The country’s top three banks have opted not to utilize an outward-facing robot due to the perceived high risks involved. However, the adoption of Generative AI has catalyzed a significant and positive shift in Citi’s approach towards data-driven decision-making.

During a presentation at VB’s AI Impact Tour in New York, Promiti Dutta, the head of analysis technology and innovation, highlighted these key points.

Initially, when Dutta joined Citi four and a half years ago, research and analysis were often treated as an afterthought. She recalled how research was primarily used to validate preconceived notions within the company. However, the introduction of generative AI marked a pivotal paradigm shift. Dutta emphasized that this technological advancement propelled data and analytics to the forefront of operations, sparking widespread interest in leveraging Gen AI to address various challenges.

The integration of generative AI fostered a dynamic and engaging environment within the organization, prompting employees to proactively undertake AI-related tasks. While not every issue necessitated a Gen AI solution, Citi’s technology leaders embraced the opportunity for exploration and innovation. Dutta underscored the importance of initiating discussions on the potential applications of AI within the company, lauding the newfound curiosity surrounding data-related endeavors.

As part of Citi’s strategic focus on generative AI initiatives, projects were categorized based on the value they delivered, time efficiency, and the level of certainty associated with their outcomes.

The primary project categories included “agent assist,” where Large Language Models (LLMs) empowered call center agents with concise customer information, enabling quicker note-taking and enhanced responsiveness to customer inquiries. Additionally, LLMs streamlined tasks such as reviewing extensive compliance documents, thereby assisting staff in accessing relevant information efficiently.

Furthermore, Citi developed an internal search engine to centralize information for researchers and employees, facilitating data-driven insights. Dutta revealed plans to incorporate generative AI into the solution to enable real-time analysis for staff members, with the application expected to benefit hundreds of users later this year.

Despite the promising prospects of LLMs, Citi remains cautious about deploying generative AI directly for customer interactions, citing potential risks associated with precision and reliability. Dutta emphasized the critical nature of customer interactions in the banking industry, stressing the importance of maintaining trust with customers by avoiding errors or misunderstandings.

While Citi aims to explore external applications of LLMs in the future, the organization prioritizes human oversight to ensure responsible deployment of AI technologies. This strategic approach aligns with the bank’s commitment to regulatory compliance and risk management.

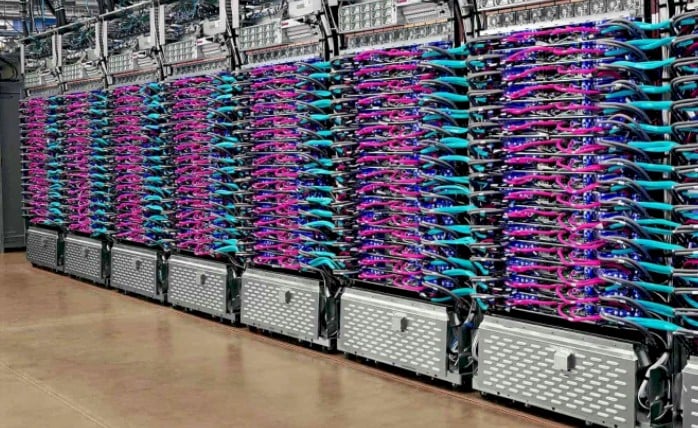

In contrast to Citi’s approach, Wells Fargo has successfully integrated generative AI into its Fargo digital assistant, leveraging LLMs to enhance customer interactions and streamline service delivery. The evolving landscape of generative AI is prompting financial institutions to reassess their technology infrastructure and consider cloud-based solutions for optimal performance.

In conclusion, Citi’s internal review process for generative AI projects, spearheaded by a dedicated task force including top executives like Jane Fraser, reflects a comprehensive and cautious approach to AI adoption. The collaboration between industry leaders such as Citi and Microsoft underscores the importance of responsible AI implementation and ongoing efforts to address challenges in AI development.