The British public’s concerns about inflation have heightened due to disruptions in shipping routes through the Red Sea, which could lead to increased expenses.

A recent survey conducted by Citi/YouGov revealed that the expected inflation rate for the next 12 months rose to 3.9% in January from 3.5%, indicating a shift from the previous decline in December.

Several shipping companies are opting to bypass the Suez Canal, resulting in longer shipping times and higher transportation costs.

Another survey pointed out a surge in expenses for UK manufacturers, with Adidas, a prominent sportswear manufacturer in Europe, warning about potential impacts on its profit margins due to shipping disruptions.

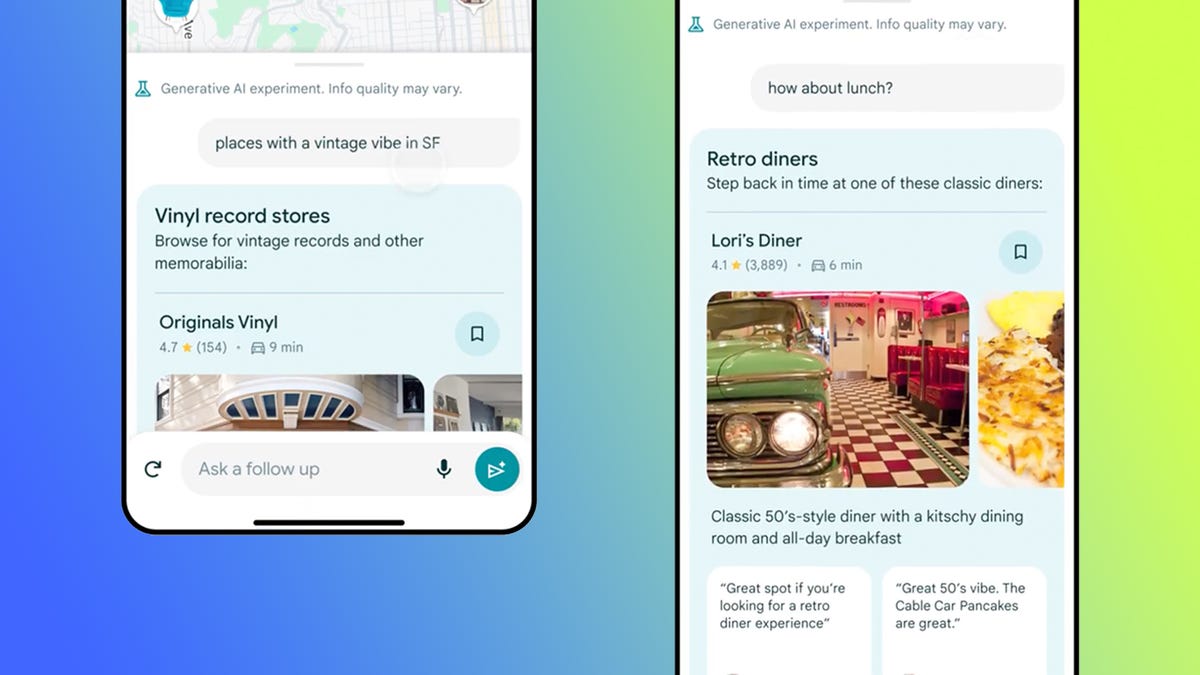

There is a growing debate on whether artificial intelligence could potentially outperform the Bank of England in setting interest rates.

Recent discussions among BoE policymakers have shown a divergence in views on monetary policy, with two members advocating for a rate hike, one for a cut, and six in favor of maintaining rates at 5.25%.

The Bank appears inclined towards a future rate reduction, pending further evidence of inflation returning to the 2% target and remaining stable at that level.

Market projections hint at a probable rate cut by June, with a 10% likelihood of it occurring as early as March.

ChatGPT has outlined scenarios under which monetary policy might be eased, speculating on the timeline for a rate cut:

-

Economic Downturn: Significant economic downturns could prompt the BoE to lower interest rates to stimulate economic activity by encouraging borrowing, spending, and investment.

-

Inflation Below Target: Prolonged inflation below the central bank’s target could lead to interest rate cuts to boost spending and investment, aligning inflation with the desired level.

-

Global Economic Uncertainty: External factors such as global economic uncertainties might influence the BoE’s decisions, with rate cuts serving as a preemptive measure to support the economy and financial stability.

-

Exchange Rate Considerations: The impact of interest rate adjustments on the exchange rate is a critical factor for the central bank to consider. Lower rates could result in currency depreciation, benefiting exports and economic growth.

-

Credit Conditions: Tightened credit conditions that hinder borrowing and investment could prompt rate cuts to make borrowing more attractive and accessible.

-

Unemployment Concerns: Rising unemployment rates might drive the central bank to lower rates to stimulate economic growth and job creation.

The UK government refutes claims of excessive focus on AI safety, emphasizing its leadership in AI research and development and substantial investments to harness AI’s potential across various sectors.

In response to the report, a spokesperson from the Department for Science, Innovation, and Technology (DSIT) stated:

“The UK’s pioneering position in AI research and development is undeniable. We are dedicated to leveraging AI’s transformative capabilities to enhance healthcare, education, and business growth. Our investments, including the AI Opportunity Forum, underscore our commitment to fostering safe AI for a prosperous future.”

PM Rishi Sunak spearheaded a crucial AI Safety summit at Bletchley Park in November, advocating for a human-centric, trustworthy, and responsible approach to AI design.

Andrew Bailey’s remarks on AI align with warnings from the House of Lords Committee regarding the UK potentially missing out on the “AI goldrush” and the need for a more optimistic government outlook.

The committee emphasizes the transformative potential of AI, akin to the impact of the internet, and stresses the importance of balancing AI safety concerns with the vast opportunities it presents to avoid missing out on significant advancements.

Baroness Stowell of Beeston, Chairman of the House of Lords Communications and Digital Committee, emphasized:

“The rapid advancement of AI Large Language Models is poised to reshape society akin to the internet’s introduction. It is imperative for the government to strike a balance, leveraging AI’s potential while mitigating risks to avoid missing out on a potential AI boom.”

The Bank of England governor views Artificial Intelligence (AI) technologies as beneficial for the economy, dismissing concerns about AI leading to widespread job losses and highlighting the synergistic relationship between humans and technology.

Bailey’s optimism shines through in his statement to the BBC:

“Economies adapt, jobs evolve, and we learn to collaborate with technology. The synergy of human expertise with technological advancements yields superior outcomes compared to standalone machines. I remain optimistic…”

The evolving landscape of generative AI prompts global policymakers to address its implications on employment and misinformation dissemination, alongside concerns about its impact on financial stability.

Businesses are increasingly adopting AI technologies like chatbots, with a noticeable uptick in AI investments reported to the BoE.

This week’s financial reports from tech giants underscore the influence of AI, with Microsoft experiencing substantial revenue growth in its Azure platform attributed to artificial intelligence applications.

Satya Nadella, CEO of Microsoft, highlighted:

“The shift from theoretical discussions on AI to practical implementations at scale is evident.”

While AI advancements are driving growth, companies are also grappling with rising costs associated with cutting-edge AI product development.

Upcoming Events

Today’s focus shifts to the US jobs market, with expectations for the latest jobs report pointing to a slight slowdown in job creation compared to the previous month.

Forecasts suggest 180 new jobs in January, down from 216,000 in December, with average hourly earnings expected to increase by 0.3% monthly or 4.1% annually.

The outcome of the jobs report could influence Federal Reserve decisions, potentially impacting expectations of rate cuts in the coming months.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, provided further insight:

“A weaker jobs report could push the Federal Reserve towards a dovish stance, while a strong report might dampen expectations of an imminent rate cut. The spotlight now turns to the May meeting, with a high likelihood of the first Fed cut.”