Share to FacebookShare to TwitteShare to Linkedin

In the preceding year, Nat Friedman, a former entrepreneur now transitioning into an investor, found himself unexpectedly thrust into the role of a full-time intermediary for emerging AI companies in need of computer chips. He shared with Forbes how he dedicated significant time to acquiring GPUs, crucial graphics processing units essential for AI data analysis, for various individuals, making the resolution of founders’ primary challenges his foremost concern.

Former CEO of Microsoft’s developer platform GitHub, Friedman, alongside his frequent investment collaborator Daniel Gross, who previously vended his startup to Apple, capitalized extensively on their connections with chip suppliers. Subsequently, they opted to invest a substantial upfront amount, totaling nine figures, to establish their own supercomputer named the Andromeda Cluster. This cluster, comprising over 4,000 GPUs, is accessible to companies within their investment portfolio at a discounted rate compared to the market price. Their proactive approach has spurred other tech investors to introduce similar initiatives to assist startups. Index Ventures, for example, launched a program providing startups with complimentary access to a cluster managed by Oracle. Conversely, Microsoft allocated several thousand chips to startups affiliated with its venture arm M12, startup accelerator Y Combinator, and a select group of early-stage funds. Conviction Partners, as highlighted in Forbes by founder Sarah Guo, also operates a smaller cluster.

Rumors suggest that Andreessen Horowitz is in talks with chip providers to establish a comprehensive compute program, aiming to offer tens of thousands of GPUs, surpassing existing provisions. While this ambitious endeavor is poised to set a new industry standard, the firm has refrained from commenting on these speculations.

Underlining the significance of equitable resource access in the tech sphere, Gross stressed the importance of ensuring that both newcomers and established individuals have equal opportunities and computational capabilities, particularly in the AI domain, which has historically encountered disparities.

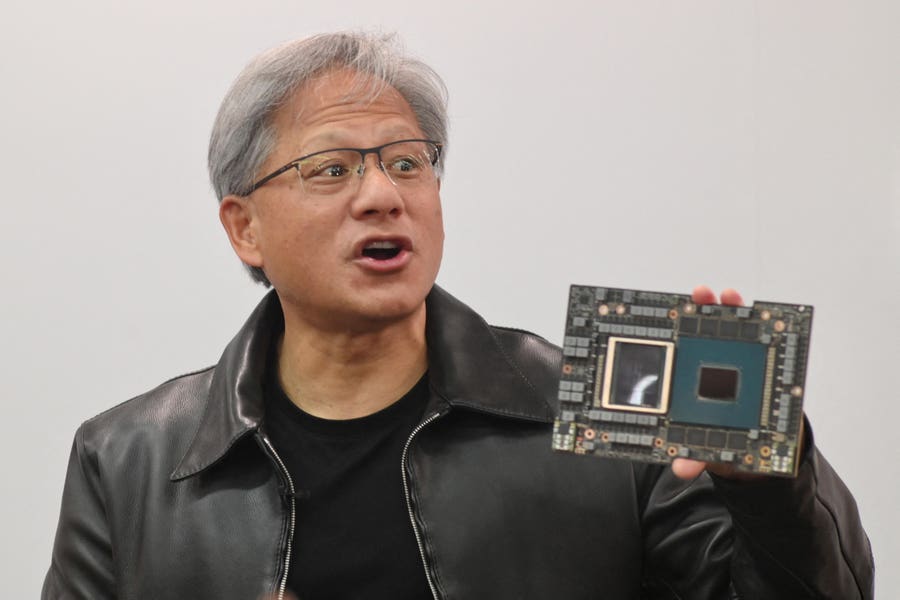

During his tenure as GitHub CEO, Friedman spearheaded the procurement of over 4,000 GPUs to develop GitHub Copilot, a tool facilitating code creation for software engineers. This endeavor has proven to be a lucrative venture, yielding revenues exceeding $100 million. The demand for GPUs has surged, notably due to their pivotal role in training AI models such as OpenAI’s ChatGPT and the latest iteration, GPT-4. Leading tech entities like Mark Zuckerberg’s Meta are aggressively acquiring high-end chips like Nvidia’s H100s to fortify their AI endeavors, propelling Nvidia to a trillion-dollar market cap. Despite endeavors by industry giants like Google and Amazon to ramp up AI chip production, supply chain constraints persist due to reliance on a sole semiconductor manufacturer.

The limited supply has posed challenges for startups, which often grapple with securing adequate computing resources. Even if cloud service providers like Microsoft Azure or Amazon Web Services possess surplus capacity, they typically prioritize larger clients. Startups, constrained by limited capital, encounter obstacles in securing long-term GPU commitments, which usually entail substantial upfront investments and extended contracts.

In response to these challenges, Andromeda emerged as a solution, offering startups access to computational resources based on a flexible, usage-driven model. By facilitating access to GPUs at competitive rates, Andromeda has empowered startups like Pika to embark on innovative projects, accelerating their growth trajectory. Friedman emphasized that the primary objective is to bolster startups in their progression towards success, utilizing compute resources as a catalyst for rapid advancement.

Managing a cluster of this magnitude necessitates significant investments and operational intricacies. Friedman and Gross undertook considerable upfront expenses to lease the chips, primarily procured from CoreWeave, a cloud computing provider they have endorsed. The operational facets, encompassing supercomputer management, software development for scheduling, and hardware maintenance, demand a dedicated team of engineers and contractors.

The duo’s substantial personal investments in AI-focused ventures have provided them with the flexibility to diverge from traditional venture capital practices and explore unconventional methods to support startups. This autonomy has empowered them to establish Andromeda as a pivotal asset for their portfolio companies, fostering innovation and growth within the AI landscape.

While other firms have introduced compute assistance programs, their scale and scope pale in comparison to Andromeda. Index Ventures, for instance, delegates infrastructure management to Oracle, offering startups a limited-duration testing platform. Similarly, Y Combinator and M12 collaborate with Microsoft to provide complimentary compute access for experimental purposes, catering to nascent startups.

Despite the escalating demand for GPUs, supply constraints persist for large clusters requiring thousands of chips. Friedman and Gross are contemplating expanding Andromeda into a more extensive supercomputing infrastructure to meet the evolving needs of larger enterprises. Their dedication to addressing the industry’s computational challenges underscores their commitment to fostering innovation and leveling the playing field for AI-driven advancements.