Beatlemania, a cultural phenomenon that emerged in 1964, was actually instigated by Americans, much to the disappointment of the English who had hoped for its resurgence since 1962. Finger Holdings, a company currently facing a similar surge in popularity, is experiencing a comparable situation.

The price of the Cambridge-based device designer has skyrocketed, doubling since the release of its quarterly results last year. Since its debut on the Nasdaq in September, its valuation has surged by an impressive 192 percent. Had it remained listed in London, where it was previously but no longer is, its market capitalization of $152.8 billion at the close of Monday’s trading session would have positioned it as one of the largest constituents in the FTSE 100, surpassing HSBC and trailing closely behind Shell.

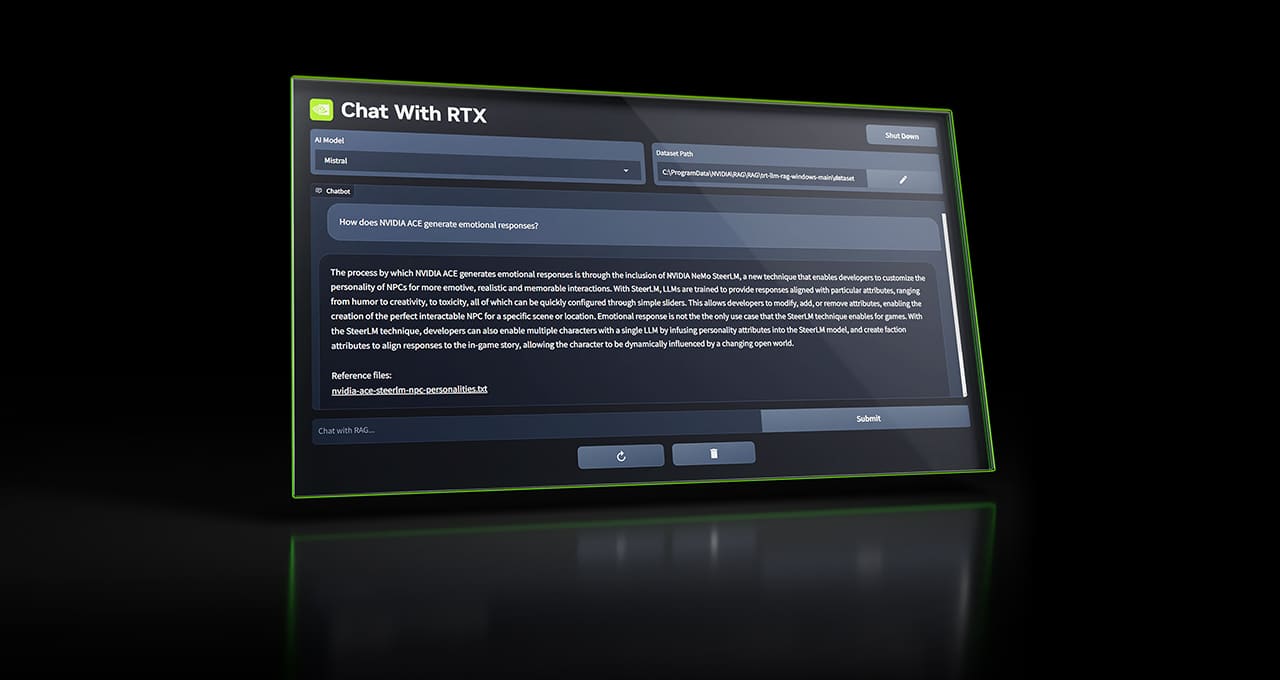

The primary driver behind this remarkable growth is Arm’s ambition to join the prestigious Beautiful Seven group. In its recent investor presentation, Artificial Intelligence (AI) took center stage, being mentioned 19 times and serving as the central theme of the conference call. Arm boasts a wide array of AI licensees, including tech giant Nvidia, which had attempted to acquire the company for $40 billion in 2020 before regulatory hurdles led to the deal’s cancellation.

For those interested in aligning with the cutting-edge themes prevalent in the tech industry, such as edge AI, specialized AI inference, AI-optimized data centers, and AI acceleration, Arm emerges as a compelling choice. A fraction of the substantial funds being raised by AI luminary Sam Altman, estimated at $7 million, is likely to find its way to Arm’s headquarters at 110 Fulbourn Road in Cambridge.

Many aspects of Arm’s current trajectory harken back to its pre-dotcom bubble era, evoking a sense of déjà vu for industry observers. Analyst Dylan Patel’s insight sheds light on Arm’s potential to enhance its revenue streams by adjusting its royalty rates for device manufacturers utilizing its chip designs. Notably, Arm’s strategic positioning in the market has enabled it to wield significant influence over pricing, with Qualcomm reportedly paying up to $13 in royalties for utilizing Arm’s radio chips in premium smartphones.

Throughout Arm’s history, royalty rates have been a focal point of discussions, emphasizing the delicate balance between accessibility and pricing power. Despite holding a virtual monopoly in certain product segments, Arm has maintained its neutrality and provided cost-effective solutions for businesses looking to streamline their development processes. While royalties traditionally constitute around 5% of the device price, recent initiatives, such as offering subsystem licenses with integrated GPU and memory paths, aim to cater to a broader clientele base, including automakers and appliance manufacturers.

The transition from Arm’s V8 to V9 architecture, introduced last year, has bolstered the company’s financial performance, with record profits recorded in the second quarter. However, the cyclical nature of license sales, influenced by seasonal demand patterns in the consumer electronics sector, has historically posed challenges for Arm’s revenue consistency. By diversifying into new market segments and adopting innovative pricing models, such as annual subscriptions for larger clients, Arm aims to mitigate these fluctuations and sustain its growth trajectory.

Looking ahead, Arm’s foray into emerging technologies like generative AI holds promise for transforming its business landscape. While the specifics of this transformation remain uncertain, Arm’s expertise in power-efficient chip architectures positions it favorably for inference tasks within the AI domain. Collaborations with industry players like Apple and Qualcomm underscore Arm’s commitment to driving innovation and adapting to evolving market dynamics.

In conclusion, Arm’s evolution from a London-based software pioneer to a global semiconductor powerhouse reflects its resilience and adaptability in an ever-changing industry landscape. As investors speculate on Arm’s future prospects and market positioning, the company’s strategic initiatives and technological advancements will undoubtedly shape its trajectory in the coming years.