A startup backed by Y Combinator, Cambio, is disrupting the banking industry by introducing AI technology through phone interactions with businesses and consumers. Initially focused on providing AI-driven debt collection negotiation services, Cambio assisted 70% of its clients in resolving debts and enhancing their credit scores. The company, led by CEO Blesson Abraham, a banking industry entrepreneur with a background in finance, pivoted its business model to cater to users seeking assistance in debt repayment after participating in the Y Combinator program in 2022.

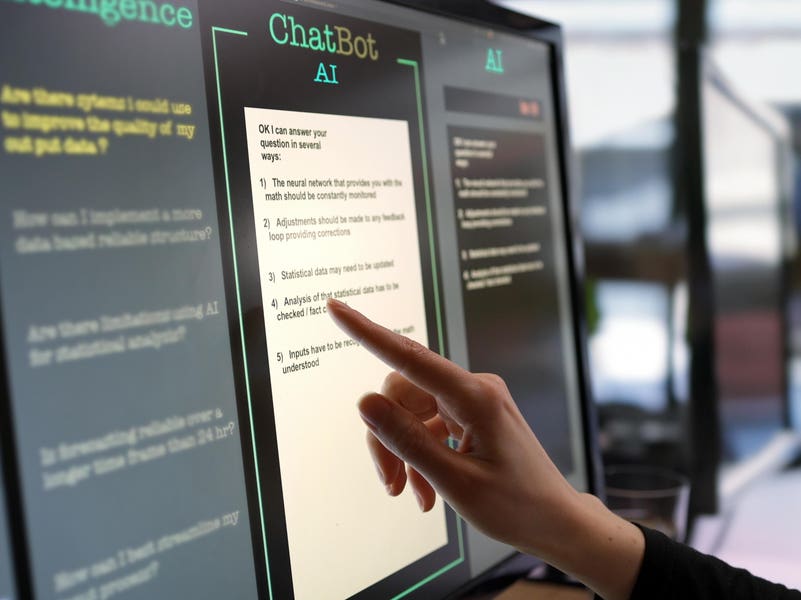

Cambio’s innovative approach involves deploying AI-powered solutions like ChatGPT to facilitate real-time coaching during debt collection calls. By leveraging AI capabilities to negotiate debts on behalf of users with written authorization, Cambio has successfully helped clients improve their credit scores. The company’s latest offering, AviaryAI, enables banks and credit unions to utilize AI for sales and referral calls, enhancing customer engagement and cross-selling opportunities.

Despite regulatory challenges, Cambio aims to collaborate with regulators and ensure compliance with laws governing AI-initiated calls. By integrating AI technology into financial services, Cambio strives to empower individuals to manage debt effectively and improve their financial well-being. With early adopters testing their systems and substantial seed funding from prominent investors, Cambio is poised for growth and innovation in the fintech sector.