- Steve Eisman, renowned for his role in the “Big Short,” expressed optimism about the infrastructure sector for four primary reasons during an interview on the Odd Lots podcast.

- The areas driving this positivity include artificial intelligence, investments in the electric grid, industrial onshoring, and the growth of green energy, all contributing to the sector’s advancement.

- Eisman emphasized the significance of infrastructure over AI, noting the latter’s concentration within a select group of leading companies.

Although the fallout from the 2008 housing crisis has faded, Steve Eisman continues to seek out new major macroeconomic opportunities.

Eisman, known for his successful bet against subprime mortgages as depicted in “The Big Short,” has now turned his attention to infrastructure as a standout beneficiary in today’s economic landscape.

During his appearance on the Odd Lots podcast, Eisman, serving as the senior portfolio manager at Neuberger Berman, outlined his bullish stance on infrastructure, highlighting four key factors that make it a compelling long-term investment choice.

He remarked, “For the first time in my memory, this sector now has a genuine long-term narrative. While still subject to cyclical trends, it is now bolstered by secular tailwinds that were previously absent.” Eisman added, “These tailwinds are poised to endure for a considerable period.”

One of the driving forces behind this positive outlook is the shift towards onshoring post-COVID, as countries worldwide untangle their economic dependencies. Eisman noted that the supply chain disruptions during the pandemic prompted domestic companies to reconsider their production strategies, leading to a partial return of manufacturing to the United States.

This trend, marked by the emergence of new factories, is in its nascent stages but is expected to unfold over the next decade.

While Eisman does not have a stake in the company, he highlighted Eaton as a prime example of a firm capitalizing on this trend. With a focus on manufacturing vehicle, electrical, and aerospace products, Eaton has seen a 38% increase in its stock value year-to-date.

Another significant tailwind is the industrial implications of artificial intelligence. The advanced microchip technology powering AI consumes three times more electricity than a CPU. JPMorgan forecasts a tenfold surge in power demand by 2026 due to AI adoption.

Eisman pointed out that the new GPUs used in AI applications generate more heat than traditional hardware, necessitating enhanced cooling systems in data centers. This, in turn, will drive investments in electric grid enhancements.

Discussing the substantial investments required to upgrade the U.S. grid, Eisman highlighted estimates ranging from \(200 billion to \)300 billion. He praised Quanta Services, a utility stock, as a significant beneficiary, with its shares rising by over 22% since the beginning of 2024.

Lastly, the ongoing transition towards green infrastructure aligned with renewable standards presents a persistent tailwind for the sector. However, Eisman remains cautious about fully embracing all aspects of green energy, citing poor fundamentals in residential solar as a reason for his reservation.

Considering these four pillars, Eisman underscored the impact of the United States’ newfound industrial policy, driven by the combined efforts of the IRA and the IIJA, which are set to inject approximately $1.2 trillion into the economy over the next decade.

While Eisman maintains a positive outlook on AI, his enthusiasm is tempered by the dominance of a select few major players in the field. Identifying the potential beneficiaries remains challenging, although he hinted at Apple as a primary contender.

Expressing skepticism towards the broader applications of AI, Eisman emphasized his preference for established winners over speculative ventures. He highlighted the hype surrounding other AI companies, stating his focus on what is evident and proven.

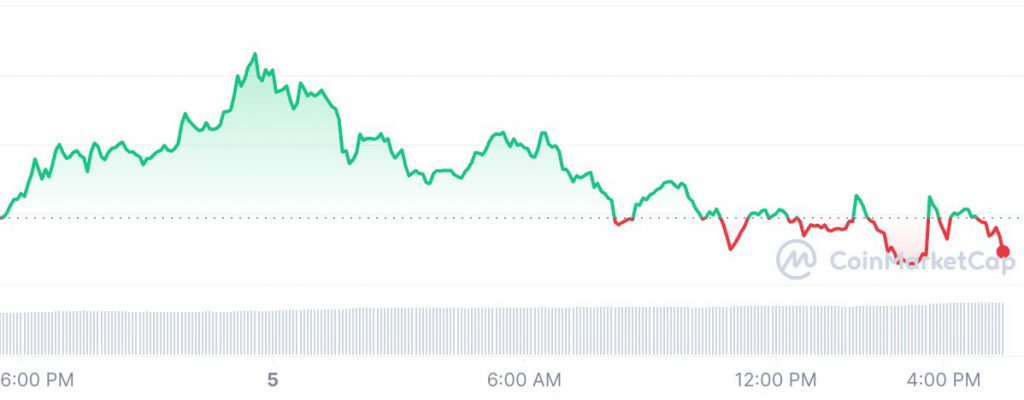

Despite his optimism towards AI and infrastructure, Eisman remains unconvinced of cryptocurrency’s potential. He views digital assets as lacking the characteristics of a hedge security, as their movements do not align with rising inflation concerns or market downturns. Instead, he perceives the crypto market as purely speculative in nature.