workloads are transitioning towards Cloudflare’s Artificial Edge platform.

In late September, Cloudflare announced collaborations with Microsoft (MSFT), privately held Databricks, and Hugging Face, in addition to its “Workers AI” platform. Hugging Face is among the plethora of AI startups developing AI education models for applications.

Cloudflare Stock: Unveiling a New AI System for “Employees”

According to Oppenheimer analyst Tim Horan, “Employees” is positioned as a provider of inferencing at the edge. Engineers are swiftly implementing disruptive services on “Employees.” The potential for AI inference could be tenfold greater than the education sector. Cloudflare holds the advantage of being the frontrunner in this space. However, the development of edge inference does require time.

Furthermore, Cloudflare is affiliated with the conceptual artificial intelligence firm OpenAI, the creator of ChatGPT. Upon registering to utilize OpenAI’s ChatGPT, a conversational AI, users are provided secure links to cloud services.

The sell-off of NET stock on April 28 was triggered by a weak June quarter and a reduced revenue growth forecast for 2023, down from 37% to 31%.

Cloudflare Q3 Earnings Beat

Cloudflare aims for a long-term target of \(5 billion in annual recurring revenue (ARR) from subscription-based services. Its revenue for 2022 stood at \)975.2 million.

For the quarter ending on September 30, Cloudflare reported earnings of 16 cents per share, marking a 166% surge from the previous year’s 6 cents. Revenue climbed by 32% to \(335.6 million, exceeding economists’ projections of \)330.5 million in revenue and 10 cents per share in earnings.

In Q3, Cloudflare added 206 new significant customers spending over $100,000 annually, bringing the total to 2,558 large customers by quarter-end, reflecting a 34% increase from the previous year.

Technical Ratings for NET Stock

NET stock currently boasts an IBD Composite Rating of 97, as per IBD Stock Checkup.

The Composite Rating amalgamates five distinct proprietary ratings into a single user-friendly score. Top growth stocks typically exhibit a Composite Rating of 90 or higher.

Moreover, Cloudflare’s Accumulation/Distribution Rating stands at B, indicating a positive trend where more funds are flowing into the stock than out of it.

This rating assesses price and volume shifts over the preceding 13 weeks of trading, with higher grades indicating stronger buying activity. A+ signifies significant buying, while E denotes substantial selling, with C being a neutral rating.