UiPath (PATH) has been highlighted as the IBD Stock of the Day due to its position as a leading provider of back-office automation software, presenting an early opportunity for enterprising investors. The discussion around UiPath stock revolves around the influence of generative artificial intelligence and the introduction of new Microsoft products on the company’s future growth trajectory.

UiPath holds a significant position in Cathie Wood’s ARK Innovation ETF (ARKK) and ranks as the second-largest holding across all ARK Invest ETFs. Wood has emphasized that UiPath stands out as a prime investment in the realm of artificial intelligence.

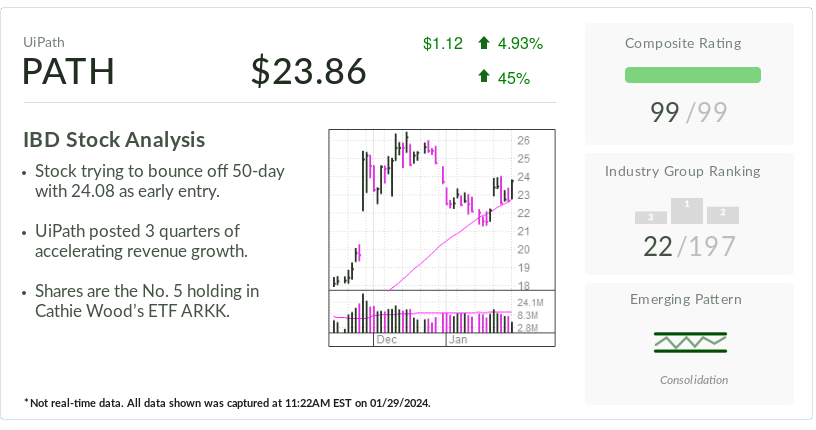

On the current stock market, UiPath observed a 4.4% increase, reaching 23.73.

Specializing in robotic process automation (RPA), UiPath operates in a sector where software companies develop tools to automate manual, repetitive tasks in back-office functions like accounting, billing, and customer service.

Furthermore, UiPath made a significant stride with its initial public offering in April 2021, raising $1.3 billion.

Strategic Entry Point

Additionally, PATH stock has undergone consolidation subsequent to its surge in November following UiPath’s third-quarter earnings announcement. Analyzing the weekly chart, UiPath presents a conventional entry point at 26.52.

The shares are currently attempting to rebound from their 50-day moving average. A more assertive entry point would align with the stock’s peak on Jan. 24, standing at 24.08.

The company has demonstrated three consecutive quarters of escalating revenue growth, with sales climbing by 24% to nearly $326 million in the October quarter.

Moreover, there has been a resurgence in earnings growth following a slowdown during the onset of the pandemic and the shift towards remote work.

UiPath’s software capabilities encompass document scanning, data entry into spreadsheets, PDF file operations, and various other tasks.

A pivotal query for UiPath investors pertains to the potential impact of generative AI tools on the demand for UiPath software. Gen AI “copilots” serve as enhancements to software processes, aiding in interpreting user prompts such as search queries.

Organizations are actively engaged in developing tailored AI solutions for specific industries by leveraging proprietary data to train AI models.

Keith Bachman, an analyst at BMO Capital Markets, maintains a neutral stance on UiPath shares.

Microsoft’s Influence on UiPath Stock

Regarding the long-term outlook, Bachman highlighted the dual effect of gen AI on PATH. He noted, “On one hand, gen AI might exert pressure on the RPA market, potentially altering the competitive landscape, especially with the entry of new players like Microsoft (MSFT) into the RPA domain.” Bachman further added, “Conversely, we believe gen AI could stimulate the adoption of RPA tools by appealing to a broader audience and diverse use cases. PATH offers robust and secure RPA solutions.”

Microsoft holds a significant stake in OpenAI, a pioneering entity in developing gen AI training models. The tech giant has integrated gen AI-enabled “Microsoft Copilot” into its suite of business productivity software.

Moreover, companies have the option to procure UiPath’s RPA software through Microsoft’s Azure cloud computing platform.

In a client communication, Terry Tillman, an analyst at Truist Securities, emphasized, “UiPath has articulated its perspective that Microsoft’s automation strategy leans towards personal productivity, while UiPath prioritizes enterprise productivity. Fundamentally, we believe Microsoft serves as a crucial infrastructure partner for UiPath. Both companies are likely to uphold mutual interests while operating in distinct spheres to address automation and productivity use cases.”

Assessment of UiPath Stock: Technical Insights

UiPath stock boasts an outstanding IBD Composite Rating of 99, as per IBD Stock Checkup.

The Composite Rating amalgamates five distinct proprietary ratings into a single comprehensive metric. For top-performing growth stocks, a Composite Rating of 90 or higher is considered favorable.

Additionally, UiPath stock holds an Accumulation/Distribution Rating of A, indicating a positive trend based on price and volume movements over the past 13 weeks. The current rating suggests a higher volume of buying activity compared to selling.

The Accumulation/Distribution Rating, graded from A+ to E, evaluates institutional trading patterns in a stock. An A+ rating signifies robust institutional buying, while an E rating indicates significant selling pressure. The C grade denotes a neutral stance.

Moreover, in January, analyst Jake Roberge from William Blair initiated coverage of UiPath stock with an outperform rating. He noted the company’s expansion beyond traditional RPA functions into broader workflow automation and process optimization realms.

“UiPath has diversified its product portfolio beyond conventional RPA applications to encompass a wider spectrum of workflow automation and process enhancement solutions,” Roberge remarked. “Since 2020, UiPath has introduced offerings related to document processing, process/task mining, and low-code application development, among others, receiving positive reception for these products.”