Chipmaker Astera Labs (ALAB) made a significant impact with its recent initial public offering, capitalizing on the current investor enthusiasm for artificial intelligence companies. The IPO, which took place just a few weeks ago, saw Astera stock surge by an impressive 72% from its offering price of 36 on its first trading day on March 20. Despite reaching a record high of 95.21 in its fifth trading session, the stock closed at 69.77 on April 4, indicating a potential formation of an IPO base.

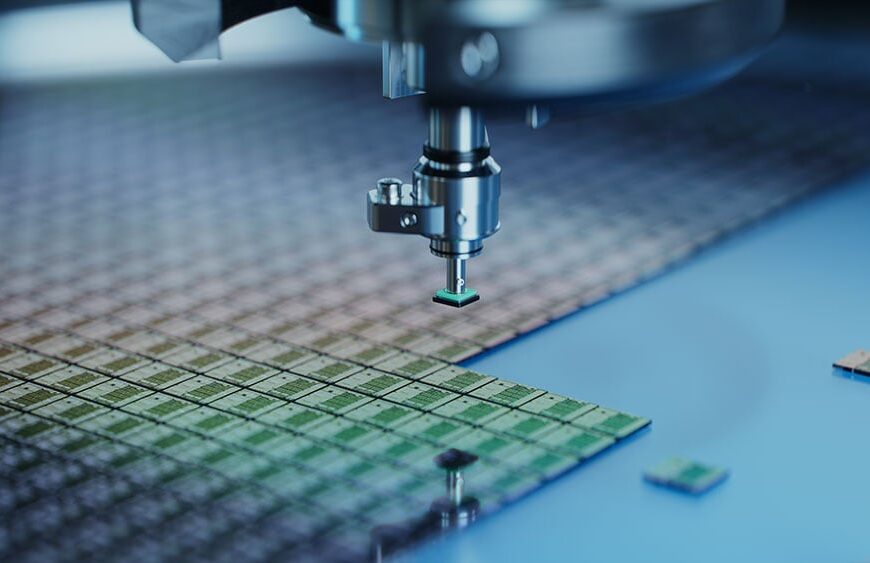

Based in Santa Clara, California, Astera Labs specializes in producing connectivity chips tailored for cloud and artificial intelligence data centers. The IPO raised $604.4 million in gross proceeds for Astera, earmarked for working capital and general corporate purposes.

Astera Labs experienced a notable 45% revenue growth last year as key players in hyperscale cloud services and artificial intelligence platforms adopted its connectivity and networking solutions. In 2023, the company’s sales surged to \(115.8 million from \)79.9 million in 2022, accompanied by a reduction in losses from \(58.3 million in 2022 to \)26.3 million in 2023.

Astera’s product lineup includes three semiconductor-based hardware product families named Aries, Taurus, and Leo, each designed to cater to specific market needs. The company’s founders, Jitendra Mohan, Sanjay Gajendra, and Casey Morrison, drew inspiration from astronomy in naming the company and its products.

The company’s offerings target critical bottlenecks in AI infrastructure, providing solutions to enhance data input-output bandwidth, network bandwidth, and memory bandwidth and capacity for CPUs and GPUs. Astera’s products, built on the Cosmos software architecture, have garnered attention for their superior connectivity solutions in large-scale AI computing systems.

Astera Labs has received positive coverage from Northland Capital Markets analyst Gus Richard, who initiated coverage with an outperform rating and set a price target of 85 for the AI stock. Richard highlighted Astera’s unique product offerings and emphasized the company’s potential for stellar performance in the market.

With a sharp focus on cloud and AI infrastructure, Astera aims to deliver optimal performance tailored to its customers’ needs. The company holds several patents and pending patent applications in the U.S., focusing on interconnect and memory control technology, as well as circuit board and package designs.

Astera competes with industry giants like Broadcom (AVGO), Credo Technology (CRDO), Marvell Technology (MRVL), Microchip Technology (MCHP), and Rambus (RMBS) in the market for connectivity solutions. The company estimates its total addressable market to be \(17.2 billion, projected to grow to \)27.4 billion by 2027.

As hyperscalers embark on a multiyear investment cycle to enhance cloud and AI infrastructure, Astera Labs stands to benefit from the expanding market opportunities. Research firm Dell’Oro forecasts substantial growth in data center infrastructure capital expenditures and server deployments, particularly in the segment of accelerated servers for AI applications.

For more updates on consumer technology, software, and semiconductor stocks, you can follow Patrick Seitz on X, previously known as Twitter, at @IBD_PSeitz.