Broadcom

AVGO

$1,383.77

$20.56 1.51%

1.51% 25%

25%

IBD Stock Analysis

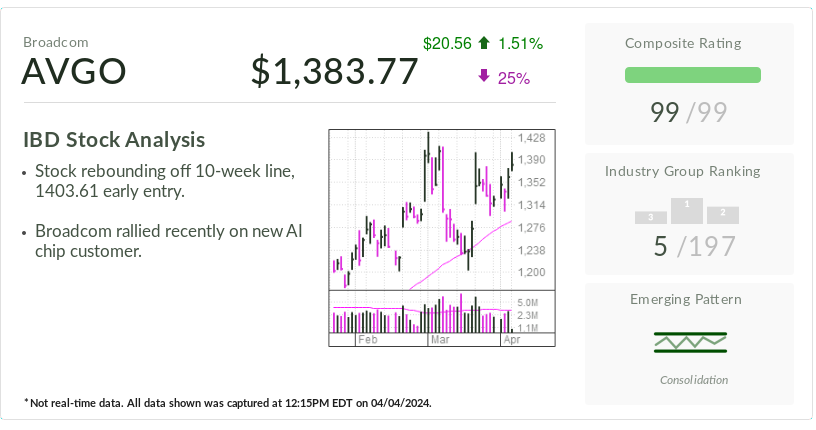

- The stock is bouncing back from the 10-week line, with an early entry at 1403.61.

- Recently, Broadcom experienced a surge in its stock price due to acquiring a new customer for its AI chip.

Composite Rating

Industry Group Ranking

Emerging Pattern

Consolidation

Consolidation

\* Please note that the data provided is not real-time and was last updated at 12:15PM EDT on 04/04/2024.

Broadcom (AVGO) is the highlighted stock of the day, recognized for its role as a semiconductor and infrastructure software provider with a growing focus on AI technology. The stock of Broadcom is currently at a record high level.

During afternoon trading on the stock market today, Broadcom’s stock price increased by 1% to 1,377.48. This value is slightly below its peak of 1,438.17, achieved on March 4. Notably, it reached its highest point within the 20%-to-25% profit-taking range following its breakout earlier this year.

On January 19, Broadcom’s stock broke out of an ascending base, hitting a buy point of 1,151.82, as indicated by IBD MarketSurge charts.

Following a decline from its record peak, Broadcom’s stock demonstrated a bullish trend by rebounding from its 10-week moving average line, as illustrated by MarketSurge charts. An early entry point is identified at 1,403.61.

Shining in the Aftermath of AI Event

Broadcom garnered positive attention from analysts following its investor event titled “Enabling AI Infrastructure” on March 20. During the event, Broadcom disclosed the addition of a new customer to its AI chip business, specializing in application-specific integrated circuits (ASICs).

Apart from custom AI processors, Broadcom is also a key supplier of networking and switching chips for data centers. Its recent focus has been on applications related to artificial intelligence, demanding high-speed and high-bandwidth capabilities.

At the AI event, Broadcom restated its objective of achieving over $10 billion in revenue from AI chips in the current fiscal year, marking a 140% increase from the previous year.

Piper Sandler analyst Harsh Kumar expressed confidence in Broadcom’s strategic position in networking and custom accelerators for both short and long-term prospects. Kumar emphasized that AI is a long-term trend, and Broadcom is well-equipped with active involvement in various connectivity products like custom XPUs, networking solutions, and supplementary products such as optics.

Kumar recommends buying Broadcom stock, with an overweight rating and a price target of 1,650.

Broadcom Stock Recognition

Simultaneously, Broadcom and industry leader Nvidia (NVDA) maintain a complex relationship in the AI chip sector, described as “frenemies” by Rosenblatt Securities analyst Hans Mosesmann. Mosesmann highlighted that customers support both companies due to their distinct technological approaches.

The competition between Nvidia’s AI compute roadmap, characterized by GPU-centric solutions and proprietary CUDA, InfiniBand networking, and NVLink connectivity, and Broadcom’s emphasis on ‘open’ standards, including custom/merchant XPU and open Ethernet, is viewed as a significant rivalry in the long run.

Mosesmann recommends buying Broadcom stock with a target price of 1,500.

Furthermore, Broadcom’s stock is featured on two IBD lists: Big Cap 20 and Tech Leaders.

Follow Patrick Seitz on X, previously known as Twitter, at @IBD_PSeitz for more updates on consumer technology, software, and semiconductor stocks.