Some of the most prominent capital experts globally are actively seeking out international champions in artificial intelligence.

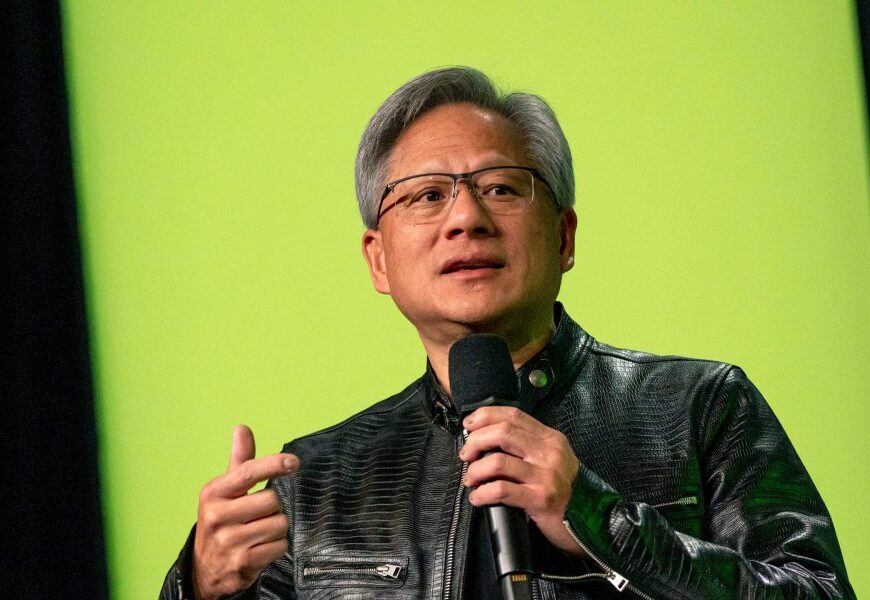

Investors are now turning their attention towards emerging markets for more competitive pricing and a broader array of options. The surge in global interest surrounding AI has resulted in a three-fold surge in Nvidia Corp. and a 50% spike in a significant US semiconductor supplier index in less than a year.

Goldman Sachs Group Inc.’s asset management division is particularly interested in acquiring stakes in companies that produce cooling systems and power supplies for AI supply chains. Meanwhile, investment professionals at Morgan Stanley are focusing on companies undergoing transformations in their business models due to AI, while JPMorgan Asset Management is inclined towards conventional electronics firms transitioning into industry leaders.

“We view AI as a growth catalyst in emerging markets,” stated Jitania Kandhari, the deputy chief investment officer at Morgan Stanley Investment Management. “While we have previously invested in semiconductors and other immediate beneficiaries of AI, it is crucial to explore businesses in diverse sectors as they integrate AI to drive profitability.”

According to Bloomberg’s data, Japanese and South Korean chip companies like Taiwan Semiconductor Manufacturing Co. and SK Hynix Inc. are currently spearheading the $1.9 trillion surge in emerging markets this year.

Despite this progress, the majority of AI enterprises in emerging markets offer significantly higher valuations compared to their US counterparts. While Nvidia is trading at 35 times its projected revenue, Asian AI companies are typically valued between 12 and 19 times.

Advancements are expected to accelerate in developing regions. Analysts, as per Bloomberg’s data, anticipate a 61% earnings uptick for technology firms in emerging markets collectively, surpassing the projected 20% increase for their US counterparts.

The standout performers in this arena are companies such as TSMC and Hon Hai Precision Industry Co., which held prominent positions in the industry even before the AI surge.

These key players, along with MediaTek Inc., a chipmaker, are featured in a JPMorgan fund that focuses on Chinese equities, outperforming 96% of over 1,400 peers. They also constitute the top ten holdings in the iShares MSCI EM Ex-China ETF, which has seen a remarkable $20,000 growth in the last five weeks.

According to Anuj Arora, head of JPMorgan Asset Management’s emerging markets and Asia-Pacific equities, the software firms that have traditionally served as suppliers to major players are poised to become industry leaders. “These companies are significantly ahead of their competitors in leveraging the latest advancements due to their early adoption of this technology.”

The enthusiasm in the sector is expanding, with more investors pouring in funds.

For instance, Hanmi Semiconductor Co. in Korea, predominantly owned by businessman Kwak Dong Shin’s community, has surged by 120% this year, boasting the highest returns among members of the MSCI Emerging Markets Index. Foreign ownership of the company has also witnessed a rise in recent months, as per Bloomberg’s reports.

The Ashmore EM Frontier Equity Fund’s performance among actively managed emerging market funds in the US has surged by approximately 20% this year, primarily attributed to FPT Corp., an IT services provider in Vietnam.

More than half of the inflows this year have been directed towards the iShares MSCI EM ex-China ETF, with its top 10 holdings including companies investing in AI, according to Bloomberg’s data.

Established companies have also piqued fresh investment interest by signaling their intent to venture into artificial intelligence.

Saudi Arabia is emerging as a hub for Chinese AI firms, evident from Saudi Telecom Co.’s collaboration with Alibaba Group Holding Ltd.

Reliance Industries Ltd. in India, led by businessman Mukesh Ambani, has developed a ChatGPT-style model featuring capabilities in 22 Indian languages. The company is also actively involved in India’s online revolution, encompassing 1.4 billion individuals.

Goldman Sachs’ global head of fundamental equity client portfolio management, Luke Barrs, highlighted the emerging trend of nurturing ‘national champions’ in the AI landscape. “Countries are committed to fostering domestic companies that can lead in the future.”

However, the trade landscape poses several risks.

Emerging markets are closely intertwined with the US, which could trigger a global AI market downturn. Conversely, if stock market gains diversify, other sectors might catch up, potentially causing AI stocks to lag behind.

Nonetheless, investors are increasingly exploring EM alternatives to US tech stocks that may have overextended themselves, noted Morgan Stanley’s Kandhari.

“In emerging markets, AI is viewed as an undervalued growth driver moving forward,” she emphasized. “There is immense potential to capitalize on the readily available opportunities.”